Analysis

June 21, 2017

US Vehicle Sales and NAFTA Vehicle Production through May 2017

Written by Peter Wright

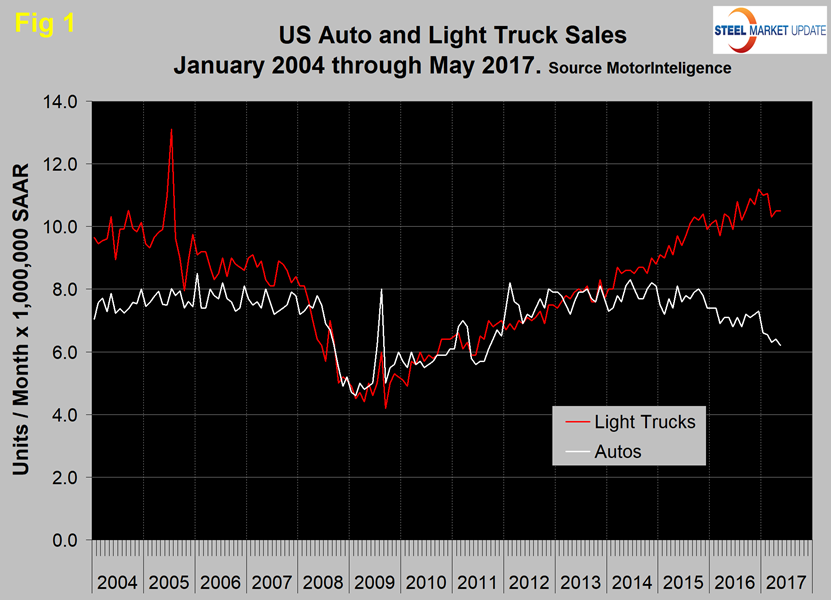

Vehicle sales in the U.S. averaged 17.1 million units at a seasonally adjusted annual rate (SAAR) per month in the first five months of 2017, down from 18.1 million in Q4 2016. March, April and May sales were each below 17.0 million units SAAR for the first time since June last year. In May, light truck sales were unchanged at 10.5 million, but autos declined from 6.4 to 6.2 million.

Figure 1 shows auto and light truck sales since January 2004.

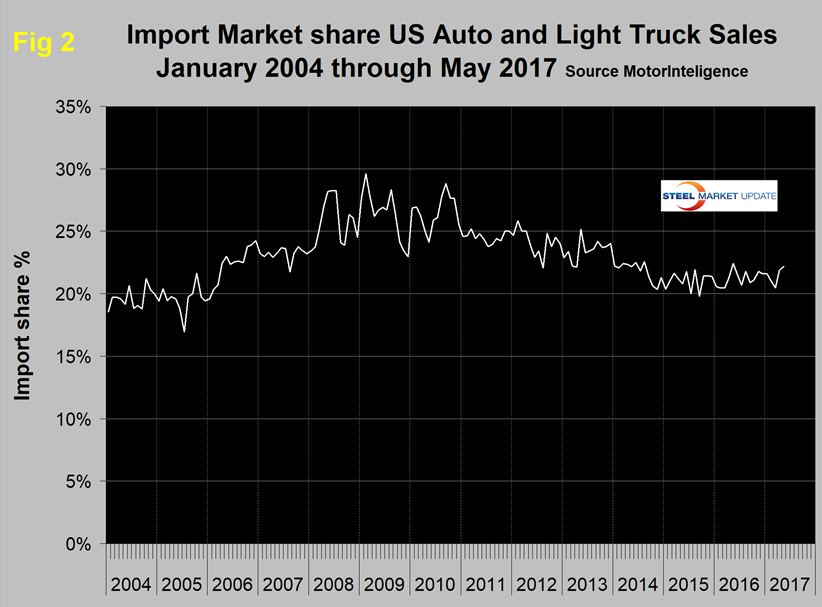

Import market share at 22.2 percent in May has changed little in the last 18 months, as shown in Figure 2.

Economy.com had this to say: “Following April’s light results, May vehicle sales again were well below consensus expectations, marking the third consecutive month with sales below 17 million units. This represents a 3 percent decline in both the year-ago pace and compared with the year-to-date average. While record-high incentive spending attempts to support near-term retail sales, fleet sales are down and the wild card of pent-up demand is likely diminished. Further, credit is tightening and inventories are also at record highs. According to J.D. Power, incentive spending in May averaged nearly $3,600 per new vehicle, which is a record for the month. It also marks the 10th month out of the past 11 where incentives made up at least 10 percent of the average vehicle transaction price. Elevated incentives are a result of automakers attempting to clear record-high levels of inventory and balance production to more closely match changing consumer demand and preferences. Overall, Moody’s Analytics still expects slightly more than 17 million vehicle unit sales at a seasonally adjusted annualized rate for the remainder of 2017 before waning slowly through the end of the decade.”

