Market Data

June 22, 2017

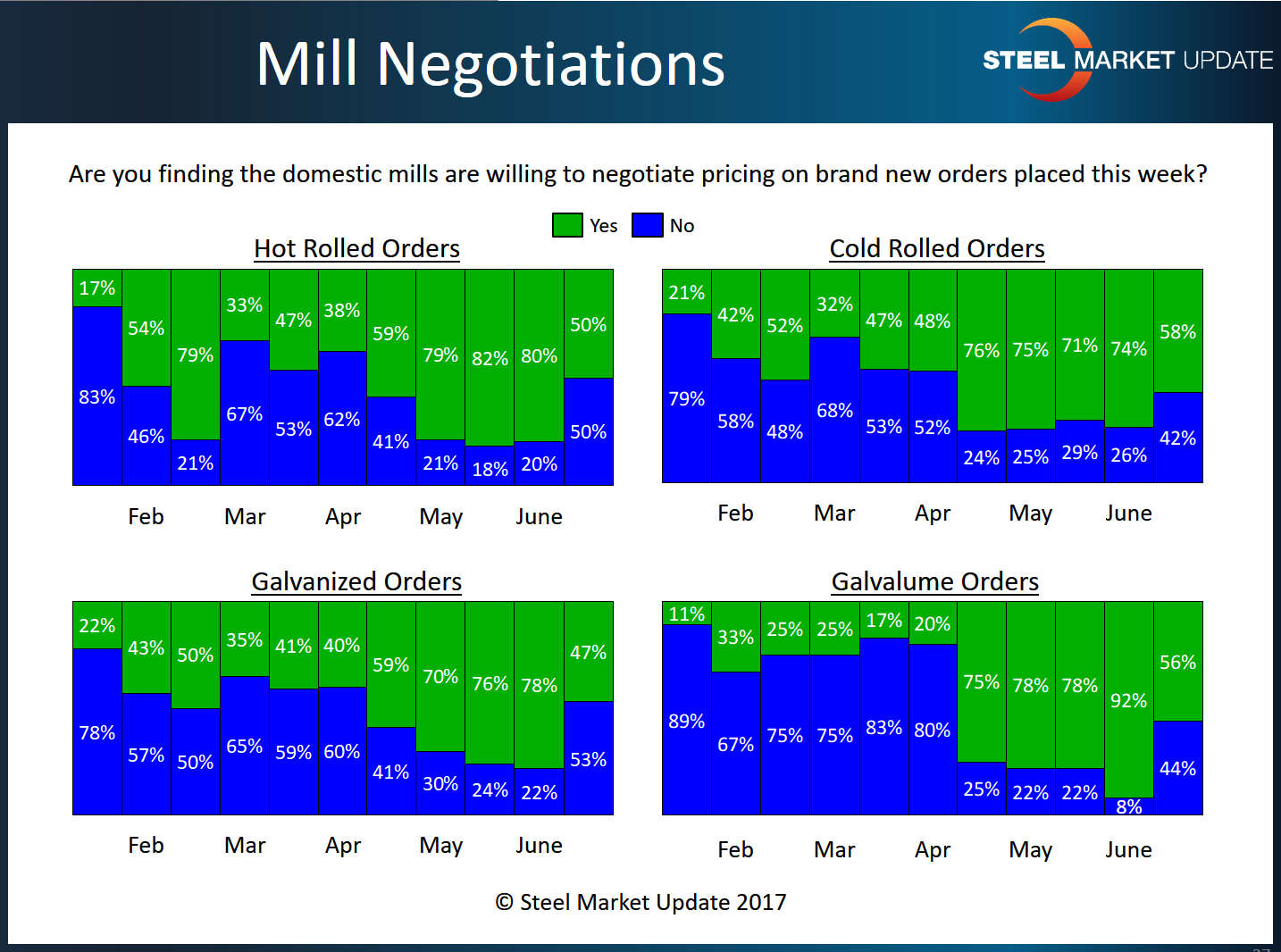

Mill Spot Price Negotiations Shift?

Written by Tim Triplett

Steel buyers report that mills are considerably less willing to negotiate prices on spot orders than they were a month, or even two weeks, ago.

The findings of the latest SMU survey of service centers and manufacturers indicates that only about half find mills willing to negotiate on hot roll spot buys, compared with more than 80 percent willing to dicker a month ago. The situation is similar for cold roll, where 58 percent of buyers say mills will negotiate price, compared with 71 percent last month. Less than half the galvanized buyers find mills will to deal, down from 76 percent in mid-May. In Galvalume, more than 90 percent say spot orders were negotiable around June 1, but only 56 percent find that true today.

SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.