Prices

March 26, 2017

We Are 5 Months into Current "Up" Cycle

Written by John Packard

Last week, Steel Market Update (SMU) conducted our mid-March flat rolled steel market trends survey. We invited 670 people to participate in the gathering of data and opinions which resulted in our flat rolled steel market trends analysis presented to our Premium level members last Friday in the form of a Power Point presentation.

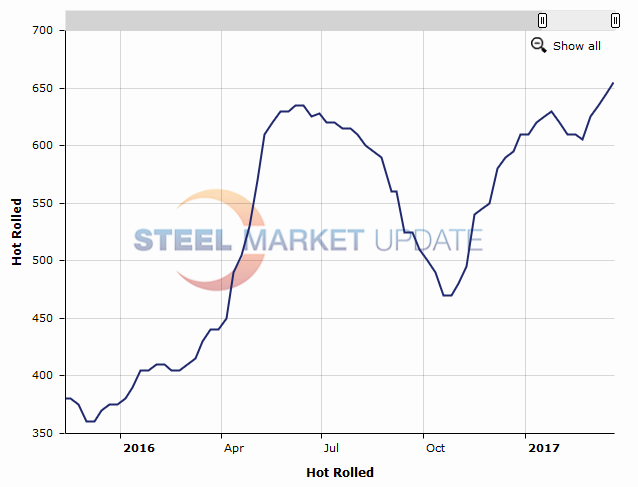

It is Steel Market Update opinion that for there to be further price increases by the domestic steel mills they need the support of the steel service center community. We recently went through a short period of time similar to what we saw last year during 1st Quarter when price support briefly waned (small dip in 1Q ’16 in below graphic) and then came storming back. The biggest difference a year makes is the starting HRC price point of the cycles ($360 in December 2015 vs. $470 in October 2016).

The total move in hot rolled prices from December 2015 to the peak in June 2016 was $275 per ton. The cycle we started in October 2016 has so far moved a total of $185 per ton. If you look at the graphic below you will see a listing of the AK Steel price announcements made during the current cycle. The seven price increase announcements in 2016/2017 now total $240 per ton.

There were six increase announcements made in the 2015/2016 cycle totaling $260 per ton (the $420 base referenced in the first announcement is assumed to be approximately $60 per ton increase based on our $360 per ton index at the time of the announcement. They actually were able to collect $275 per ton in increases from early December 2015 ($360 per ton) to the peak of the market in June 2016 ($635 per ton).

The 2015/2016 rise in prices happened over a six-month period (early December to early June). The current cycle is closing in five months old and has not yet ceased to post higher prices.

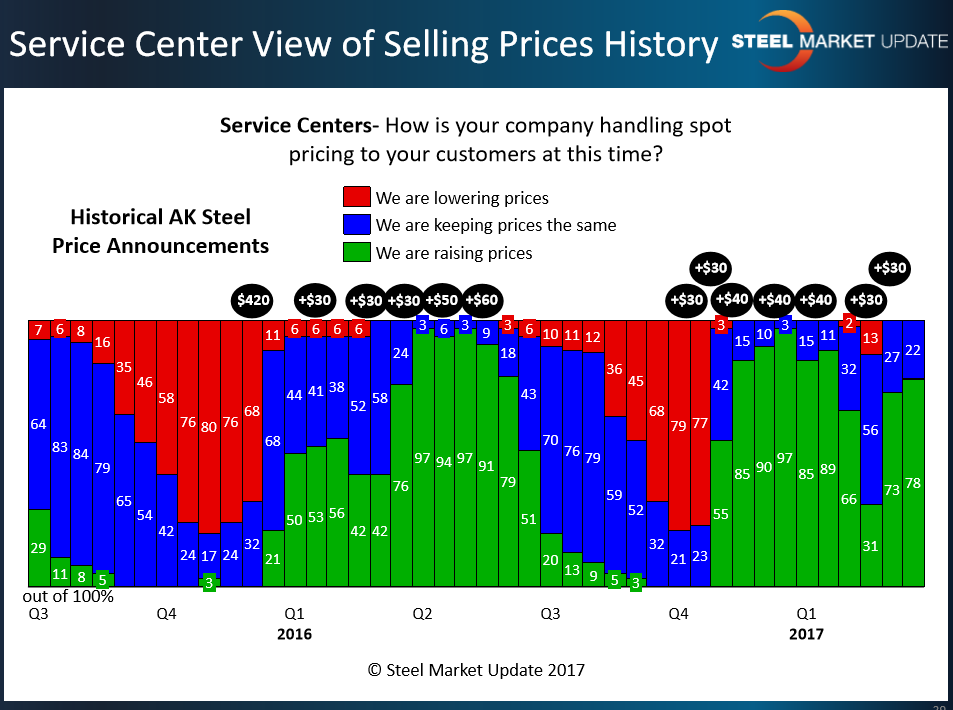

The graphic below depicts how service centers are handling spot pricing to their customers right now. The key from our perspective is the higher the percentage (green bars) raising prices the better the chances of the domestic mills to collect increases. However, if you go back to 2016 you will note that over the course of basically six weeks the percentage of service centers raising prices went from 91 percent to 20 percent… You will also notice that the price increases ceased at the same time.

As we have mentioned in other articles in tonight’s newsletter – from here we will need to watch lead times, scrap and commodity prices and any changes in the supply/demand ratio. We have Big River Steel coming on strong and should be producing hot rolled, cold rolled and galvanized products by the time we get into the month of May 2017. We have another mill, Acero Junction, that appears to be having difficulties getting started so their impact on the hot rolled market is, so far, limited. At the moment, Steel Market Update has our Price Momentum Indicator pointing toward higher prices over the next 30 days.