Market Segment

May 23, 2017

Service Center Intake, Shipments and Inventory through April 2017

Written by Peter Wright

When we saw that shipments had dropped by over 500,000 tons in April our first thought was “Yikes!” but as we looked deeper we saw that shipping days in March were 23 days (their highest in the cycle) and in April fell to 19 days. Daily shipments in April increased by 6.6 percent from March. On average since 2009, April has contracted by 0.5 percent therefore these latest numbers are encouraging. Carbon steel shipments were 156,000 tons per day in April and months on hand on the 30th were 2.28, up from 1.94 at the end of March.

![]() Intake and Shipments

Intake and Shipments

In April total carbon steel intake at 154,900 tons per day (t/d) was 1,200 tons less than shipments. This was the second month of deficit after three months of surplus. Total sheet products had an intake deficit for the third successive month in April when the value was negative 1,300 tons.

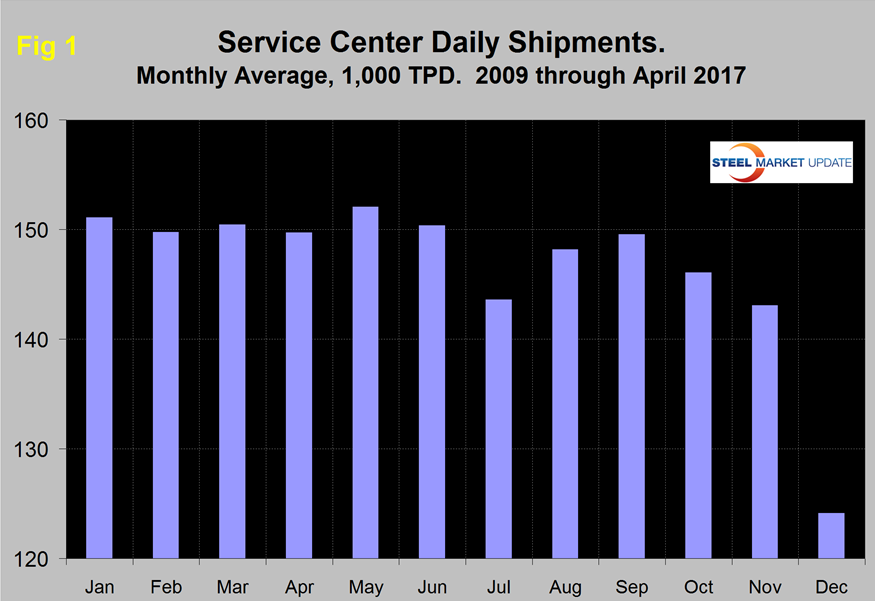

Total service center t/d carbon steel shipments increased from 151,400 in March to 156,000 in April. This was the best month since May 2015. MSCI data is quite seasonal and we need to eliminate that effect before commenting in detail on an individual month’s result. Figure 1 demonstrates this seasonality and why comparing a month’s performance with the previous month is often misleading, particularly in January and the second half of the year. In the analysis described below we report year over year changes to eliminate seasonality, our intention is to provide an undistorted view of market direction.