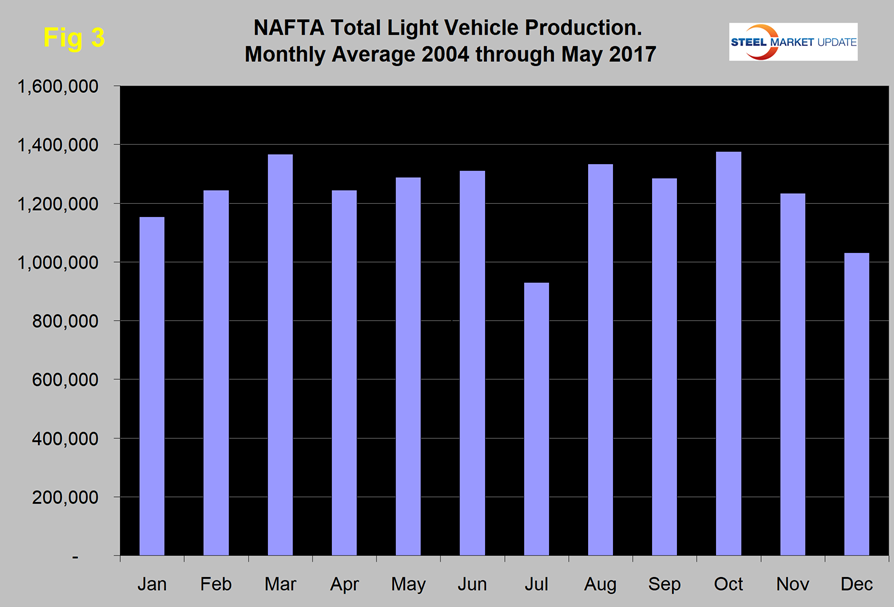

Total light vehicle (LV) production in NAFTA in May hit an annual rate of 18.890 million units, up from 16.334 million in April. On average since 2004, May’s production has been up by 3.5 percent from April. This year, production was up by 15.7 percent, therefore stronger than normal (Figure 3).

We can expect production to increase slightly in June, then take a dive in July when manufacturers take their maintenance and re-tooling shutdowns. Note: production numbers are not seasonally adjusted; the sales data reported above are seasonally adjusted.

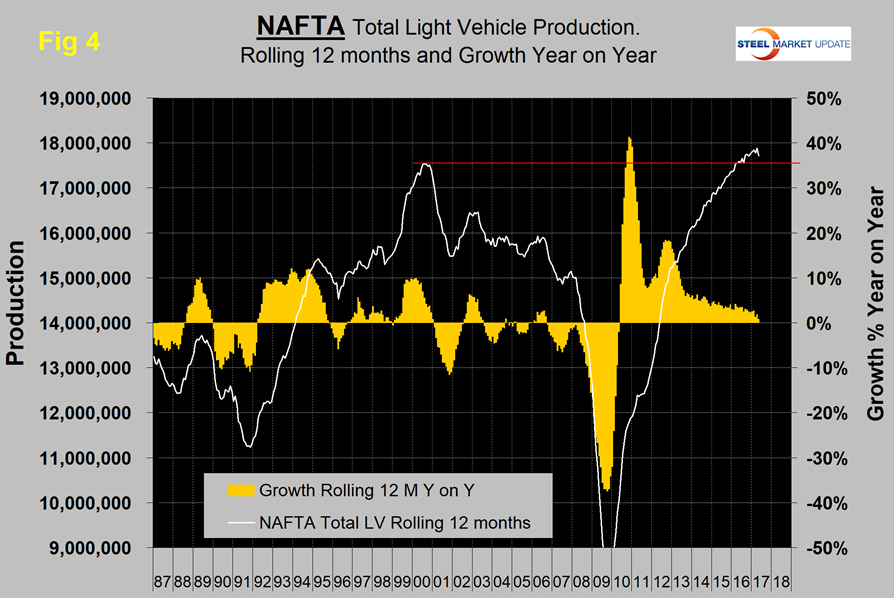

On a rolling 12-month basis year-over-year through May, NAFTA light vehicle production increased by 0.8 percent, which was down from the 1.9 percent achieved in 12 months through April. This was the lowest year-over-year growth rate in seven years (May 2010). There has been a very gradual slowdown in growth for the last three years as indicated by the brown bars in Figure 4. However, production has been higher than the previous all-time high every month since early 2016.

