Prices

March 31, 2017

Global Trade of Hot Rolled Coil Through Q4 2016

Written by Peter Wright

We are continuing our investigation to quantify the players in the global trade of both HRC and CRC. We now have data for all of 2016. This information is sourced quarterly from the Iron and Steel Statistics Bureau in the UK. Data is not very current because many countries are slow in reporting but we feel that the history does explain where we are now and shines a light on the relative position of the US in the global picture.

This update covers the global trade of HRC through Q4 2016. We will follow up with a CRC report in a few days.

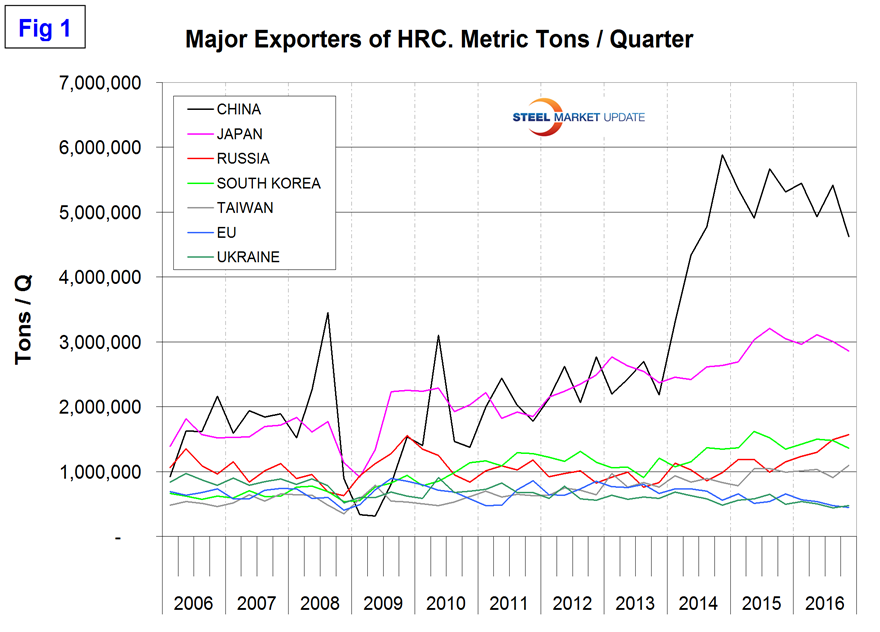

In 2016 as a whole 60,780,000 metric tons of hot rolled coil were traded around the world. This tonnage does not include trade within the EU. The seven major exporters in Q4 in order of volume were China, Japan, Russia, South Korea, Taiwan, the EU and Ukraine. Figure 1 shows the relative size of China as an exporter but also that Japan is exporting over half as much as China.

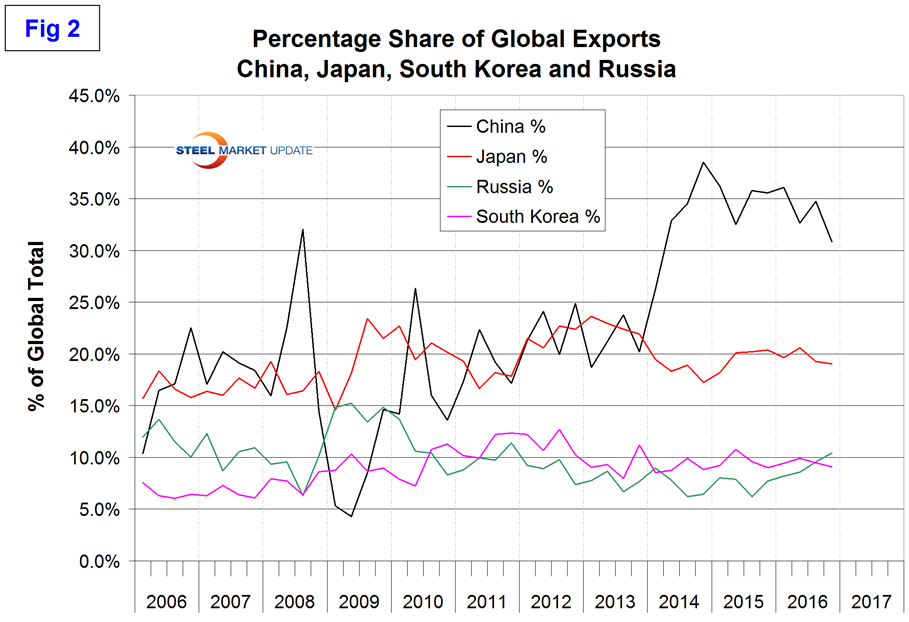

Total global trade of HRC declined by 3.8 percent in Q4. China’s exports declined by 14.6 percent as Japan’s declined by 4.8 percent. Russia’s increased by 5.1 percent. In the last five quarters, Russia has increased its exports by over 50 percent. China exported 20.4 million tonnes of HRC in 2016. Figure 2 shows the export market share of the top four nations.

