Analysis

May 16, 2017

Housing Starts and Permits Fall in April

Written by Sandy Williams

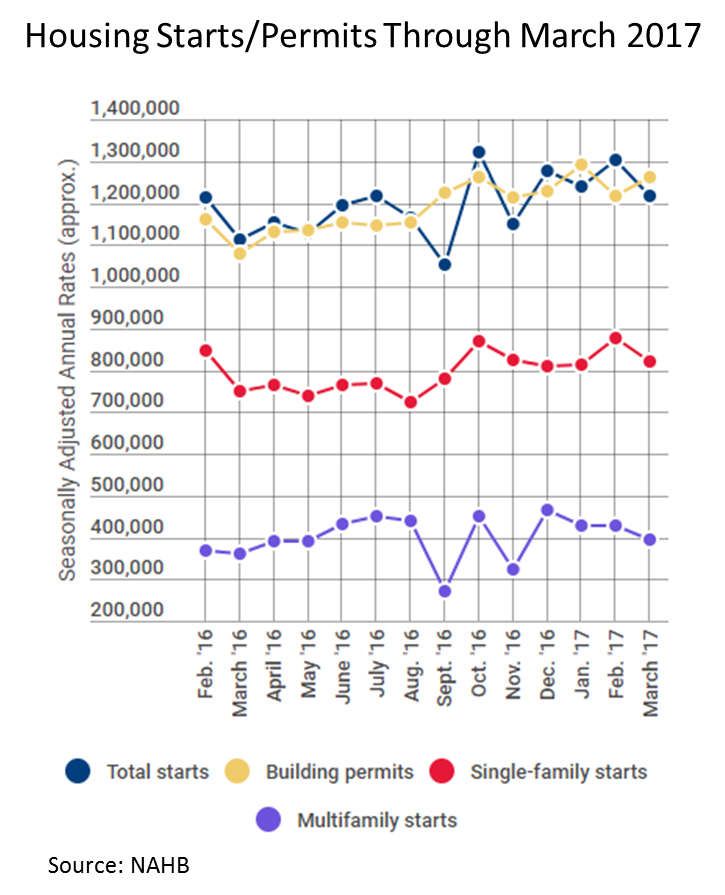

Housing starts surprised economists by moving lower in April to a seasonally adjusted annual rate of 1,172,000. April’s tally is 2.6 percent below the March estimate of 1,203,000 but 0.7 percent higher than a year ago. Projections were for starts to reach 1.26 million in April.

Starts increased 41.1 percent in the Midwest and 5.4 percent in the West. Starts in the Northeast and South declined 37.3 percent and 9.1 percent, respectively.

Single family starts increased 0.4 percent from March while apartment style homes of five units or more fell 9.6 percent.

Permit authorizations, an indicator of future growth, also fell in April. Building permits were at a seasonally adjusted annual rate of 1,229,000, 2.5 percent below March but 5.7 percent above April 2016. Single family permit authorizations were down 4.5 percent sequentially and multi-family up 1.5 percent. Regionally, housing permits issuance compared to March were down 10.3 percent in the Northeast and down 7.4 percent in the South. Permit authorizations rose 1.0 percent in the Midwest and 8.7 percent in the West.

A recent survey by the National Association of Homebuilders showed builder confidence at the second highest rate since the downturn. Builders continue to be optimistic even as they deal with higher building material costs, low lot availability and labor shortages, said NAHB.

“Despite this minor pull back, builders are optimistic about market conditions and expect more consumer activity in the months ahead,” said Granger MacDonald, chairman of the National Association of Home Builders. “However, builders need to be careful to manage expenses as construction costs continue to rise.”

“While we saw a little pause in market growth this month, single-family production is still up 7 percent since the start of 2017,” said NAHB Chief Economist Robert Dietz. “The April report falls in line with our forecast for continued, gradual strengthening of the single-family sector throughout the year.”