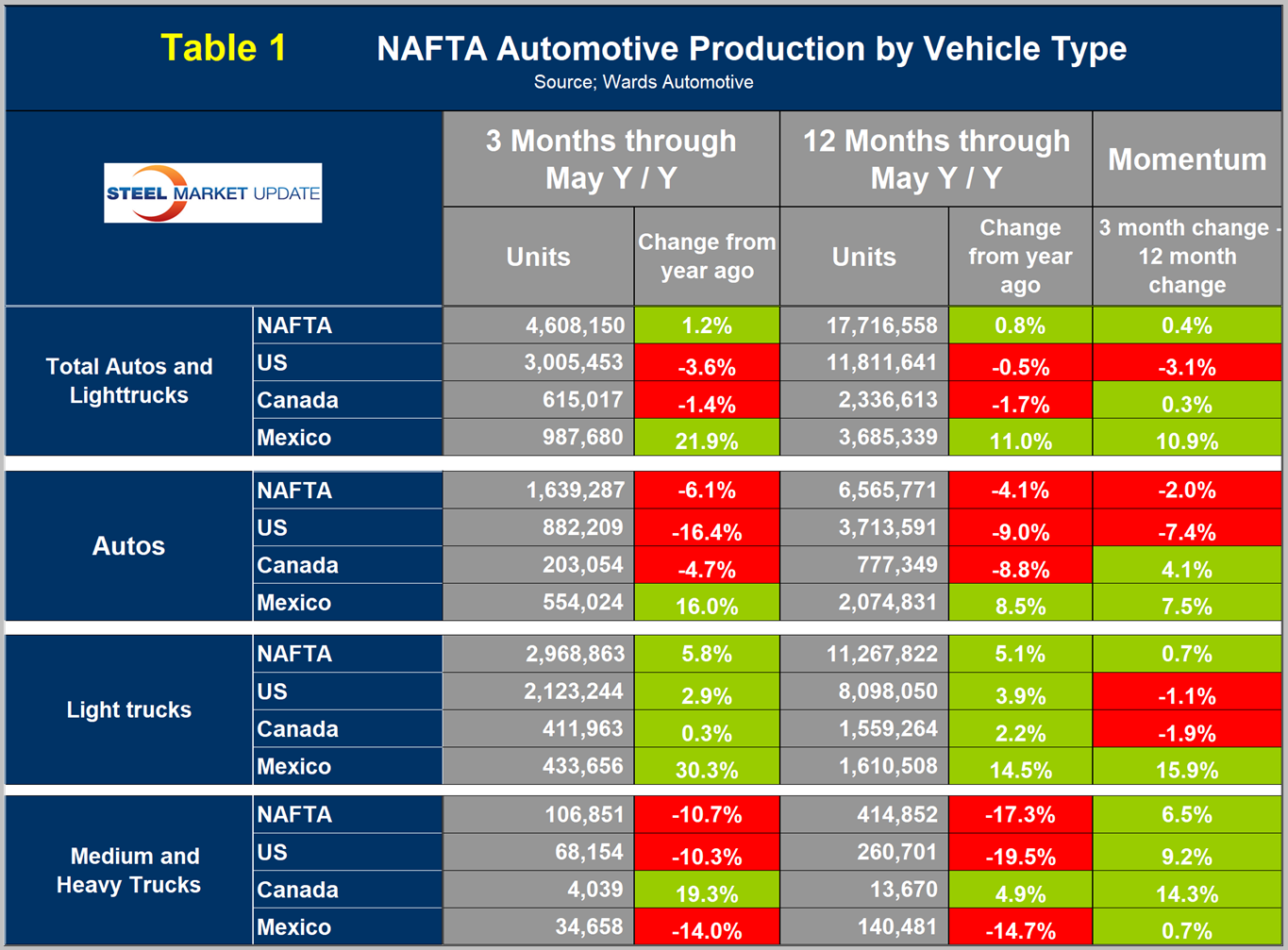

It now seems irrefutable that we are in the midst of a huge shift in assembly volume of both autos and light trucks from the U.S. and Canada to Mexico. On a rolling 12-month basis year-over-year, total light vehicle production in the U.S. declined by 0.7 percent, Canada was down by 1.7 percent and Mexico was up by 11.0 percent. The comparison is even starker comparing the latest three months when the results saw the U.S. decline by 3.6 percent, Canada dip by 1.4 percent and Mexico gain 21.9 percent year-on-year (Table 1).

