Prices

June 27, 2017

SMU Price Ranges & Indices: Mills Waiting for Section 232?

Written by John Packard

We are seeing a strengthening in the resolve of the steel mills as most (but not all) steel buyers were reporting an attempt to take numbers up or to restrict orders by having mills move to an “inquire only” position. Even so, we continued to get some pricing at the lower end of our range mostly from large OEMs or service centers. There continues to be concern related to the Section 232 recommendations, which many buyers and steel mills feel is imminent.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $590-$620 per ton ($29.50/cwt-$31.00/cwt) with an average of $605 per ton ($30.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to one week ago, while the upper end remained the same. Our overall average is up $5 per ton compared to last week. Our price momentum on hot rolled steel is pointing to Neutral as we evaluate whether the market has truly turned a corner and will head higher or lower from here.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU price range is $760-$820 per ton ($38.00/cwt-$41.00/cwt) with an average of $790 per ton ($39.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week, while the upper end remained unchanged. Our overall average is up $10 per ton compared to one week ago. Our price momentum on cold rolled steel is pointing to Neutral as we evaluate whether the market has truly turned a corner and will head higher or lower from here.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU base price range is $38.00/cwt-$41.50/cwt ($760-$830 per ton) with an average of $39.75/cwt ($795 per ton) FOB mill, east of the Rockies. The lower end of our range declined $10 per ton compared to one week ago, while the upper end remained the same. Our overall average is down $5 per ton compared to last week. Our price momentum on galvanized steel is pointing to Neutral as we evaluate whether the market has truly turned a corner and will head higher or lower from here.

Galvanized .060” G90 Benchmark: SMU price range is $838-$908 per net ton with an average of $873 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 6-12 weeks

Galvalume Coil: SMU base price range is $39.00/cwt-$41.50/cwt ($780-$830 per ton) with an average of $40.25/cwt ($805 per ton) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week, while the upper end remained the same. Our overall average is up $5 per ton compared to last week. Our price momentum on Galvalume steel is pointing to Neutral as we evaluate whether the market has truly turned a corner and will head higher or lower from here.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,071-$1,121 per net ton with an average of $1,096 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-10 weeks

Plate: SMU price range is $740-$770 per ton ($37.00/cwt-$38.50/cwt) with an average of $755 per ton ($37.75/cwt) FOB delivered. The lower end of our range increased $20 per ton compared to one week ago, while the upper end decreased $20 per ton. Our overall average is unchanged compared to last week. Our price momentum on plate steel is pointing to Neutral as we evaluate whether the market has truly turned a corner and will head higher or lower from here.

Plate Lead Times: 4-6 weeks

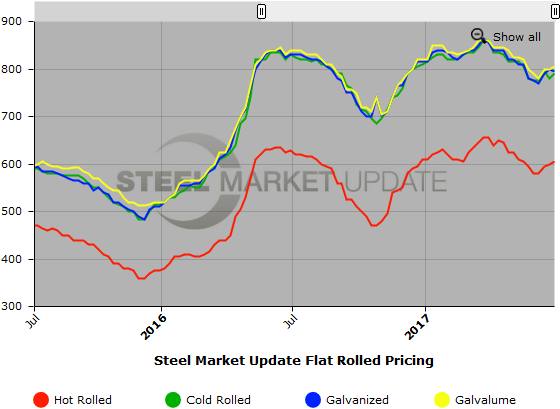

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. We will add plate prices to this graph in the coming weeks. To use the graph’s interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.