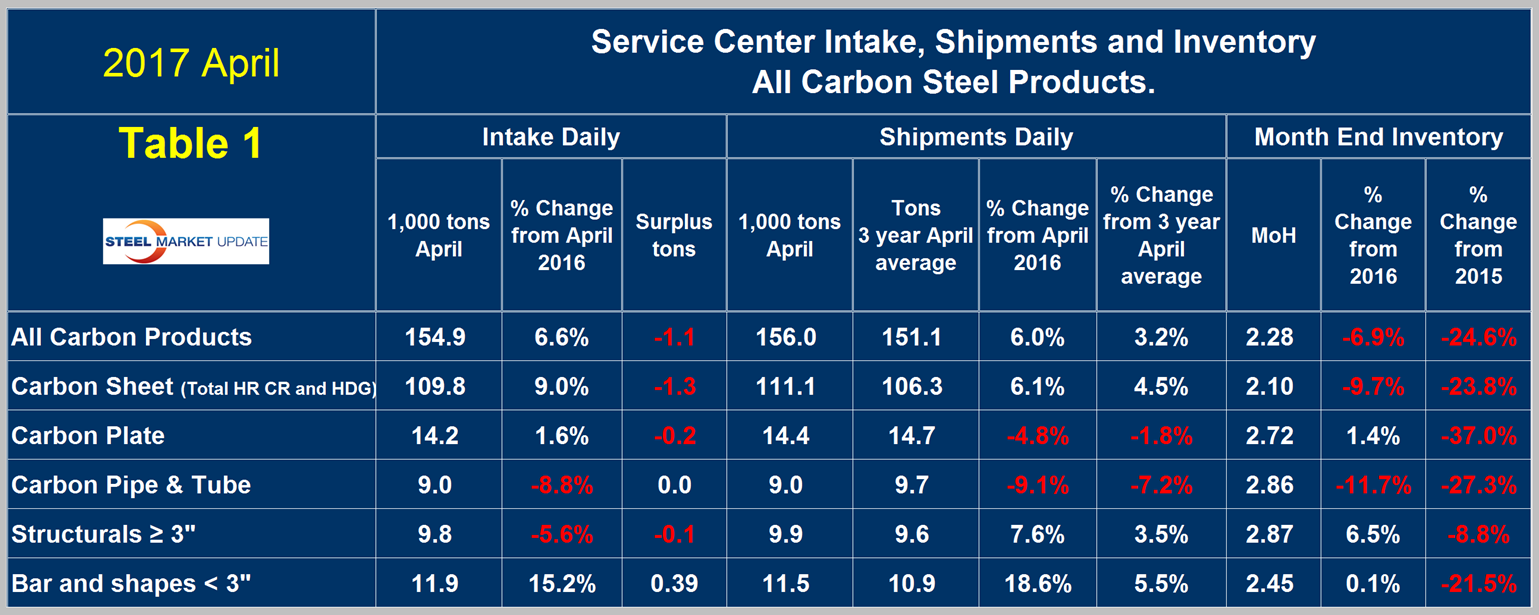

Table 1 shows the performance by product in April compared to the same month last year and also with the average t/d shipments for this and the two previous months of April.

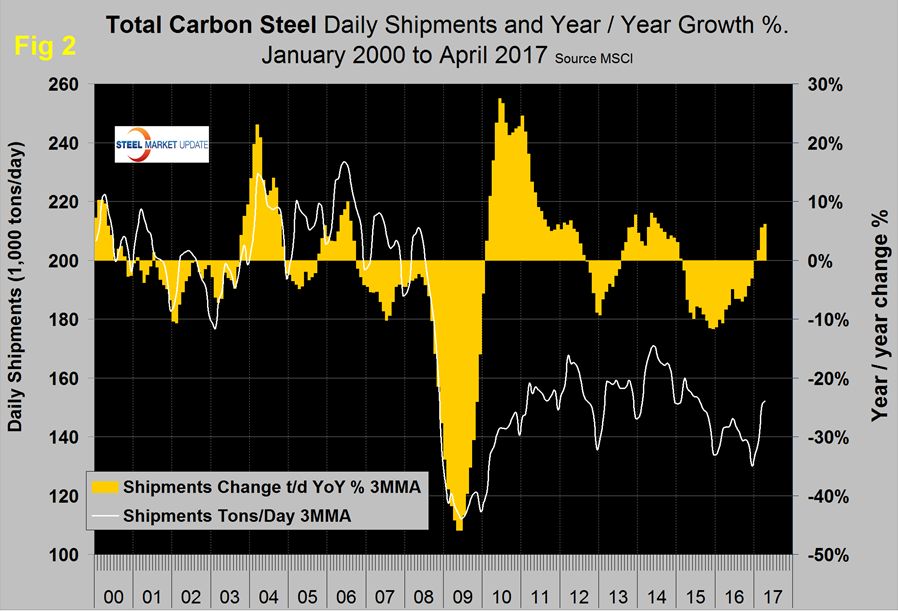

We then calculate the percent change between April 2017 and April 2016 and with the most recent 3 year April average. April this year was up by 6.0 percent from April 2016 and up by 3.2 percent from the three year April average. The fact that the y/y growth comparison is better than the three year comparison suggests that momentum is positive. Shipments of sheet and long products were up from April last year but plate and tubulars were down. Figure 2 shows the long-term trend of daily carbon steel shipments since 2000 as three month moving averages. (In our opinion the quickest way to size up the market is the brown bars in Figures 2, 3, 4 and 5 which show the percentage y/y change in shipments.)

In January on a 3MMA basis there was positive y/y growth of 0.07 percent which improved in each month of 2017 to 6.2 percent in April. These were the first positive y/y result since April 2015.

