Analysis

May 2, 2017

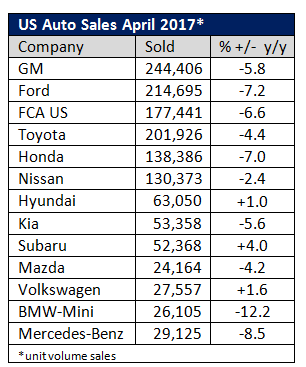

Auto Sales Falter in April

Written by Sandy Williams

Despite incentives, U.S. automotive sales dipped in April with almost all brands showing declines year-ove- year. Of the Big Three Detroit manufacturers, Ford had the worst results, down 7.2 percent to 214,695 for the month. FCA USA posted sales of 177,441, down 6.6 percent and GM had sales of 244,406, down 5.8 percent.

Slower sales were expected with Edmunds predicting a 1 percent decline to a seasonally adjusted annual rate of 17.1 million. Automotive analysts expect 2017 to be the first year of industry sales decline since 2009.

“The industry has been holding its breath to see if the days of peak sales are over, and while Q1 sales managed to remain stable, we’re starting to see the slowdown in 2017 we’ve been anticipating,” said Jessica Caldwell, Edmunds executive director of industry analysis. “Year-over-year declines in monthly sales may become more typical as the year progresses, but there’s no reason to be in panic mode. Historically, car sales are still strong.”