Prices

May 26, 2017

Global Steel Production in April and Forecast through 2018

Written by Peter Wright

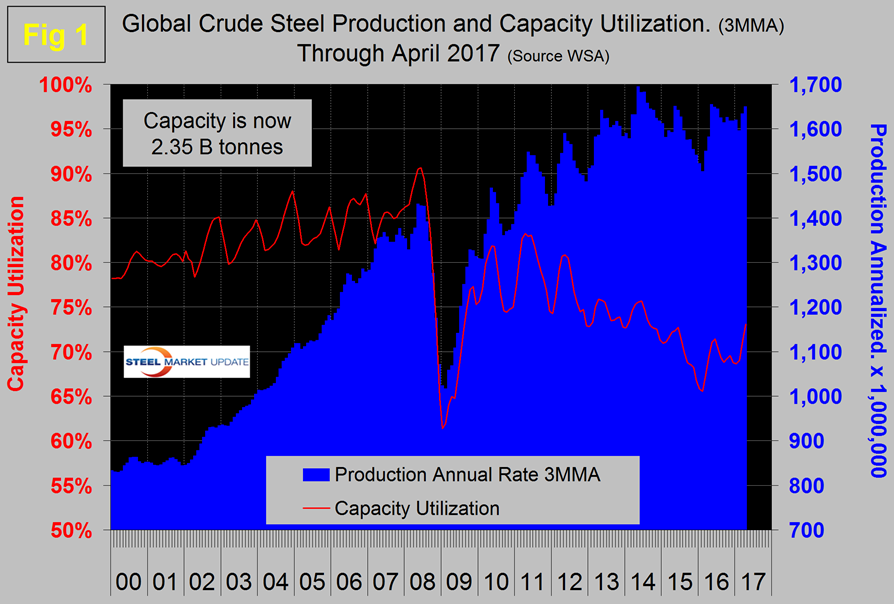

Production in the month of April was 142,080,000 metric tons, down from up from 143,469,000 tons in March. Capacity utilization at 73.6 percent was up from 71.9. The three month moving averages (3MMA) that we prefer to use were 137,479,000 and 72.0 percent respectively. Capacity is 2.35 billion tonnes per year. Figure 1 shows monthly production and capacity utilization since April 2000.

On a tons per day (t/d) basis, production in April was 4.736 million tonnes with a 3MMA of 4.633 which was the highest t/d result since our data stream began in January 2008. The growth of daily production month on month was 2.1 percent which was down from 2.3 percent in March. Since 2011, capacity utilization has been on an erratically downward trajectory but that may be changing as a turnaround is developing. On October 9th the OECD’s steel committee reported that global capacity is expected to increase by almost 58 million tonnes/year between 2016 and 2018 bringing the total to 2.43 billion tonnes.

