Market Segment

April 18, 2017

MSCI United States Service Center Data for March

Written by John Packard

Steel Market Update (SMU) is providing two articles on the MSCI (Metal Service Center Institute) data for March 2017 for United States steel distributors in tonight’s newsletter. The first article is our normal analysis and the second article is a deeper dive analysis normally provided to our Premium level readers. Publisher, John Packard, also provides some insights and opinions about service center inventories in his Final Thoughts at the very end of this issue.

Earlier today the MSCI released shipment and inventories data for the steel service centers located in the United States. According to the MSCI total steel shipments were 3,657,400 tons for the month of March. This is 9.7 percent above year ago levels (we had 23 shipping days compared to 20 last year). The daily shipment rate was 159,000 tons well above the 144,900 tons reported last year.

Year to date the U.S. distributors have shipped 10,124,300 net tons which is a 5.8 percent improvement during the first quarter 2016.

Inventories stood at 7,213,500 tons (all products) down 6.1 percent compared to year ago levels. Inventories are down 128,200 tons from February 2017. The number of months on hand stood at 2.0 months (not seasonally adjusted).

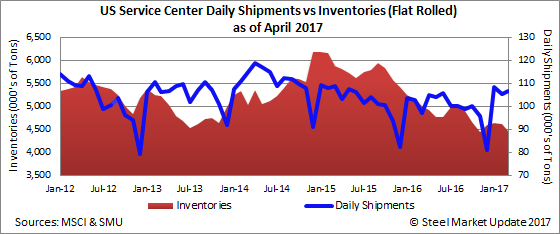

Carbon Flat Rolled

Flat rolled steel distributors shipped 2,455,000 tons of sheet products during the month of March. March 2017 shipments were 10.2 percent higher than year ago levels. The daily shipment rate was 106,700 tons, almost 10,000 tons a day higher than year ago levels (and we had three more shipping days this year over last year) and 1,600 tons a day better than February 2017.

Year to date U.S. distributors have shipped a total of 6,831,100 tons of carbon sheet products which is 5.8 percent better than year ago levels.

Sheet inventories stood at 4,458,100 tons as of the end of March. This is 10.7 percent below last March levels. The number of months on hand are 1.8 (unadjusted) and 2.0 (seasonally adjusted).

Carbon Plate

U.S. distributors shipped 331,300 tons of plate during the month of March. The daily shipment rate was 14,400 tons per day, 100 tons per day lower than February 2017 but 8.4 percent higher than year ago levels.

Through the first quarter 2017 plate distributors shipped a total of 912,400 tons which is 6.5 percent above last year.

Plate inventories stood at 748,800 tons at the end of March. This is 2.7 percent higher than year ago levels. The number of months’ supply on hand at the end of March was 2.3 (unadjusted).

Carbon Pipe and Tube

Service centers shipped 221,700 tons of pipe and tube products during the month of March 2017. This is 1.9 percent better than March 2016 and the daily shipment rate of 9,600 tons per day was 100 tons/day better than last year and 300 tons per day better than the February 2017 levels.

Year to date the distributors have shipped a total of 603,100 tons which is 1.2 percent lower than what was shipped during first quarter 2016.

Inventories of pipe & tube stood at 490,200 tons as of the end of March. Inventories are 11.8 percent below last year and the number of months’ supply stood at 2.2 (unadjusted).