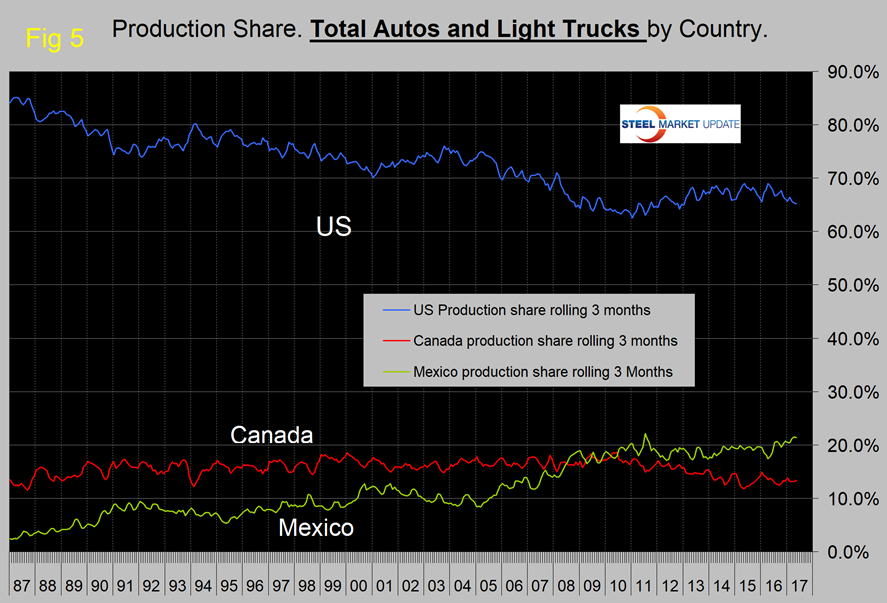

This means that the shift to south of the border is accelerating and is being driven by both autos and light trucks. Autos in Mexico increased by 16.0 percent in the three-month period, as Canada and the U.S. both declined. In the case of light trucks, the U.S. and Canada had positive growth of 2.9 percent and 0.3 percent, respectively, as Mexico grew by a whopping 30.3 percent. U.S. production’s share had a recent peak of 69 percent in April last year, falling to 65.2 percent in May this year. Mexican production’s share increased from 17.4 percent to 21.4 percent during the same period. Canada was relatively unchanged, declining from 13.5 percent to 13.3 percent. Over the longer term, Mexico surpassed Canada’s share in 2010 and the gap has been widening ever since (Figure 5). The Mexican production target for 2020 is 5.0 million units, according to Eduardo Solis, president of the Mexican Automotive Industry Association. This would be up from an average of 3.553 million in the 17 months since January 2016.