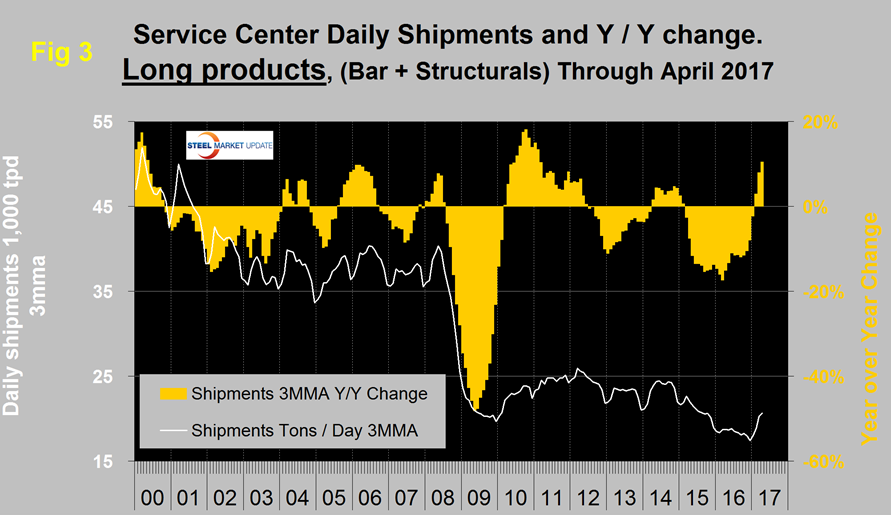

Figure 3 shows monthly long product shipments from service centers as a 3MMA with y/y change.

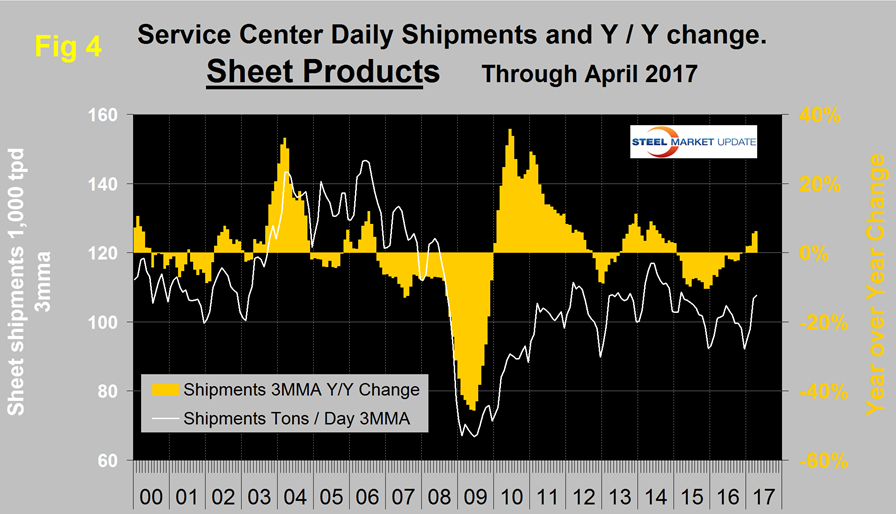

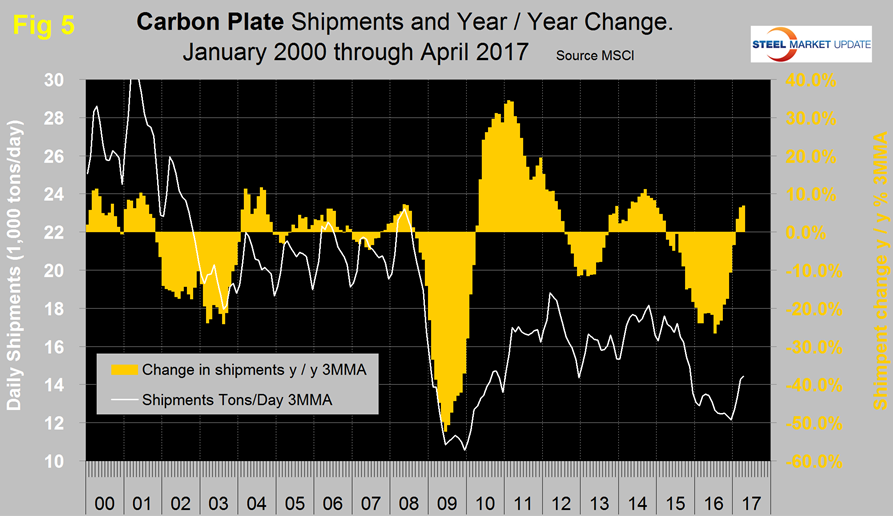

Growth has improved in each of the last seven months from negative 12.0 percent in September last year to positive 10.5 percent in April this year. February, March and April were the first positive result in two years. Sheet and plate have performed very differently in the last two years. Sheet and plate products both had a good post-recession recovery. Both had some contraction in 2013 and growth in 2014 but since early 2015 they have diverged dramatically with plate performing much worse than sheet. Figures 4 and 5 show the 3MMA of t/d shipments and the y/y growth for sheet and plate respectively.

