Market Data

May 2, 2017

Manufacturing Gains Traction in Europe, UK and Japan

Written by Sandy Williams

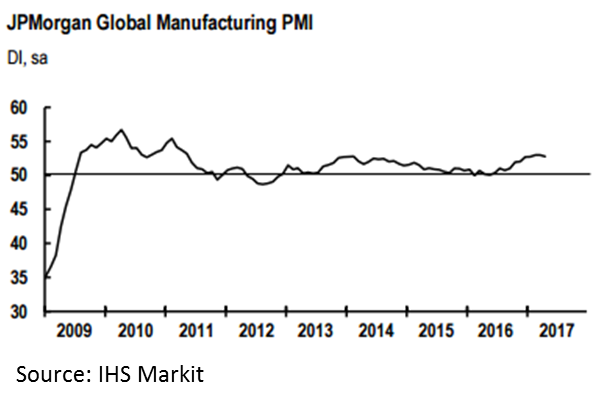

The JP Morgan Global Manufacturing PMI dipped slightly to 52.8 in April from 53.0 in March. The PMI has shown expansion (above the 50 no-change mark) for 14 months.

Manufacturing conditions slowed in the U.S. but was offset by acceleration in Europe, Japan and the United Kingdom. China expanded at its weakest rate in seven months.

Global production and new orders generally weakened during the month. International trade fared somewhat better as new export orders picked up. Prices remained elevated in April with some easing of average input costs and output charges.

Manufacturers continued to express optimism for future business conditions although the outlook index remained unchanged from its three-month low in March.

Manufacturers continued to express optimism for future business conditions although the outlook index remained unchanged from its three-month low in March.

“The start of the second quarter saw a slight loss of growth momentum in the global manufacturing sector,” said David Hensley, Director of Global Economic Coordination at JP Morgan. “Rates of increase eased for both production and new orders, although the outlook remains positive given a backdrop of solid business confidence and rising backlogs of work. The continued upturn is also feeding through to the labour market, with jobs added for the eighth straight month.”

Eurozone

The Eurozone manufacturing PMI rose to a six year high in April, registering 56.7 from 56.2 the previous month. Seven of the eight countries recorded expansion, with Germany close to a 71-month high. Greece was the outlier below the no-change mark at 48.2. Output, new orders and employment levels grew at stronger rates in April. Supplier delivery times lengthened. Demand was improved both domestically and abroad and new export orders rose at the quickest pace in six years. Input costs and selling prices both continued to rise April.

“Companies are benefitting from the historically weak euro, improved growth in key export markets, rising domestic demand and ongoing central bank stimulus including record-low interest rates,” commented Chris Williams, Chief Business Economist at IHS Markit. “Optimism about the year ahead meanwhile appears unaffected by political worries, with the first four months of 2017 seeing confidence remaining elevated at the highest level since the future output series started in 2012.”

United Kingdom

Brexit doesn’t seem to be slowing the UK manufacturing sector. The Markit/CIPS UK Manufacturing PMI rose to 57.3 for a three-year high in April. Output, new orders and employment all grew due to a strong domestic market. New exports also increased as the sterling exchange rate weakened and global market conditions improved. Input costs continued to be elevated although the rate of inflation eased somewhat during the month. Higher input costs continued to be passed through in selling prices. The PMI survey noted that companies were purchasing and holding raw materials to protect against future price increases.

Rob Dobson, Senior Economist at IHS Markit commented: “Although only accounting for 10% of the economy, the upturn in the manufacturing sector represents some welcome good news after the sharp slowing in GDP seen in the first quarter. The big question is whether this growth spurt can be maintained, especially given the backdrop of ongoing market volatility and a number of political headwinds such as elections at home and abroad.”

China

Second quarter began with a further slowdown in production and new orders for Chinese manufacturers. The PMI registered 50.3 in April, down from 51.2 in March. Employment numbers dropped as companies cut costs and personnel. Input price inflation was at a seven month low and as a result output charges increased only modestly. Business confidence in the 12 month outlook was at its lowest level so far this year.

Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group commented: “The downward pressure on manufacturing gradually emerged in April, with all indicators weakening. The Chinese economy may be starting to embrace a downward trend in the near term as prices of industrial products decline and active restocking comes to an end.”

Russia

The pace of manufacturing improvement slowed in Russia with output and new order growth at eight month lows. The PMI dropped to 50.8 from 52.4 in March and manufacturers expressed less optimism about future business conditions. New export orders remained in contraction for the forty-fourth month. IHS Markit expects industrial production to increase by 1.7 percent in 2017 but March growth was only 0.8 percent y/y.

Japan

Japan manufacturers saw export sales strengthen in April resulting in continued expansion for the sector. The headline PMI inched up to 52.7 from 52.4 in March. Indexes for orders, production, and employment all increased last month. Raw material costs increased along with demand; fuel and steel products led the increase in overall prices. Stronger overall demand across South East Asia drove growth in April, especially for capital goods, said IHS Markit.

Mexico

The manufacturing sector in Mexico failed to build much momentum in April. The PMI slipped to 50.7 from 51.5 in March as production levels fell during the month. New orders, however, continued to rise in April augmented by an upturn in demand from abroad.

Tim Moore, senior economist at IHS Markit commented: “While manufacturing firms are relatively optimistic about the year ahead, they remain cautious in terms of inventory volumes. Stocks of finished goods fell to the greatest extent for four years in April amid efforts to improve cash flow against a backdrop of squeezed operating margins. There were also some reports that rising raw material prices had led to shortages of stock among vendors. Depleted inventories and supply chain disruptions contributed to the fastest rise in backlogs of work at manufacturing firms since October 2011.”

Canada

Business conditions continued in expansion for the fourteenth straight month for Canadian manufacturers. April’s overall manufacturing growth was at the fastest pace in six years. The PMI rose to 55.9 from 55.5 in March. Strong demand pushed orders and production volume higher mostly from domestic sales although a modest increase in new export orders was noted. Raw material prices increased as manufacturers built inventory to meet production demands. A rebound was seen in the energy sector along with a modest increase in new export orders. Canadian manufacturers were optimistic about the business outlook for the next 12 months; expectation for higher production requirements was at the highest level since February 2014.

United States

The Markit U.S. Manufacturing PMI dipped to 52.8 in April from 53.3 in March. Output and new order growth weakened in April, with production growth at its weakest pace in seven months and new orders expanding at their slowest rate since September 2016. Input prices accelerated to the fastest rate since September 2014 resulting in higher factory gate charges. Survey respondents cited higher prices for metals, especially steel. Exports climbed at the steepest rate in eight months. Manufacturers continue to be optimistic and expect order books to improve in the coming months.