Market Data

April 6, 2017

No Surprises in Steel Mill Flat Rolled Lead Times

Written by John Packard

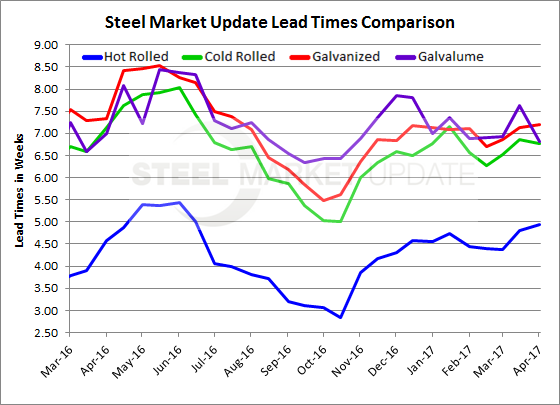

Steel Market Update (SMU) just concluded our early April flat rolled steel market trends analysis. A portion of that study is focused on steel mill lead times as we look to see if there are any changes in the trend which could affect flat rolled steel price negotiations.

Lead times remained constant compared to what was reported to our readers when we concluded our middle of March market trends analysis.

Hot rolled lead times are averaging about 5 weeks (4.94 weeks) which is very close to the 4.81 weeks reported during the middle of March. Hot rolled lead times are about one-half a week longer than what we saw in early April 2016.

Cold rolled lead times are averaging 6.78 weeks, similar to the 6.85 weeks reported during the middle of March. One year ago, CRC lead times averaged 7.12 weeks.

Galvanized lead times average 7.19 weeks. In mid-March they averaged 7.13 weeks and last year they averaged 7.33 weeks.

Galvalume lead times dropped from the 7.62 weeks average reported during the middle of March to 6.82 weeks. One year ago, Galvalume lead times averaged 7.0 weeks.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.