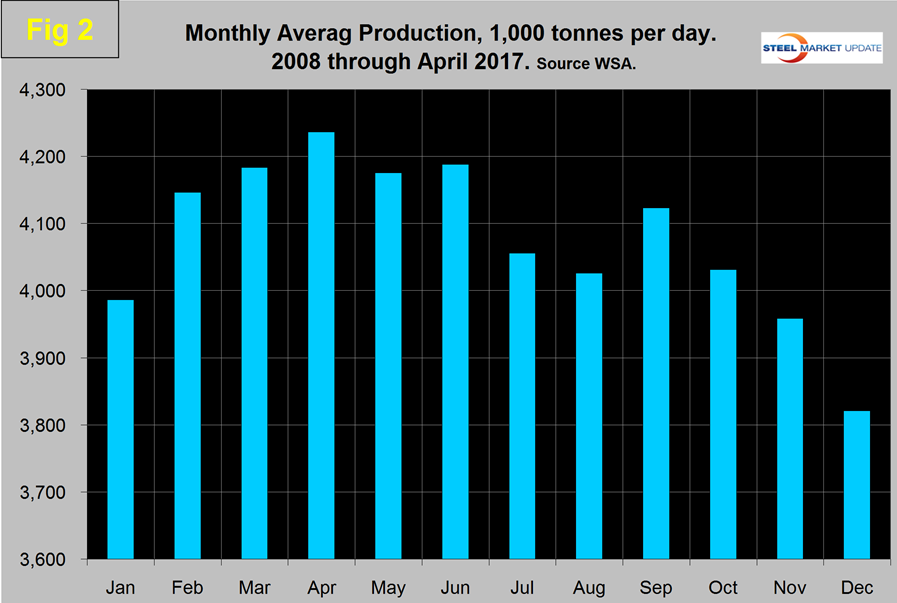

As we dig deeper into what is going on we start with seasonality. Global production has peaked in the early summer for the last seven years with April on average having the highest volume in the last 10 years. Figure 2 shows the average tons/day production for each month since 2008.

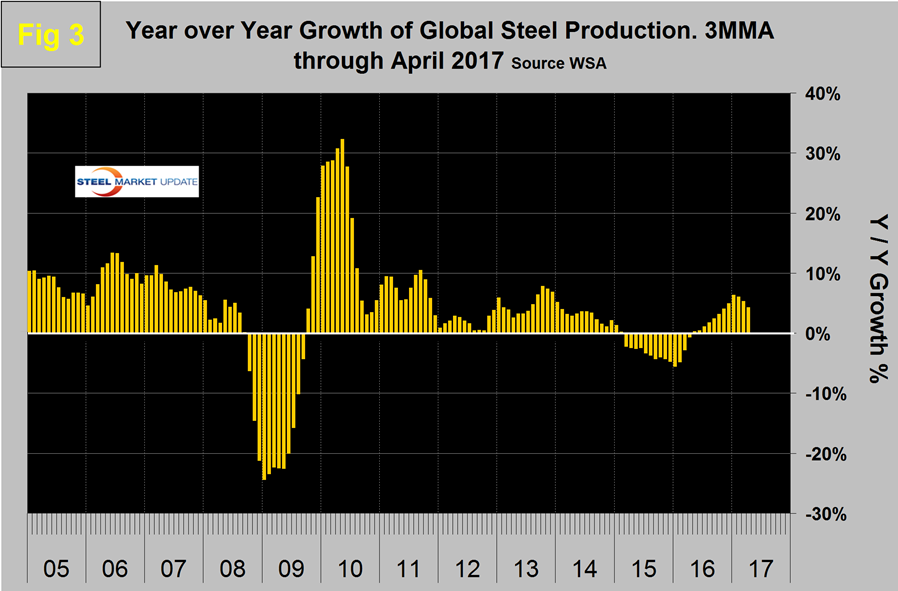

In those ten years on average, April has increased by 1.3 percent, this year April increased by 2.3 percent. Figure 3 shows the monthly year over year growth rate on a 3MMA basis since January 2005.

Production began to contract in March 2015 and the contraction accelerated through January 2016 when it reached negative 5.5 percent. Growth improved every month through February this year when it reached positive 6.1 percent. Growth slowed to 5.3 percent and 4.3 percent in March and April respectively. For the last five months China’s growth rate has been lower than the rest of the world. A welcome sign which if it becomes a long-term trend will take some pressure off the global market.

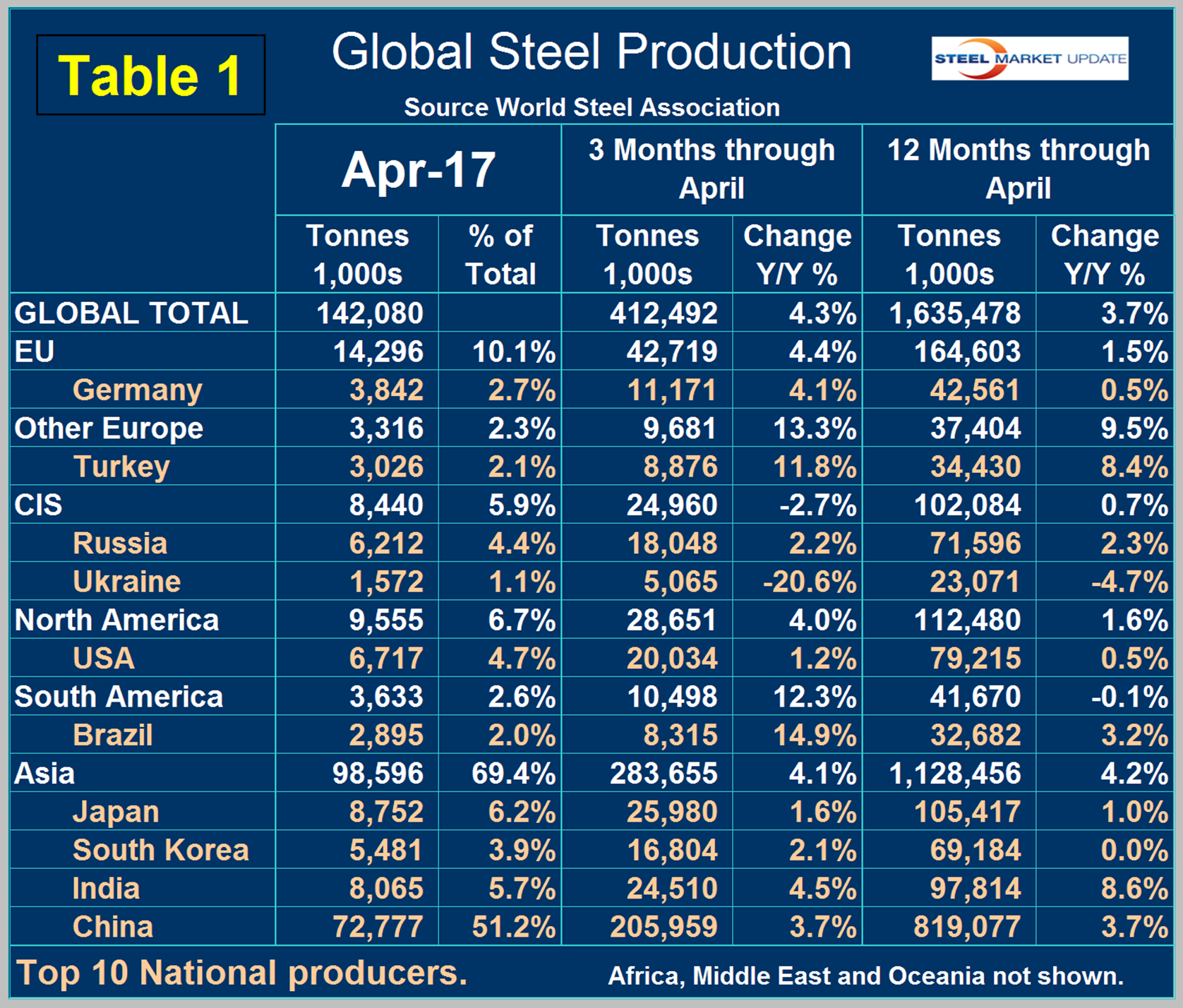

Table 1 shows global production broken down into regions and also the production of the top ten nations in the single month of April and their share of the global total. It also shows the latest three months and twelve months production through April with year over year growth rates for each period. Regions are shown in white font and individual nations in beige.

The world as a whole had positive growth of 4.3 percent in 3 months and 3.7 percent in 12 months through April. If the three month growth rate exceeds the twelve month we interpret this to be a sign of positive momentum which has been the case for the last fifteen months. In April China’s share of global production was 51.2 percent. In peering at the numbers from 67 nations we noticed something for the first time this month. Vietnam doesn’t appear in Table 1 and wasn’t even recognized as a producer by the World Steel Association until January last year. Vietnam has seen its production grow by over 100 percent in 16 months from 407,000 tons in January last year to 860,000 tons in April this year. This may be another piece of the puzzle that describes the re-processing and export of Chinese hot rolled coil.

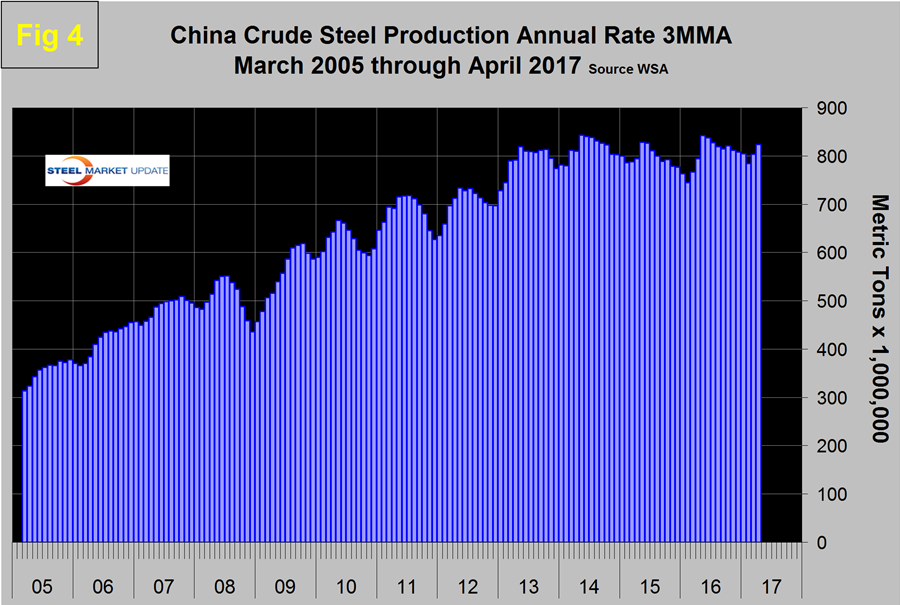

Figure 4 shows China’s production since 2005 and Figure 5 shows the y/y growth.

China’s production after slowing for 13 straight months year over year returned to positive growth each month in May 2016 through April this year on a 3MMA basis. It may look from Figure 4 as though China’s production was falling through February but on a y/y basis this was not the case. Therefore the slowdown in Chinese steel production that they have been promising is not happening.

In 3 months through April y/y every region except the CIS which was dragged down by Ukraine had positive growth. Other Europe led by Turkey had the highest regional growth rate followed by South America led by Brazil. Considering all the bad news coming out of Brazil, this seems to be an anomaly. Asia as a whole was up by 4.1 percent. North America was up by 4.0 percent. Within North America the US was up by 1.2 percent, Canada was up by 5.5 percent and Mexico up by 16.0 percent. In the first quarter of 2017, Mexico produced 25 percent more steel than Canada.

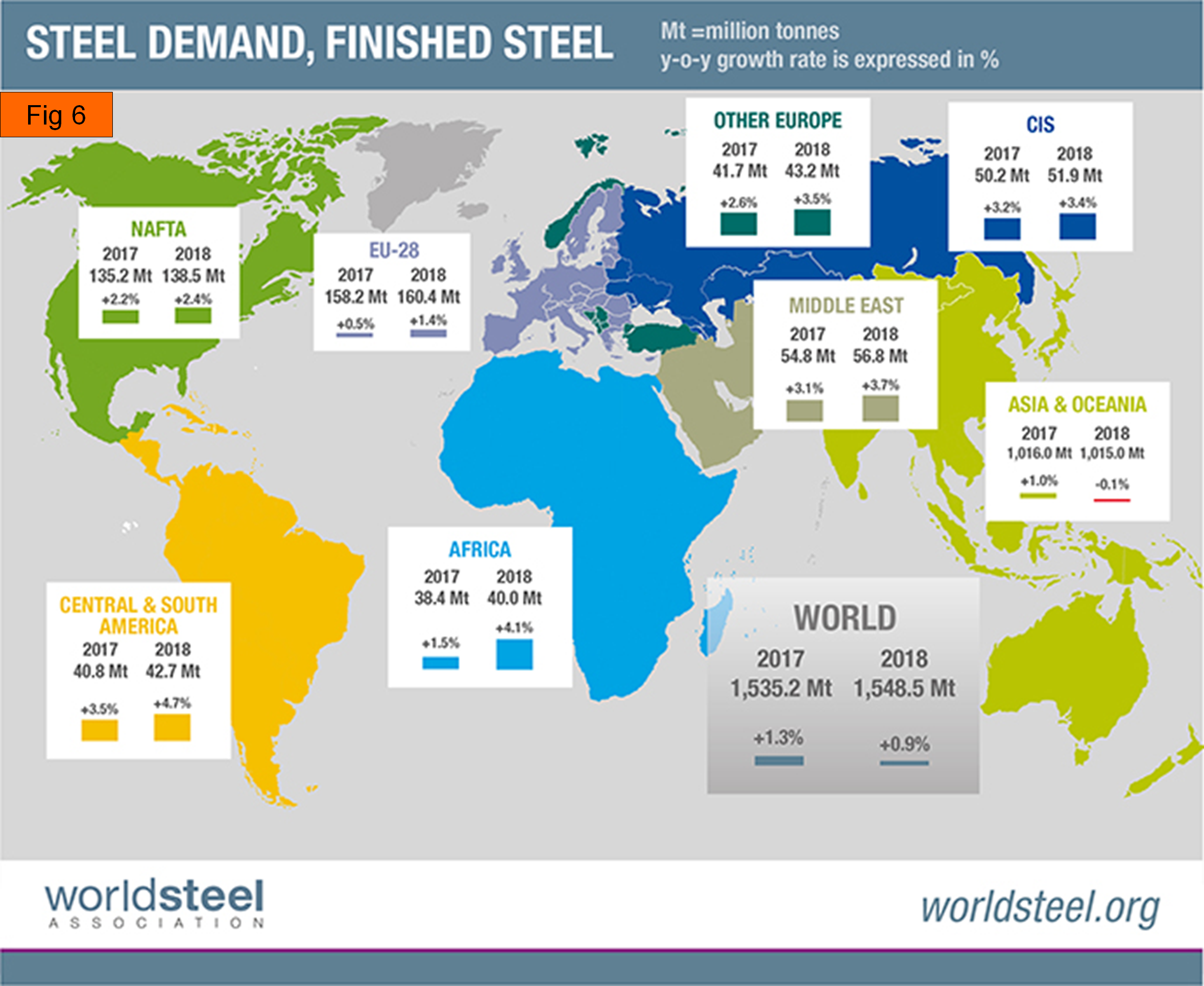

The April 2017 version of the World Steel Association Short Range Outlook (SRO) for apparent steel consumption in 2017 and 2018 forecast a global growth of 1.3 percent and 0.9 percent in 2017 and 2018 respectively. The previous SRO through 2017 released last October had a growth rate of 0.5 percent in 2017 therefore the latest forecast is an upgrade. Figure 6 is reproduced from the WSA web site and shows the forecast by region pictorially for 2017 and 2018.

North American steel consumption is forecast to grow by 2.2 percent and 2.4 percent. Surprisingly Asia is forecast to contract next year. Note this forecast is steel consumption, not crude steel production which is the main thrust of what you are reading now.

SMU Comment: On May 11th the IMF had this to say: “The infrastructure needs of emerging market economies, like China or India, differ from those of advanced economies like the United States or Germany. Many emerging economies must substantially expand their energy and transportation networks, or build them from scratch, to accommodate rapid economic growth. Our evidence from household surveys for 20 advanced and emerging market economies reveals a strong and positive relationship between personal income and transportation spending. Whereas people making $200 a year devote only 1 percent of their income to transportation needs, those making $20,000 a year spend 18 percent on transportation. Taking these factors into account, consumer spending on transportation is projected to quadruple by 2035 in India, China, and other parts of emerging Asia, as well as in sub-Saharan Africa. Merely building the paved roads and railroads needed to accommodate growing world demand for transportation could cost some $48 trillion over the next 20 years. Emerging market and developing economies will need the bulk of that investment.” This is why we find the Asia 2018 forecast surprising or more likely unbelievable. A welcome report from the IMF in its April update of the World Economic Outlook raised the projected global growth rate for 2017 and 2018. Growth in the developing world is highly steel intensive therefore this will take some pressure off the low global rate of capacity utilization.

Sources: World Steel Association with analysis by SMU.