Prices

May 9, 2017

Service Center Spot Prices Weakening

Written by John Packard

Last week Steel Market Update completed our early May flat rolled steel market trends analysis. During the process, we asked manufacturing companies and service centers to comment on the status of the service center spot market pricing. We found agreement within both camps that steel distributors have been transitioning from a market where they were asking for higher prices to a more balanced spot price environment.

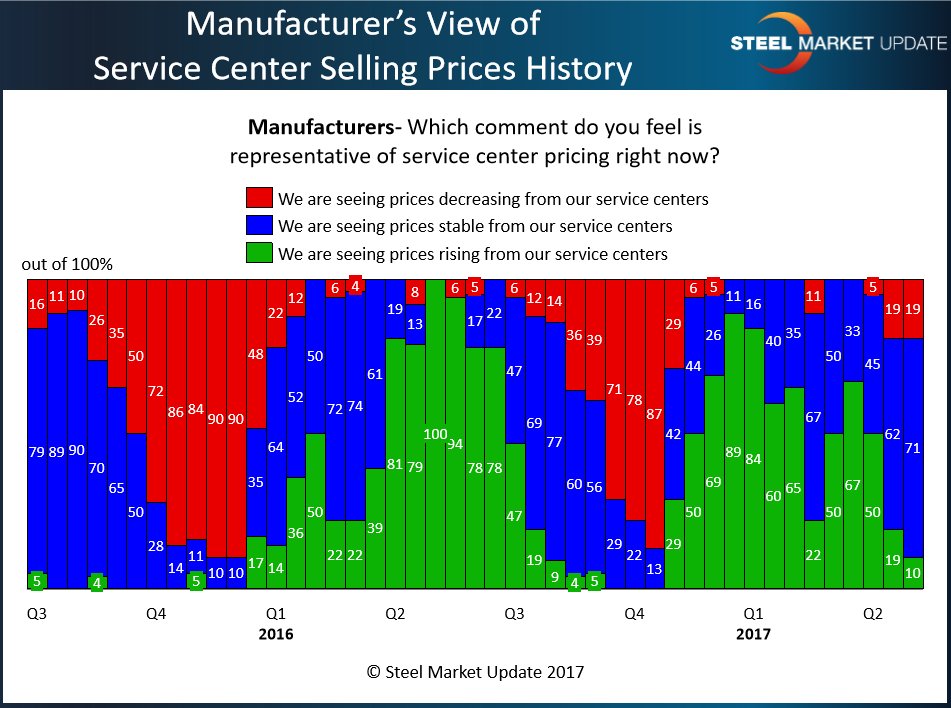

Manufacturers reported only 19 percent of flat rolled distributors were lowering prices, 10 percent raising prices and the vast majority (71 percent) were keeping prices stable (see graphic below).

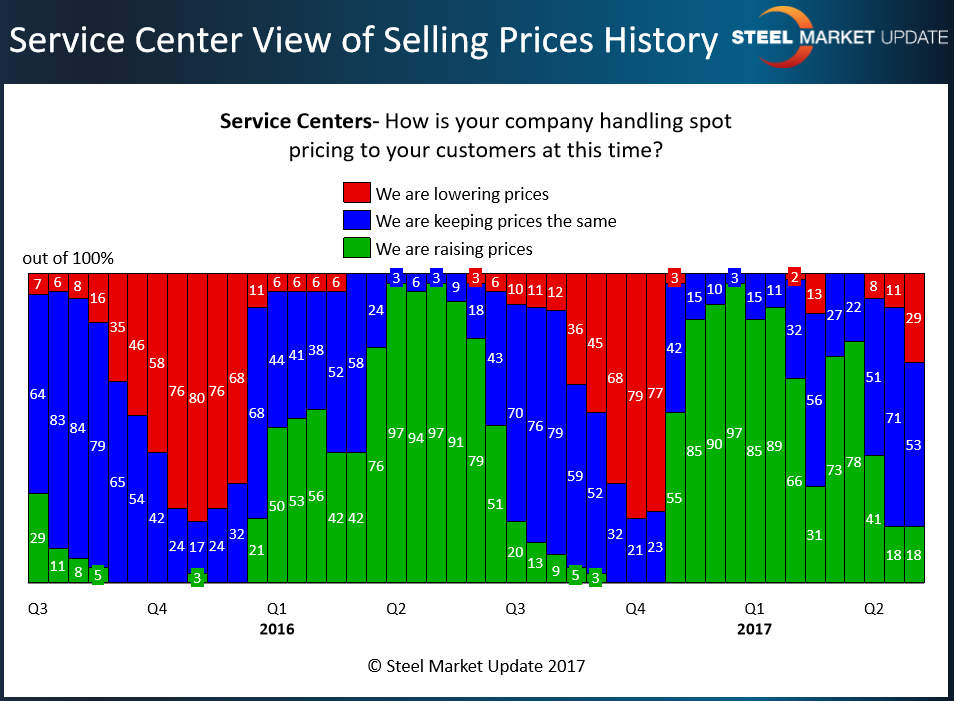

We asked the service centers a similar question, and we found 29 percent of the distributors responding to our query reporting their company as lowering spot prices. Another 18 percent reported their company as raising prices and 53 percent saw stability in their spot price offers to their customer.

If you look at our graph below you will see these response levels are radically different than what we were reporting back in mid-March 2017 when 78 percent of the service centers responding to our survey reported their company as raising spot pricing (see graphic below).

Separate from the survey, SMU received a comment from a service center executive this afternoon (Tuesday, May 9, 2017) questioning why service centers were dropping spot prices below their cost to replace… “Considering mills are attempting to maintain pricing structure it is amazing how quickly Service Centers are dropping prices below current replacement costs.”