Analysis

June 1, 2017

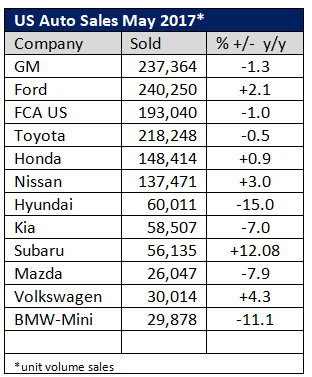

Ford Sales Outpace GM in May

Written by Sandy Williams

U.S. automotive sales in May are in reach of the 1.52 million units forecast by Edmunds and WardsAuto. WardsAuto is reporting a seasonally adjusted annual rate of 16.6 million for the month, just shy of its forecast for 16.8 million. Flat sales for the month would be welcomed by auto manufacturers that have seen sales decline after two record years.

Many analysts think 2017 sales will still total just over 17 million, but Alec Guiterezz, senior analyst at Kelley Blue Book, said continued softening could put sales in the high 16-million range.

“A performance in the high 16-million range is still very, very strong, said Guitterezz. “But coming off record numbers of 17.5 million units in the last two years, it certainly not at the record pace we’ve seen.”

Ford Motor Company outsold GM in May with sales up 2.1 percent to 240,250 units. Strong pick-up and fleet sales drove demand for Ford last month. General Motors sales were down 1.3 percent year-over-year to 237,364 units.

GM’s chief economist Mustafa Mohatarem commented, “U.S. economic fundamentals remain strong with a retail SAAR of 14.2 million, equal to last year’s record pace. The U.S. economy is operating at near full employment levels, wages are rising, interest rates and fuel prices remain low and consumer confidence remains high. The decline in total sales is primarily due to the industry’s pull back from daily rental sales. Although total sales are running below our expectations, we anticipate retail vehicle sales will remain strong.”