Market Data

June 4, 2017

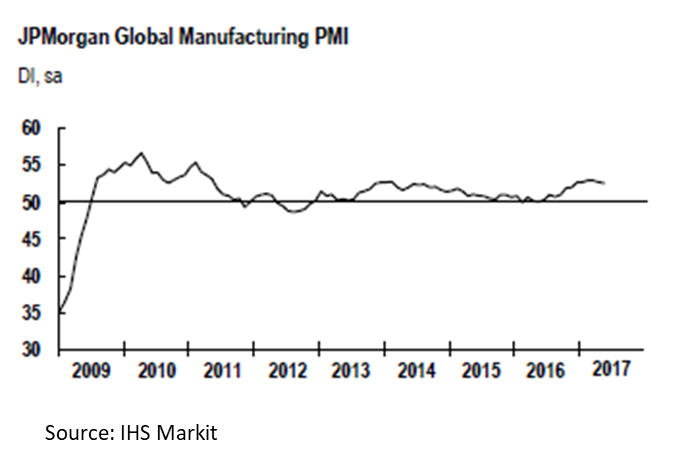

Global PMI at Six Month Low in May

Written by Sandy Williams

Global manufacturing was at a six month low in May according the latest JP Morgan Global Manufacturing PMI. The composite index inched down to 52.6 from 52.7 in April.

Developed nations showed solid steady expansion in manufacturing while growth in emerging nations was nearly flat. The PMI for the U.S. was at an 8 month low and China fell below the 50 neutral point for the first time in 11 months. The UK PMI was near the previous month’s 3-year high.

Production expanded over most sectors while variation was noted for new orders. Orders were strongest for investment goods and intermediate goods producers but slowed for consumer goods.

Inflation eased in May with increases for input costs and output charges at eight month lows.

Commenting on the survey, David Hensley, Director of Global Economic Coordination at JP Morgan, said: “The global manufacturing sector continued to expand in May, achieving further steady growth. The underlying dynamics of the survey, such as fuller order books, rising employment and positive business sentiment, also bode well for the future performance of manufacturing.”

Eurozone

The manufacturing PMI for the Eurozone was 57.0 in May, up 0.3 points from April. Business conditions improved in seven of the eight countries covered by the survey. Output and new orders accelerated at the best rate in six years creating an all-time record for job creation. Germany led the expansion in the region for the third successive month. Greece was the only country to contract in May but at its weakest rate in the last nine months. Backlogs increased and vendor lead times lengthened at the steepest rate in six years. Input costs and output charges increased at a slower rate in May potentially indicating an ease in price inflation pressure.

“The eurozone upturn is developing deeper roots as factories enjoy a spring growth spurt,” commented Chris Williamson, Chief Business Economist at IHS Markit. “ Demand for goods is growing at the steepest rate for six years, encouraging manufacturers to step up production and take on extra staff at a rate not previously seen in the two-decade history of the PMI survey. “The fact that the upturn is being accompanied by such strong jobs growth sends a signal that increasing numbers of companies are moving away from a focus on cost cutting towards investing in expansion, underscoring the elevated levels of business optimism seen across the region. The record hiring adds to the sense that the upturn is looking more and more robust as each month goes by.”

China

Overall manufacturing conditions deteriorated in China for the first time in almost a year posting a reading on the Caixin China General Manufacturing PMI of 49.6 from 50.3 in April. Production expanded only slightly during the month with new order growth the slowest since July 2016. Demand was softer domestically and abroad. The future outlook for manufacturing conditions remained at the 4-month low of April. “China’s manufacturing sector has come under greater pressure in May and the economy is clearly on a downward trajectory,” commented Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group.

Although the Caixin survey reported overall PMI fell in May, the China Federation of Logistics & Purchasing (CFLP) reported that China’s steel industry expanded at the fastest pace in a year. The PMI for the steel sector rose to 54.8 from 49.1 with new orders jumping 13.6 points to 60.5. Steel exports were weaker in May, especially to Southeastern Asia, with importers booking rebar and billet from Russia, Ukraine, Iran and Turkey in March and April, according to CRU analyst Richard Lu.

“Demand from traders and downstream consumers rose as prices rebounded. Sales are good while steel firms are seeing more orders,” said CFLP. “Steel demand fundamentals continue to improve. Currently, extremely low domestic steel stocks mean prices will continue to rally. But risk in the market is growing given that prices and margins for steel mills are at a historically high level.”

Russia

Manufacturing conditions improved in Russia with growth accelerating for the tenth consecutive month. The PMI rose to 52.4 from 50.8 on new order volume and increased demand. Orders for exports, however, continued to decline. Input prices rose but at a slower pace while output charges increased at the fastest rate since December. The outlook for the coming year was optimistic with manufacturers expecting new product development, strong underlying demand and continued increase for new orders. IHS Markit predicts Russia GDP to grow at 1.1 percent, less than the official prediction of 1.5-2 percent for 2017.

Mexico

Mexico’s PMI rose to 51.2 in May from 50.7 the previous month. Production volumes increased in May boosting the PMI reading. Expansion was slower than the historical average as demand weakened from domestic clients. Export sales rose at their strongest rate in three months, attributed to promotion and launch of new products.

“May’s survey data suggest a positive month overall for the Mexican manufacturing sector, with production levels returning to growth and export sales rising at the fastest pace since February,” commented Tim Moore, senior economist at IHS Markit. “A modest rebound in incoming new work helped to boost manufacturers’ growth expectations for the year ahead, with this sub-index reaching its strongest level since April 2016. Input cost pressures remained intense in May, largely driven by higher imported raw material prices. Efforts to alleviate squeezed margins meant that factory gate price inflation climbed back up towards the five-year peak seen in February.”

Canada

The IHS Markit Canada Manufacturing PMI registered 55.1 in May, down slightly from its six-year peak of 55.9 in April. Production volumes expanded again in May with spending increasing, particularly, in the energy sector. Export sales saw their strongest growth since November 2014 with manufacturers noting rising demand from U.S. clients. Stronger demand put pressure on operating capacity and backlogs, resulting in a surge in new jobs. Supply chain pressures and low inventory increased led to a steep increase in supplier delivery times.

United States

The IHS Markit PMI rose posted 52.7 in May, inching down from 52.8 in April for the weakest improvement in business conditions since September, said IHS Markit. New orders rose at a weaker rate and export sales slowed from April’s pace. Backlogs declined for the first time since May 2016. Price inflation also eased, down from April’s two-and-a-half year peak.

Commenting on the final PMI data, Chris Williamson, Chief Business Economist at IHS Markit said: “Manufacturing growth momentum continued to ebb in May, down to its weakest since just before the presidential election. “Manufacturing output, order books and employment all grew at only modest rates as sluggish sales prompted firms to scale back hiring. Exports sales remained especially lacklustre, hampered in part by the relatively strong dollar. The survey also brought signs of companies becoming more cautious about holding inventory. “Factories’ raw material prices meanwhile rose at a sharply reduced rate, which should at least help take pressure off profit margins and also feed through to weaker pressure on consumer price inflation.”