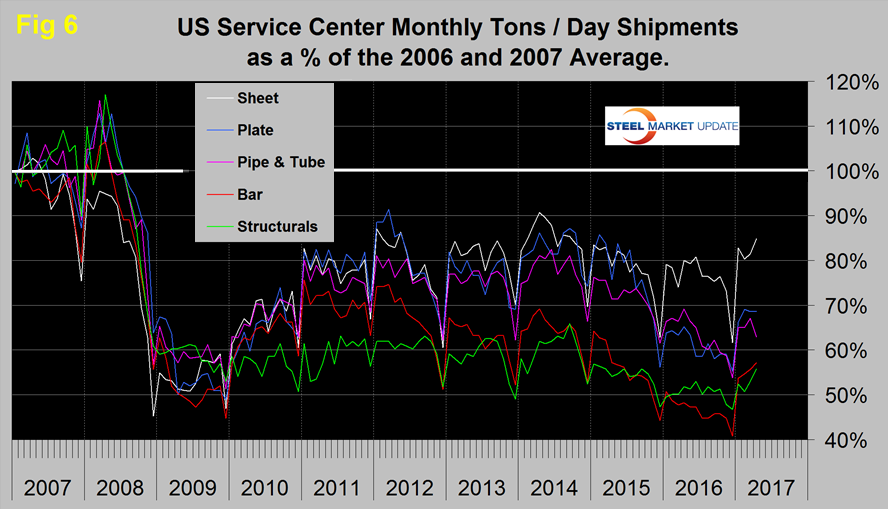

In 2006 and 2007, the mills and service centers were operating at maximum capacity, Figure 6 takes the shipments by product since that time frame and indexes them to the average for 2006 and 2007 in order to measure the extent to which service center shipments of each product have recovered. Each year all products experience the December collapse and January pick up.

The total of carbon steel products is now at 73.5 percent of the shipping rate that existed in 2006 and 2007, with structurals and bar at 55.8 percent and 57.2 percent respectively. Sheet is at 84.9 percent, plate at 68.6 percent and tubulars at 62.9 percent.

