Market Data

June 8, 2017

Sentiment’s Strong, But Showing Signs of Concern

Written by Tim Triplett

The sentiment among buyers and sellers of flat rolled steel remains largely positive, although concerns about the Section 232 investigation, the recent mill price hike and the coming summer slowdown have dampened the outlook for the market three to six months down the road, according to the latest SMU Steel Buyers Sentiment Index.

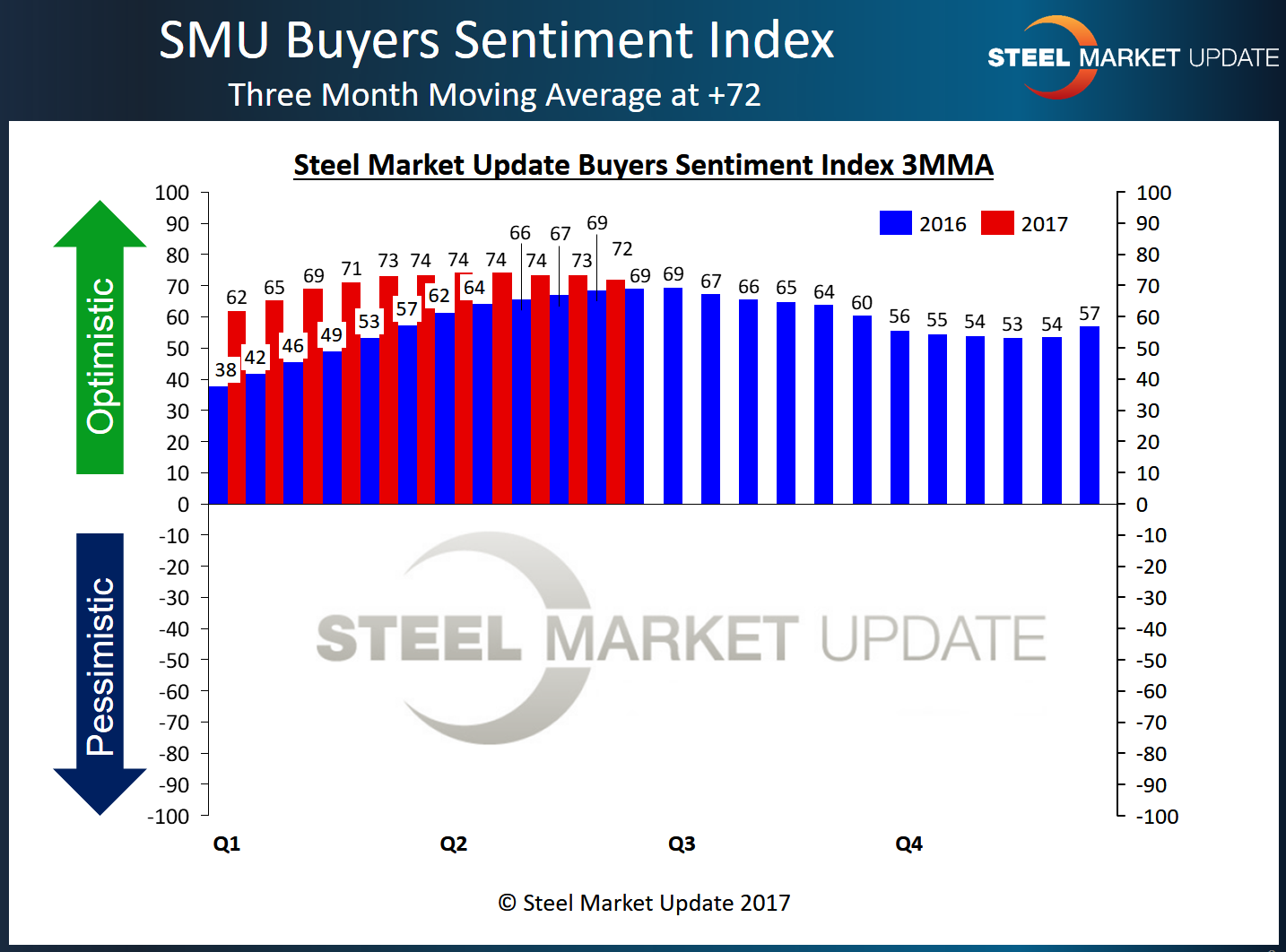

As a single data point, Current Sentiment is at +69, down 4 points from last month, but the same as this time a year ago. At +69, the index shows most respondents are still very optimistic about business conditions. The highest reading for the index was +77 in March 2017.

Looking at Current Sentiment as a three-month moving average takes some of the volatility out of the index. As a 3MMA, the index registers +72, showing an even higher level of optimism in today’s steel market. The current 3MMA is down slightly from +74 last month, but up from +69 at this time last year.

