Market Data

April 6, 2017

SMU Steel Buyers Sentiment Index 3MMA Another Record High

Written by John Packard

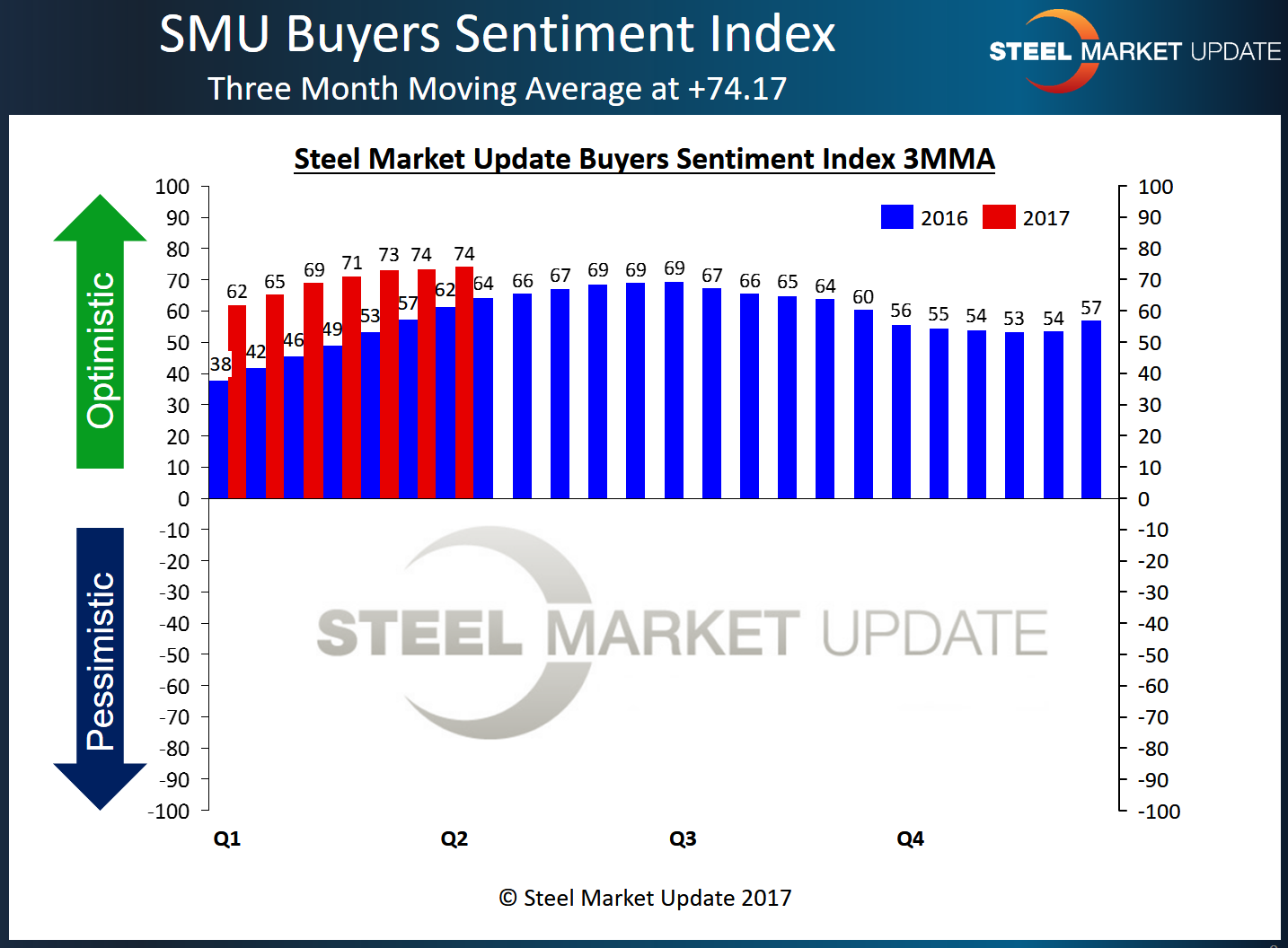

Steel Market Update is reporting today a new record high was achieved in our Current Steel Buyers Sentiment Index 3-month moving average (3MMA).

Buyers and sellers of flat rolled steel continue to be very optimistic about their company’s ability to be successful in the existing market environment. As a single data point, Sentiment was measured as being +75 which is 2 points lower than the reading we made last month. One year ago, Sentiment was -5 points lower than the +70 reported at that time.

When looking at the data from a three-month moving average perspective, Current Sentiment set a new high reaching +74.17. This is well above the reading reported last year at this time when our 3MMA for Current Sentiment was +61.50.

