Prices

April 23, 2017

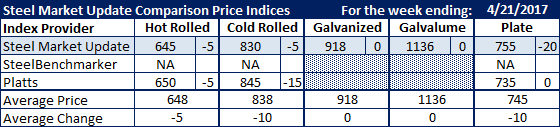

Comparison Price Indices: Slipping

Written by John Packard

Flat rolled spot prices are slipping based on an analysis of the Steel Market Update (SMU) and Platts flat rolled steel indexes. We found lower average pricing on hot rolled and cold rolled this week with no movement in galvanized and Galvalume. SMU had plate prices down $20 per ton while Platts kept plate prices the same as the prior week. SteelBenchmarker did not report prices this week as they only provide prices twice per month.

Hot rolled prices averaged $645 per ton on the SMU index and $650 for Platts. Both were down $5 per ton compared to the previous week.

Cold rolled prices dropped $5 per ton on SMU and $15 per ton on Platts.

Galvanized .060″ G90 prices remained the same as one week earlier at $918 per ton (extras used are shown below) and .0142″ AZ50, Grade 80 Galvalume prices also remained static.

SMU saw plate prices down by $20 per ton while Platts kept their average at $735 per ton.

SMU Note: Galvanized prices include $78 in extras for a .060″ G90 product. Galvalume prices include $291 in extras for a .0142” AZ50 Grade 80 product.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Plate: SMU Pricing is based on nominal weight with freight prepaid (delivered) to the customer. Platts is FOB Southeast Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.