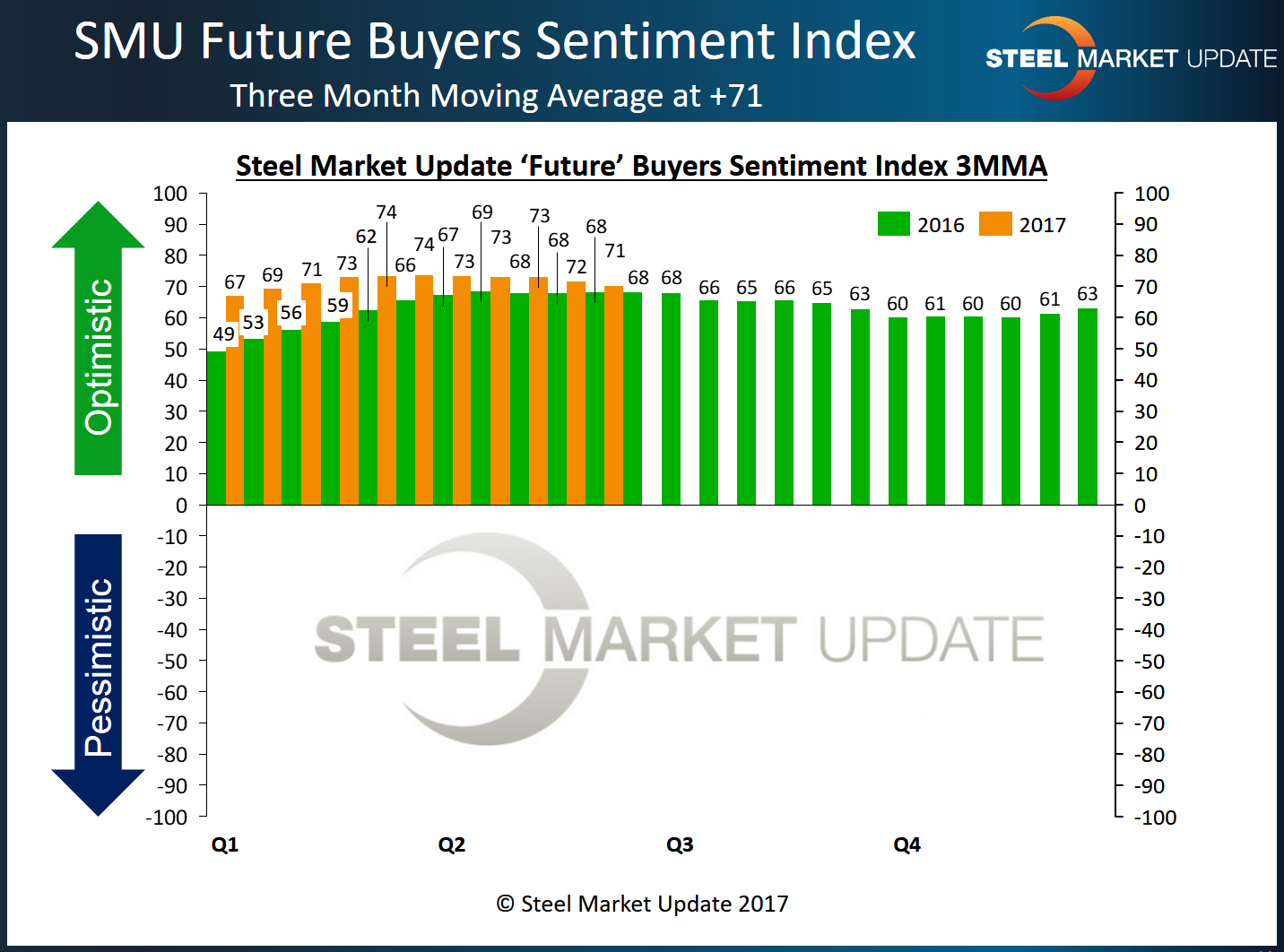

Future Sentiment Showing Erosion?

Future Sentiment is how buyers and sellers of flat rolled steel see their company’s chances of being successful three to six months into the future. As a single data point, SMU’s Steel Buyers Future Sentiment Index registers +66, down from +75 a month ago and +69 a year ago. Looking at Future Sentiment as a 3MMA, the index is now at +71, down from +73 last month, but up from +68 last year.

What Respondents Are Saying

• One mill executive reports good market conditions. “The program business has been fine. Spot is more difficult as customers wait longer to buy and only buy exactly what is needed.”

• One trader considers market conditions to be poor. “Section 232 is having an unexpected impact on importing steel. We’re not sure how to move forward.”

• Market conditions are good, but could become challenging if prices continue to drop, says one service center executive. “If the expected third-quarter turnaround occurs, we will be fine. If not, it could be a rough year for everyone.”

• Another service center expects activity to improve in the next few months. “We’re thinking demand will pick up and there will be more material available (seconds) as the mills put it back on the market.”

• For a third service center respondent, the future is less clear. “We have a solid order book, but the crystal ball gets a bit fuzzy going out beyond 60 days.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right-hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left-hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed from the SMU Flat Rolled Market Trends Analysis questionnaire distributed twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to respond to almost 600 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s questionnaire, 35 percent were manufacturing and 49 percent were service centers/distributors. The balance of the respondents are steel mills, trading companies and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.