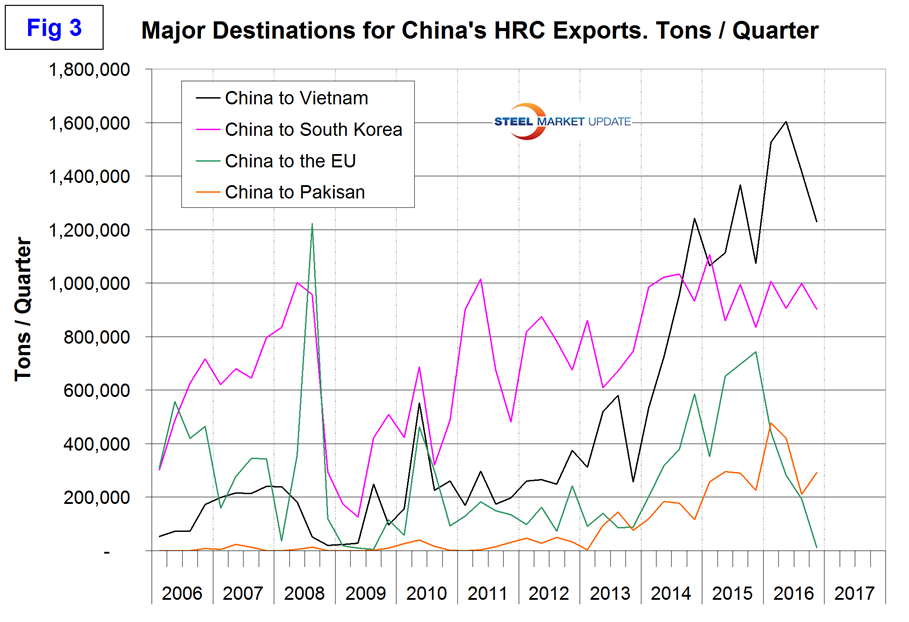

China has had a market share of >30 percent for the last eleven quarters though there has been a declining trend since Q4 2014. Vietnam is the largest volume destination for China’s exports as shown in Figure 3.

It may be highly significant that China’s exports to the EU have declined by 98.5 percent in the last four quarters which we understand is a result of trade cases filed against Chinese producers. One of the main points of this analysis is to identify trends such as this because if maintained the volume will pop up somewhere else.

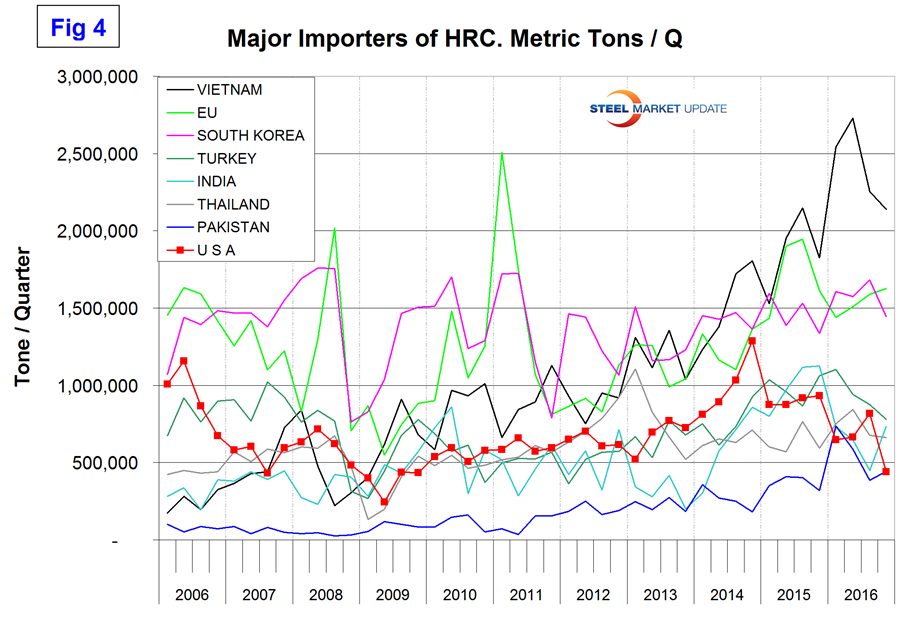

Figure 4 shows the top eight importing nations through Q4 2016.