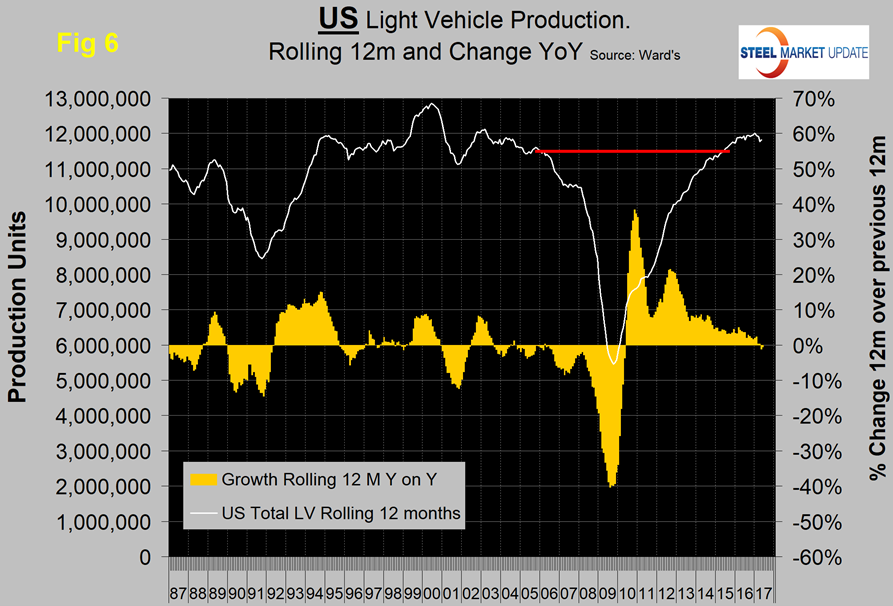

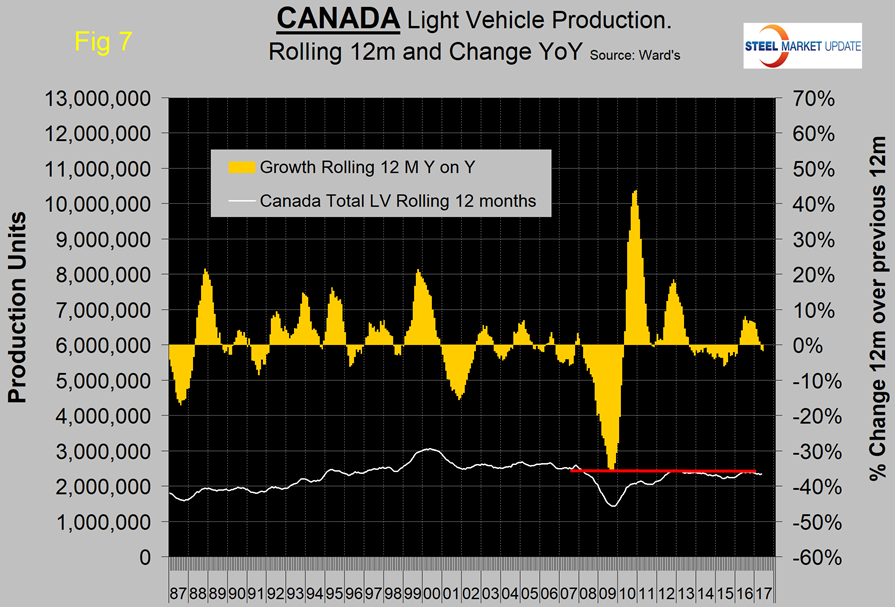

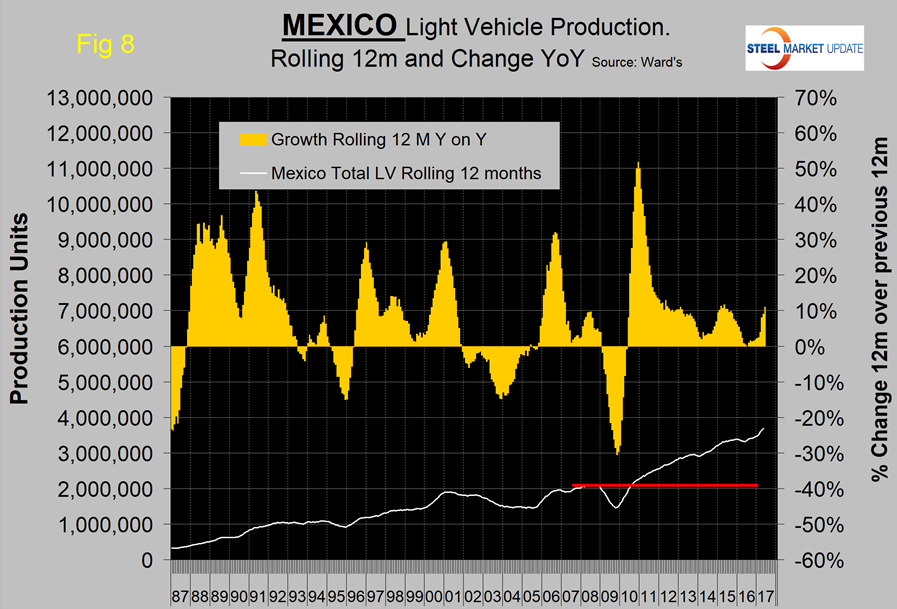

Figures 6, 7 and 8 show total light vehicle production by country with year-over-year growth rates as the brown bars. The red line on each shows the change in production since Q2 2006. Note the scales are the same to give true comparability and that Mexican growth has surged in 2017.

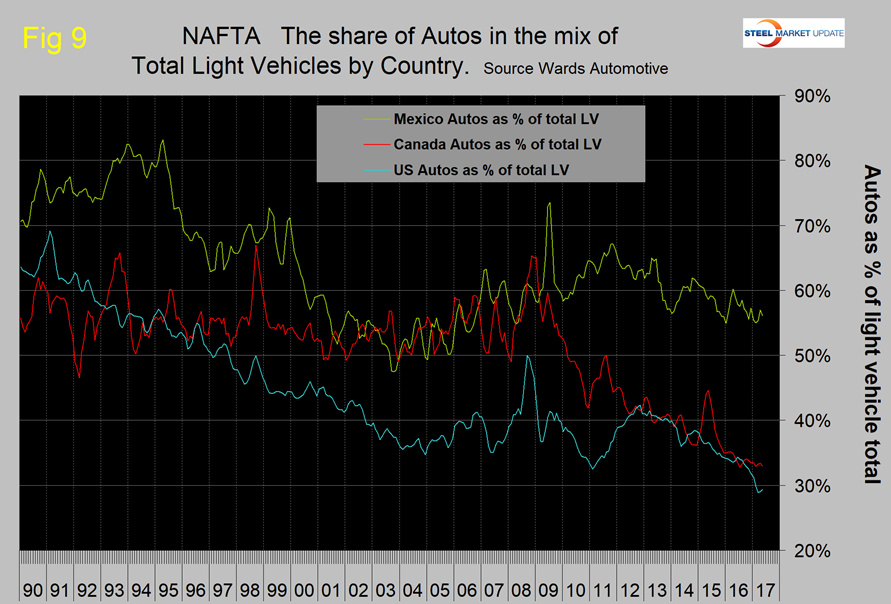

Figure 9 shows that the percentage of autos in the light vehicle mix has been declining for all three countries since 2012, driven by consumer buying preferences, which in turn are heavily influenced by gas prices.

SUVs and crossovers are classified as light trucks, which presumably is the main driver of the shift in mix. The change in preference for light trucks tends to favor the U.S. and Canada over Mexico because the mix of light vehicle production capacity is different by country. The percentage of autos in the Mexican mix in the last three months was 56.1 percent, but only 29.4 percent in the U.S. and 33.0 percent in Canada. February through May was the first time for the auto percentage in the U.S. mix to fall below 30 percent since our data stream began in January 1990. Mexico has staked out a higher relative assembly capacity in autos, which suggests that the data could turn really ugly from the U.S. point of view when gas prices eventually rebound.

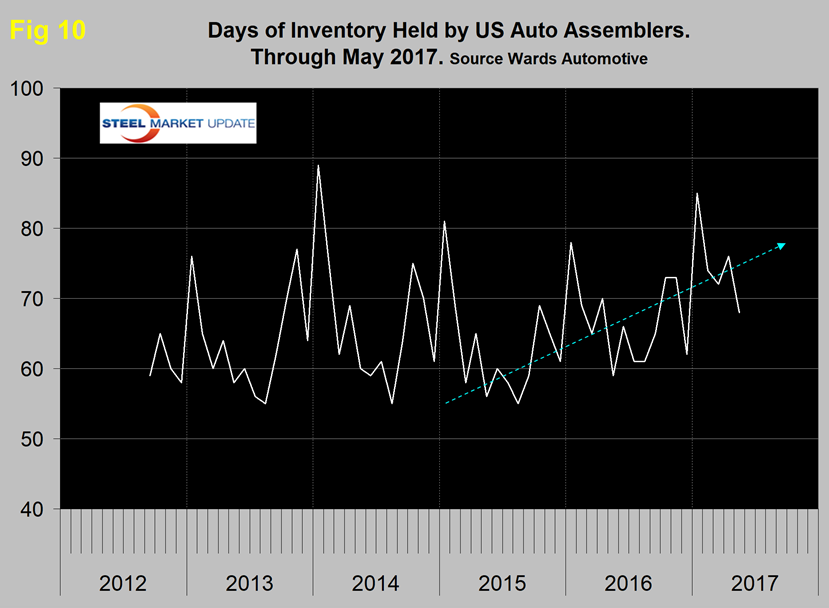

Ward’s Automotive reported this week that total light vehicle inventories in the U.S. were 68 days at the end of May, down from 76 days at the end of April. Month over month FCA’s (Fiat Chrysler Automotive) inventory fell from 81 to 66 days, GM was up 2 to 101 days and Ford was down 12 to 71 days. Figure 10 shows that inventory days of sales in the U.S. has exhibited an increasing trend since Q2 2015.

The SMU data file contains more detail than can be shown here in this condensed report. Readers can obtain copies of additional time-based performance results on request if they wish to dig deeper. Available are graphs of auto, light truck, and medium and heavy truck production and growth rates, as well as production share by country.