Prices

June 11, 2017

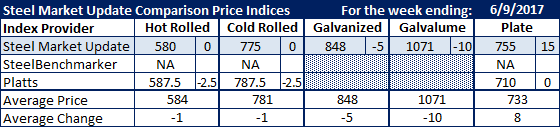

Comparison Price Indices: Sideways to Slightly Lower

Written by John Packard

The slide in flat rolled steel prices was curtailed compared to previous weeks as prices on hot rolled, cold rolled, galvanized, Galvalume moved sideways to slightly lower while plate was sideways to slightly higher.

All of the major flat rolled steel mills in the United States announced flat rolled price increases on Monday and Tuesday of this past week. SMU found the $30 per ton announced increase was waived for many customers so that they could place tonnage at the old levels during the first few days of the week.

Hot rolled price averages remained the same at $580 per ton ($29.00/cwt) according to our own index. Platts saw prices as slightly lower at $587.50 per ton ($29.38/cwt).

Cold rolled price averages saw a similar pattern as hot rolled with SMU holding our average at $775 per ton ($38.75/cwt) while Platts took their numbers down to $787.50 per ton ($39.38/cwt).

SMU took our galvanized index down $5 per ton on .060” G90. We have published the extras used for .060” G90 after the table below.

Our index also lowered Galvalume .0142” AZ50, Grade 80 $10 per ton ($.50/cwt) to $1071 per ton. The extras used to produce that price average are listed on the other side of the table.

Steel Market Update saw plate prices as slightly higher at $755 per ton delivered ($37.75/cwt) vs. Platts which kept their FOB Southeastern Mill price the same as the previous week at $710 per ton ($35.50/cwt). Again, we remind our readers that our index is a delivered price while Platts is FOB the mill.

SteelBenchmarker, which only produces their steel prices twice per month, did not provide prices for this past week.

SMU Note: Galvanized prices include $78 in extras for a .060″ G90 product. Galvalume prices include $291 in extras for a .0142” AZ50 Grade 80 product.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Plate price FOB points are different for each of the indexes:

SMU: FOB Delivered to the Customer (includes freight)

Platts: FOB Southeaster Mill (does not include freight)

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.