In the fourth quarter the US was in eighth place. Vietnam has by far the highest volume of any importing nation and we wonder to what extent this is related to the further processing of Chinese coil. The EU was in 2nd place in Q4. The question now is, “if China’s exports to the EU have dried up what other changes have taken place to maintain the EU’s volume?” That will be examined in our next write up after we receive data for Q1 2017.

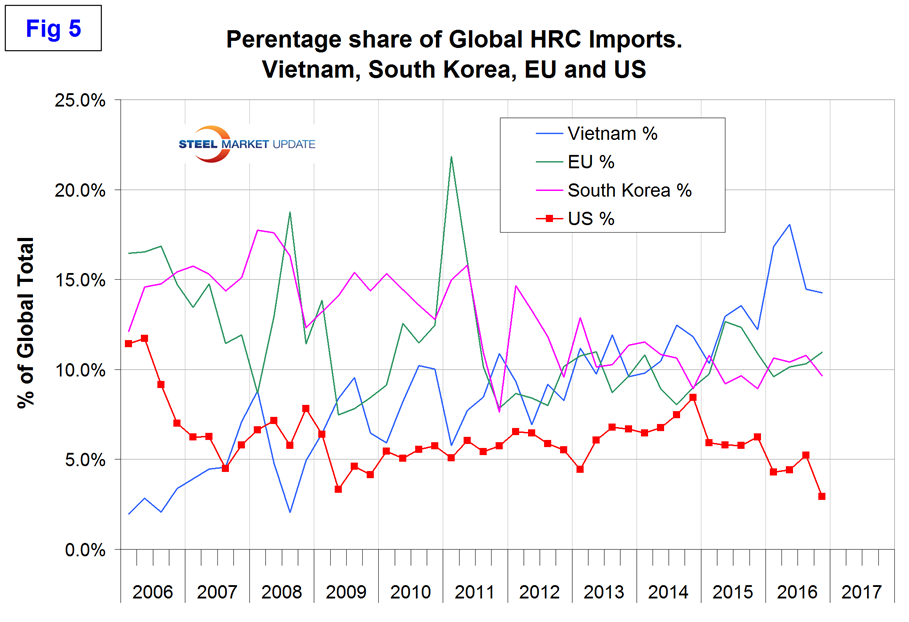

The United States imported 2.9 percent of total global trade in Q4 down from 5.2 percent in Q3 as shown in Figure 5.

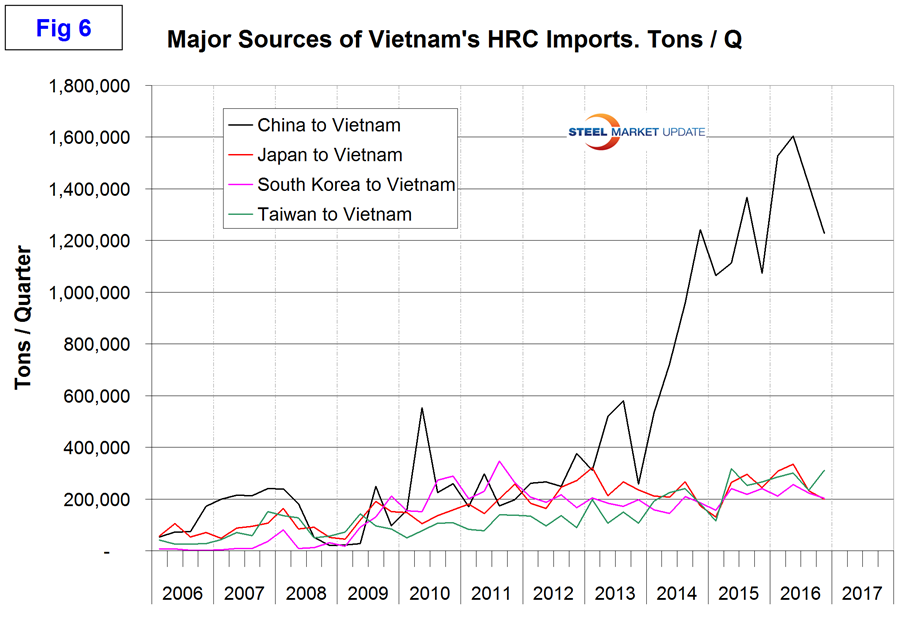

Vietnam took in 14.3 percent and the EU took 11 percent. It is evident that the US is not (as has been frequently claimed) the most porous import market in the world. In Figure 6 we see the startling increase in tonnage shipped from China to Vietnam since Q4 2013. Vietnam’s other sources have been relatively unchanged.

Our next step in this analysis will be to repeat the above for cold rolled coil and plan to repeat this exercise quarterly for our premium subscribers.