Market Data

June 14, 2017

Thursday Manufacturing Reports Show Mixed Results

Written by Sandy Williams

Two new Federal Reserve manufacturing reports came out on Thursday, one rebounding and one slowing. Manufacturing activity shot up in New York State, while activity in the Philadelphia region continued to expand, but at a slower pace.

Empire State Manufacturing Survey

The general business conditions index leaped 21 points to 19.8, its highest level in two years, according to the Federal Reserve Bank of New York. After showing renewed strength in February and March, the headline index dropped in April and entered contraction at -1.0 in May. Economists were surprised by the sharp upward bounce this month.

June’s rebound was driven by a 23 point jump in new orders and 12 points for shipments, registering 18.1 and 22.3, respectively. Inventories were higher in June. The unfilled orders index moved upward to 4.6, while the delivery times were generally unchanged. The prices paid index registered 20, similar to May, while the prices received index gained 6.3 points.

Firms in the New York area were optimistic about future business conditions, expecting further increases for new orders. The future general business index gained 2.4 points to register 41.7. Inventories were expected to be slightly lower and employment levels to continue to increase modestly. Future capital expenditures took a jump of 7.4 points for a reading of 20.8.

Below is a graph showing the history of the Empire State Manufacturing Index. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance logging into or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.

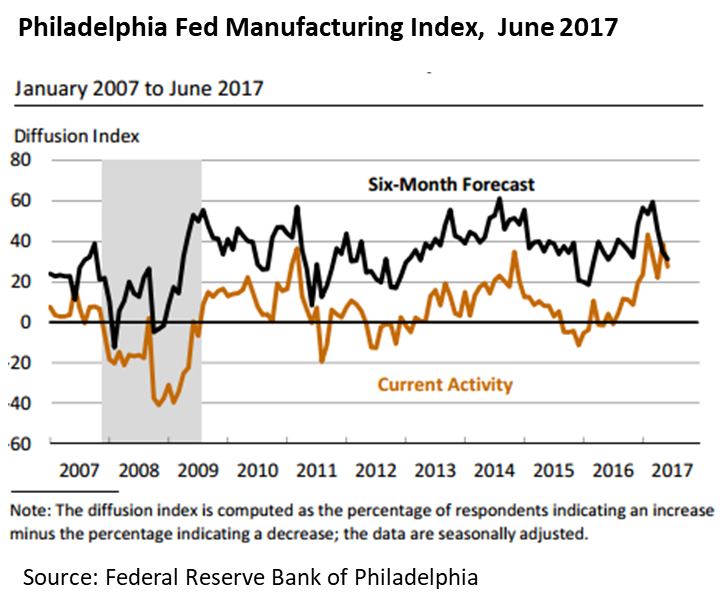

Philadelphia Fed Manufacturing Business Outlook Survey

Manufacturers in the Philadelphia area saw manufacturing slow in June. The headline index fell to 27.6 from 38.8 in May. The index, however, continued 11 consecutive positive months. Economists were expecting the drop after the May index reached its second highest reading in more than 30 years.

The shipment index fell 11 points, while new orders were mostly flat. Employment declined by 1 point.

The prices paid index fell 1 point while the prices received index increased by five points.

Future indicators continued to fall from the optimism earlier in the year. The future general activity index decreased 3.5 points to 31.3. The future new orders index declined 15 points, while the shipments index was unchanged. Future employment levels were steady with 34 percent of surveyed manufacturers expecting to add workers.