Market Data

June 21, 2017

SMU Apparent Excess/Deficit Forecast Nails Shipments/Deficit Shrinks

Written by John Packard

Last month Steel Market Update forecast steel shipments of carbon flat rolled would total 2,322,000 tons and, according to the MSCI data released last week, shipments were 3,319,000 tons. We missed the number by 3,000 tons…

Our forecast called for flat rolled inventories to total 4,344,000 tons at the end of May. We were off by 214,000 tons as inventories came in higher at 4,458,000 tons.

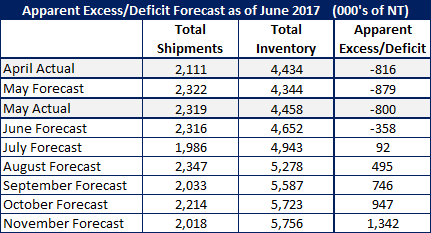

![]() Based on the SMU Service Center Inventories Apparent Excess/Deficit model we calculated distributors were short 800,000 tons (our forecast was slightly higher deficit at -879,000 tons). We ended the month of April with a deficit of -816,000 tons.

Based on the SMU Service Center Inventories Apparent Excess/Deficit model we calculated distributors were short 800,000 tons (our forecast was slightly higher deficit at -879,000 tons). We ended the month of April with a deficit of -816,000 tons.

All of these numbers are based on MSCI data and the assumption the numbers are accurate. Our own surveys and interactions with service centers are raising question as to whether the deficit is as large as our model is showing. For now, we do not have an alternative to the MSCI numbers and thus we are coming to the same conclusion that most of the domestic steel mills are making – service centers need to build back inventories.

June 2017 Forecast

Our forecast for the next few months is that shipments will be within the 4-year average putting June at 2,316,000 tons (almost exactly the same as May 2017).

Inventories of flat rolled will end the month up another 200,000 tons as we expect the month to end with 4,652,000 tons and the Apparent Deficit will, if we are correct, decline to -358,000 tons.

Here is what we are forecasting through November 2017: