Prices

May 23, 2017

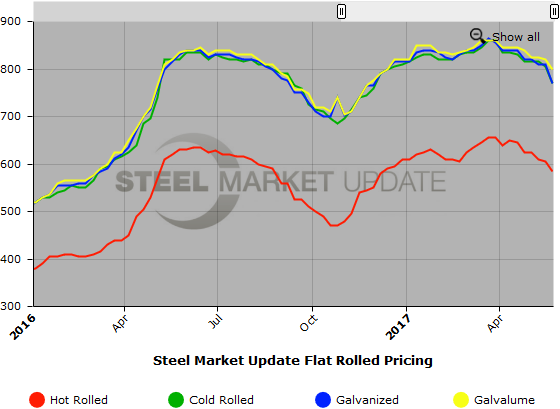

SMU Price Ranges & Indices: Benchmark HRC Breaks Below $600

Written by John Packard

“There’s been further erosion with EAF’s dropping spot to $570-$580, not necessarily tied to volume,” is what one large service center told us this afternoon. “[I am] afraid this market at risk of bigger drops than was anticipated.”

Flat rolled price averages were lower across all products followed by Steel Market Update with the exception of plate which managed to hold its average for another week.

We found steel buyers in the Upper Midwest not necessarily seeing the same steel pricing as their counterparts in the South. Mills like ArcelorMittal continue to struggle with deliveries while, as our service center executive admitted above, other steel mills were more sociable at the negotiation table.

One coating mill admitted that their numbers have been dropping and they believe $36 base prices may be available for the “dog days of summer.” Even so, this mill executive continued to be optimistic, “Tell you though, I expect a very handy rebound sometime in Q3. Import offers are less prevalent. Domestic numbers are becoming more appealing and safe. Non-auto demand is pretty good. And nobody seems to have noticed that Chinese domestic pricing has been bouncing back from the precipice.” This mill’s belief is those buying foreign steel may be in for some surprises and, “Somebody will be late to the party….”

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $570-$620 per ton ($28.50/cwt-$31.00/cwt) with an average of $595 per ton ($29.75/cwt) FOB mill, east of the Rockies. The lower end of our range declined $10 per ton compared to one week ago as did the the upper end. Our overall average is down $10 per ton compared to last week. Our price momentum on hot rolled steel is pointing to Lower which means we expect prices to decline over the next 30-60 days.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU price range is $740-$820 per ton ($37.00/cwt-$41.00/cwt) with an average of $780 per ton ($39.00/cwt) FOB mill, east of the Rockies. The lower end of our range fell $40 per ton compared to last week while the upper end declined $10 per ton. Our overall average is down $25 per ton compared to one week ago. Our price momentum on cold rolled steel is pointing to Lower which means we expect prices to decline over the next 30-60 days.

Cold Rolled Lead Times: 5-7 weeks

Galvanized Coil: SMU base price range is $37.00/cwt-$41.00/cwt ($740-$820 per ton) with an average of $39.00/cwt ($780 per ton) FOB mill, east of the Rockies. The lower end of our range fell $40 per ton compared to one week ago while the upper end declined $20 per ton. Our overall average is down $30 per ton compared to last week. Our price momentum on galvanized steel is pointing to Lower which means we expect prices to decline over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $818-$898 per net ton with an average of $858 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-9 weeks

Galvalume Coil: SMU base price range is $39.00/cwt-$41.00/cwt ($780-$820 per ton) with an average of $40.00/cwt ($800 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range declined $20 per ton compared to last week. Our overall average is down $20 per ton compared to one week ago. Our price momentum on Galvalume steel is pointing to Lower which means we expect prices to decline over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1071-$1111 per net ton with an average of $1091 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks

Plate: SMU price range is $720-$760 per ton ($36.00/cwt-$38.00/cwt) with an average of $740 per ton ($37.00/cwt) FOB delivered. The lower end of our range increased $10 per ton compared to one week ago while the upper end declined $10 per ton. Our overall average is unchanged compared to last week. Our price momentum on plate steel is now pointing to Lower which means we expect prices to decline over the next 30-60 days.

Plate Lead Times: 3-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. We will add plate prices to this graph once we have gathered a few months of data. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.