Market Data

April 3, 2017

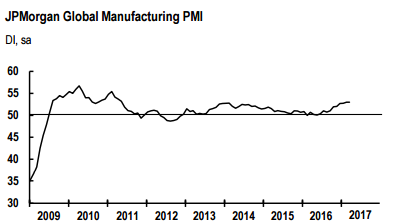

Global PMI Maintains Strength in March

Written by Sandy Williams

For the thirteenth consecutive month, manufacturing across the globe expanded. The JP Morgan Global Manufacturing PMI posted at 53.0 in March, the same as its February 69-month high. First quarter 2017 averaged a reading of 52.9, the best quarter since Q2 2011.

Prices were above historical averages although easing somewhat in March. Input and output price indexes dropped 1.0 and 0.3 points, respectively. Employment levels rose in the US, Eurozone, Japan, UK and India while slipping in China, Russia and Brazil.

Expansion was strongest in the Eurozone reaching a near six-year high, with improvements in Germany, France, and Italy. Growth was solid but slower in the US, Japan, UK, Russia, and China, said JP Morgan.

Eurozone

New orders and production were at six year highs in March as demand improved domestically and from abroad. The Markit Eurozone Manufacturing PMI was at a 71-month record of 56.2, from 55.4 in February. Germany drove growth in the region with a PMI of 58.3 while the Netherlands and Austria took a strong second and third place at 57.8 and 56.8, respectively. Exports continued to improve, nearing a six-year high and aided by a favorable euro exchange rate. Supplier delivery delays are a sign of manufacturers struggling to keep up with demand said Chris Williamson, Chief Business Economist at IHS Markit.

Upward pricing pressure resulted in higher input costs and output prices. Employment levels grew across the region except in Greece which saw its fourth month of job cuts.

“Eurozone manufacturing is clearly enjoying a sweet spell as we move into spring, but it is also suffering growing pains in the form of supply delays and rising costs,” said Williamson. “All key business activity gauges – output, new order inflows, exports, backlogs of work and employment – are close to six-year highs.”

United Kingdom

The UK posted a PMI of 54.2 in March, down from 54.5 in February. Output and orders are slower after recent highs but manufacturers are confident about future business conditions. Rising raw material costs were passed through to consumers in higher selling prices.

Duncan Brock, Director of Customer Relationships at the Chartered Institute of Procurement & Supply, commented: “Between the EU referendum in June 2017 and the triggering of Article 50 last week, British manufacturers have completed a remarkable return to confidence. However, with trouble brewing at the base of their supply chains, manufacturers must be wary of over confidence. Factories have revved up production for eight consecutive months on the back of new orders from both the UK and abroad. The feel good factor is being felt by workers with hiring growing at the fastest rate in a year and a half in March. The beginning of formal negotiations with the EU has failed to dampen the sense of optimism and manufacturers expect production to continue growing in the year ahead.”

Russia

Russia continues to exhibit solid growth domestically but still is on a downward trend for exports. The PMI was 52.4 in March, little-changed from February’s reading of 52.5. Input prices were higher in March as a result of lower inventory at suppliers and higher world prices. Manufacturer sentiment was high for output levels in the coming 12 months. IHS Markit is forecasting a 1 percent rise in GDP in 2017.

China

Growth of production and new orders moderated in March, led by slower export sales. The Caixin China General Manufacturing PMI was 51.2, a decrease of 0.5 points from February. Inventories of raw materials and finished goods declined into contraction in March. Input and output prices were higher but the rate of increase has declined for three consecutive months.

“Overall, the Chinese manufacturing economy continued to improve, but signs of a weakening have started to emerge ahead of the second quarter. Downward pressure may further increase,” commented Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group.

Mexico

The PMI rebounded in Mexico to 51.5 from 50.6 in February for the highest reading since October 2016. New orders boosted production and input buying during the month. Margins continued to be squeezed by price inflation due to rising transportation and imported raw material costs. Higher input costs were passed on to clients. Manufacturers are slightly less confident about future prospects, citing concerns about the economy and pressure on operating margins.

Canada

Good news for Canadian manufacturers who saw a robust improvement in business conditions in March. The PMI rose to 55.5 from 54.7 in February and continued a thirteen month trend above the neutral 50 mark. New orders led to the steepest rise in output growth in three years. Manufacturers are confident of continued growth in the coming months, with several citing new spending in the oil and gas sector. Higher pricing and increased demand for raw materials pushed input costs up which were passed along in higher gate prices.

United States

The Markit US Manufacturing PMI dipped to 53.3 from 54.2 in February. Manufacturing in the US continued to expand in March but at a softer rate for both new orders and output. Manufacturers reduced inventory of finished goods to accommodate slower sales. Cost inflation rose at its strongest rate since September 2014 due to higher raw material prices. A strong dollar may have dampened export order growth although some respondents said their focus was on the domestic market.

“The post-election resurgence of the manufacturing sector seen late last year is showing signs of losing steam,” said Chris Williamson. Output growth slowed to a six-month low in March, optimism about the outlook has waned and hiring has slowed accordingly. While the survey data suggest that the goods producing sector enjoyed a relatively good first quarter on the whole, the loss of momentum seen in February and March bodes ill for the second quarter.”