Market Data

May 31, 2017

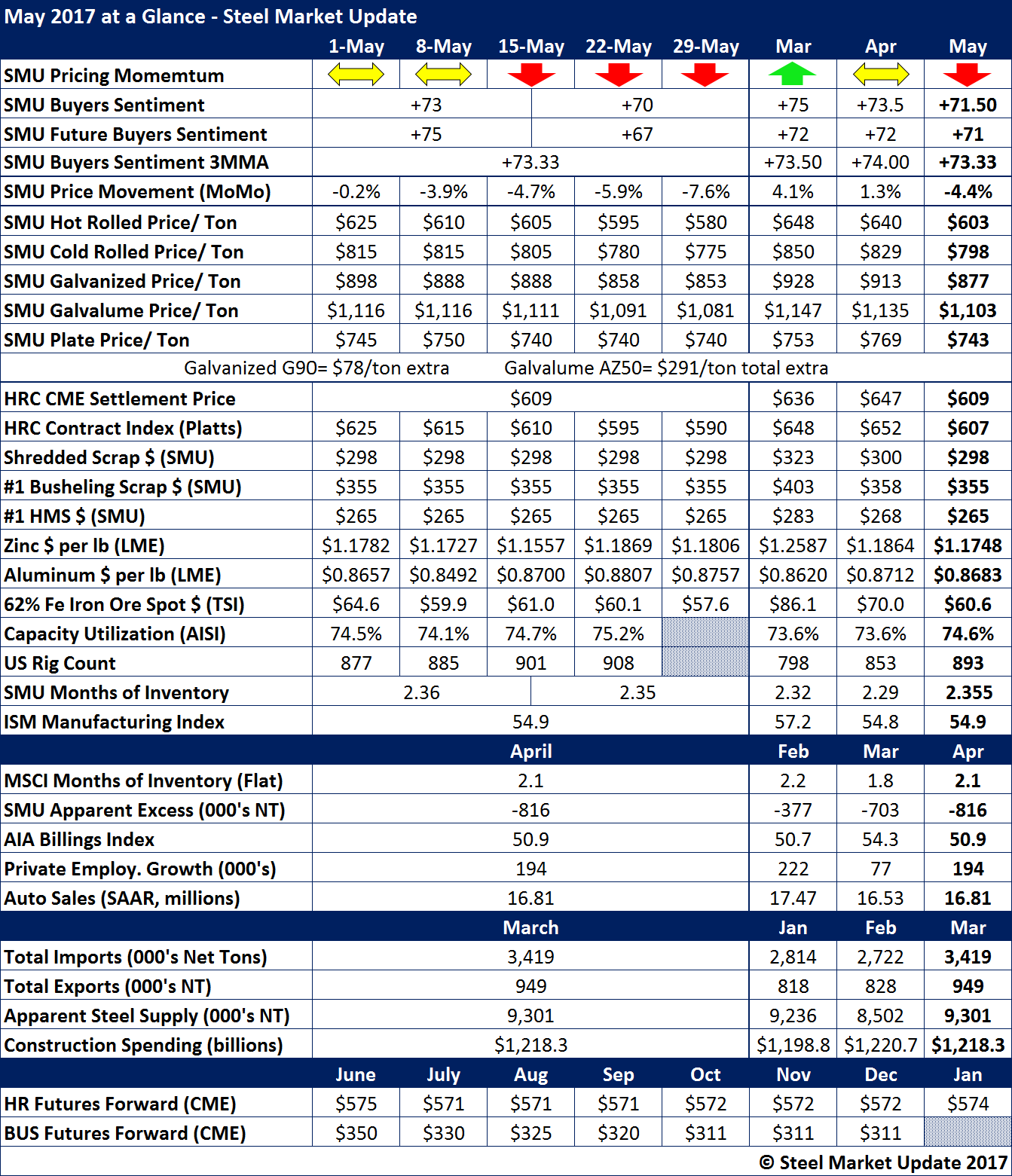

May at a Glance

Written by John Packard

The month of May saw flat rolled steel prices and our SMU Price Momentum Indicator take a turn and move lower. Benchmark hot rolled pricing was $625 during the first week of May and ended the month at $580 per ton. The HRC average for the month was $603 per ton, $6 per ton lower than the CME Settlement Price and $4 per ton lower than the Platts average for the month.

SMU Steel Buyers Sentiment Index, which is a forward looking indicator, dropped -8 points as the month progressed and our three month moving average declined for the first time in many months (albeit from record high levels).

Inventories continue to be tight, based on data out of the Metal Service Center Institute (MSCI) and SMU Service Center Apparent Deficit increased to -816,000 tons.

Here is what some of the key data points looked like for the month of May.