Future Sentiment

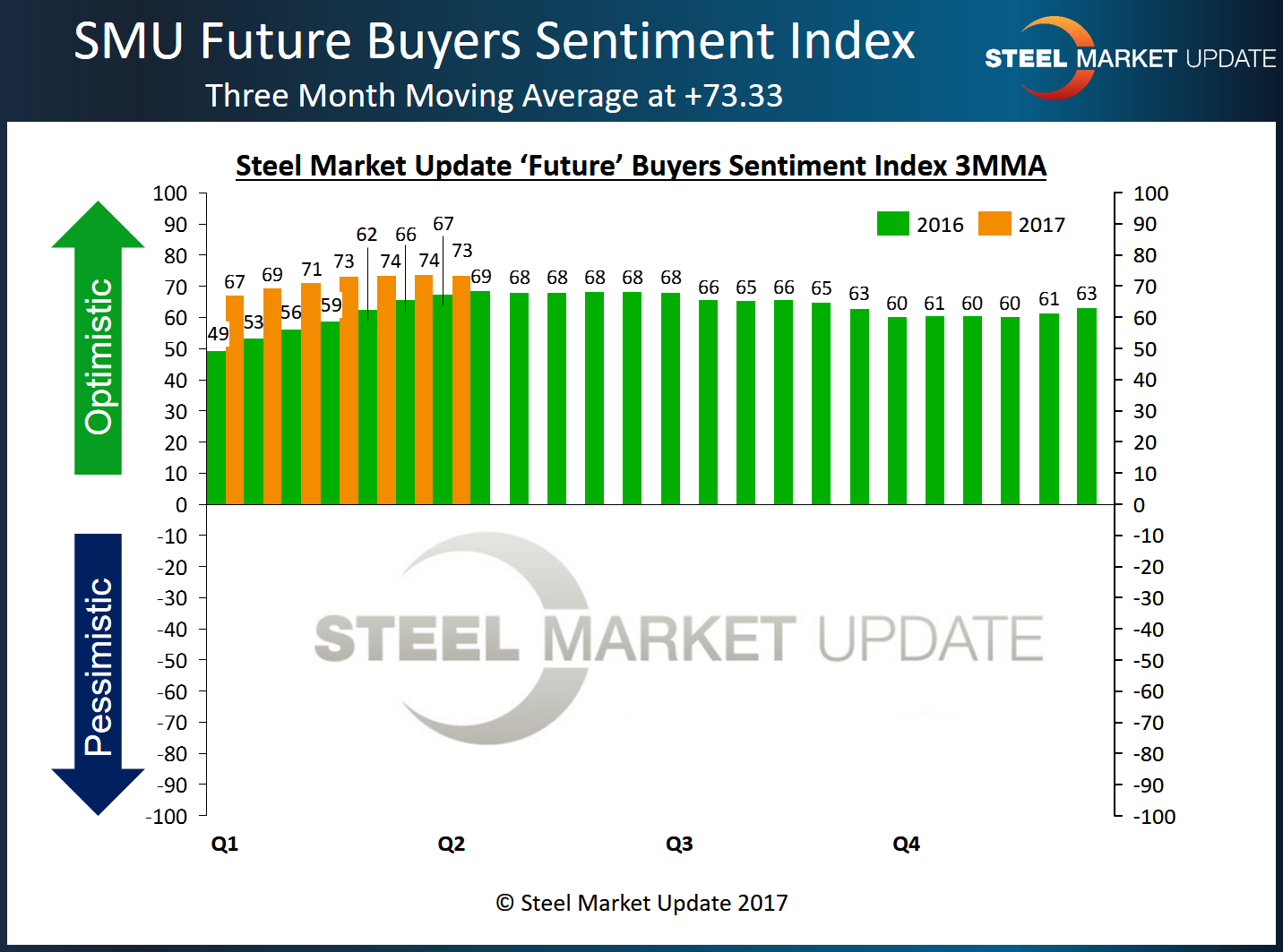

As a single data point, Future Sentiment, which is how buyers and sellers of steel feel about their company’s ability to be successful looking out 3 to six months into the future, is well within the optimistic range of our index at +72. This is down -1 point from one month ago, and very similar to one year ago, when it was reported to be +71.

Looking at Future Sentiment from a 3-month moving average (3MMA) basis, we did see our index come off the record high set in the middle of March (+73.67). Future Sentiment 3MMA is now +73.33.

What Our Respondents are Saying

“As an importer we are very concerned with the potential trade action that the Trump Administration will take. Overall it cannot be good for competition and will drive up costs for all US companies.” Trading Company

“March to April = night and day. March and the 1st quarter were excellent – even surprised us. Only the first couple days of the month but eerily quiet for April.” Service center

“We are struggling as an industry to pass along any of the increases that we have seen with our steel costs.” Manufacturing company

“With all the tariffs and dumping duties being imposed on offshore flat rolled steel and nothing on fabricated goods, manufacturing companies in this country face a difficult task remaining competitive and profitable.” Manufacturing company

“There are deals being made in the market place that appear to lack a good economic return for our competitors. Not sure about motivation.” Service center

“It’s a very strange market with many market drivers and commodities pointed upward yet customers refusing to buy at list price. No mas…..In my opinion, we’re sitting at a high pricing point and customers will do all possible to not buy or buy only what they absolutely need.” Steel mill

“Second quarter is strong, balance of year is unsettled. Orders much weaker for third quarter.” Manufacturing company

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s survey, 37 percent were manufacturing and 46 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies, and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.