Inventories

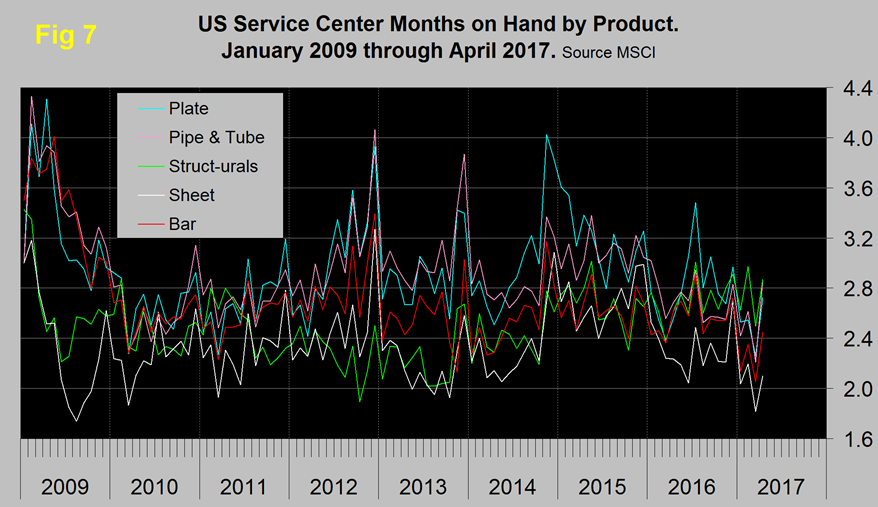

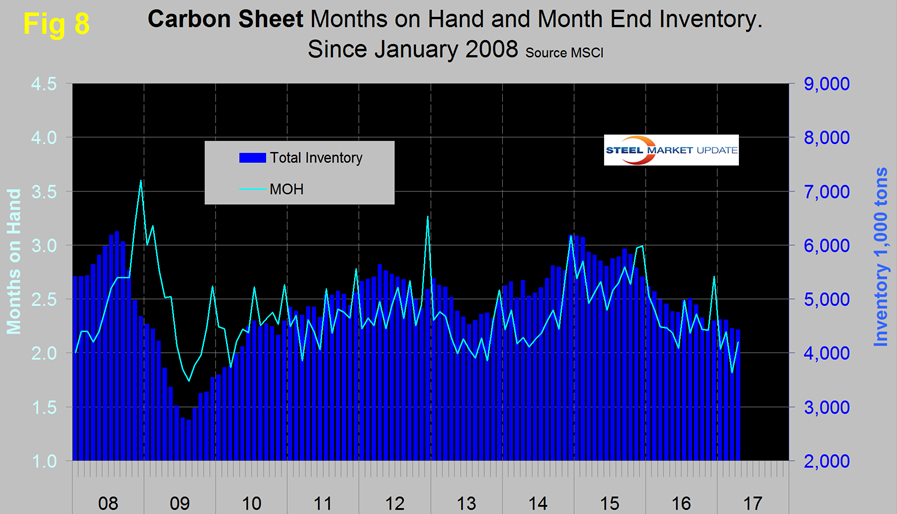

March closed with months on hand (MoH) of 1.94 for all carbon steel products, which was the lowest level in 13 years (since April 2004). April increased to 2.28. This calculation is misleading because it is based on total shipments for the month. Therefore it is highly influenced by the number of shipping days. The March MoH was so low because shipping days were at the maximum. Compared to April last year MoH in total were down by 6.9 percent led by pipe and tube which were down by 11.7 percent and sheet products down by 9.7 percent. Shipping days in April last year were 21 and as stated above were 19 this year. The fact that both shipping days and MoH were down y/y means that the inventory decline was particularly significant. Plate and long products had an increase in MoH year over year. Figure 7 shows the MoH by product monthly since April 2009.

All products had a surge in months on hand in July 2016 driven not by an inventory volume increase but by a decrease in monthly shipments as a result of a small number of shipping days. By the same token, the low MoH in March was influenced by the high number of shipping days. Figure 8 shows both the month end inventory and months on hand since April 2008 for total sheet products. The total inventory tonnage of sheet products has been in decline since the end of 2015.

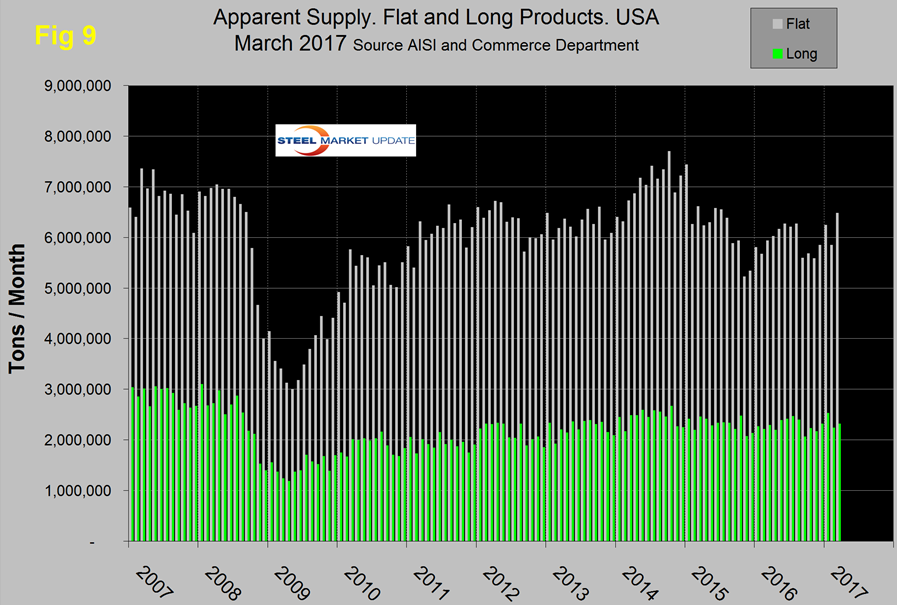

SMU Comment: In Figures 2, 3, 4 and 5, the white lines show t/d shipments. So far in 2017 the MSCI results have been encouraging. There was a decline in shipments for total carbon steel products from mid-2014 through December last year but the y/y comparison became increasingly positive in 2017. Figure 9 shows the total supply to the market of long and flat products based on AISI shipment and import data through March which is the latest data available.

Total supply of long products is much better than the MSCI report of service center shipments with a volume almost double the recessionary low point. For flat rolled the MSCI and AISI data have been in reasonable agreement with one another.

The SMU data base contains many more product specific charts than can be shown in this brief review. For each product we have ten year charts for shipments, intake, inventory tonnage and months on hand. Some readers have requested these extra charts for a particular product and others are welcome to do so.