Market Data

March 26, 2017

Steel Prices at a Peak or Do We Have More Room to Run?

Written by John Packard

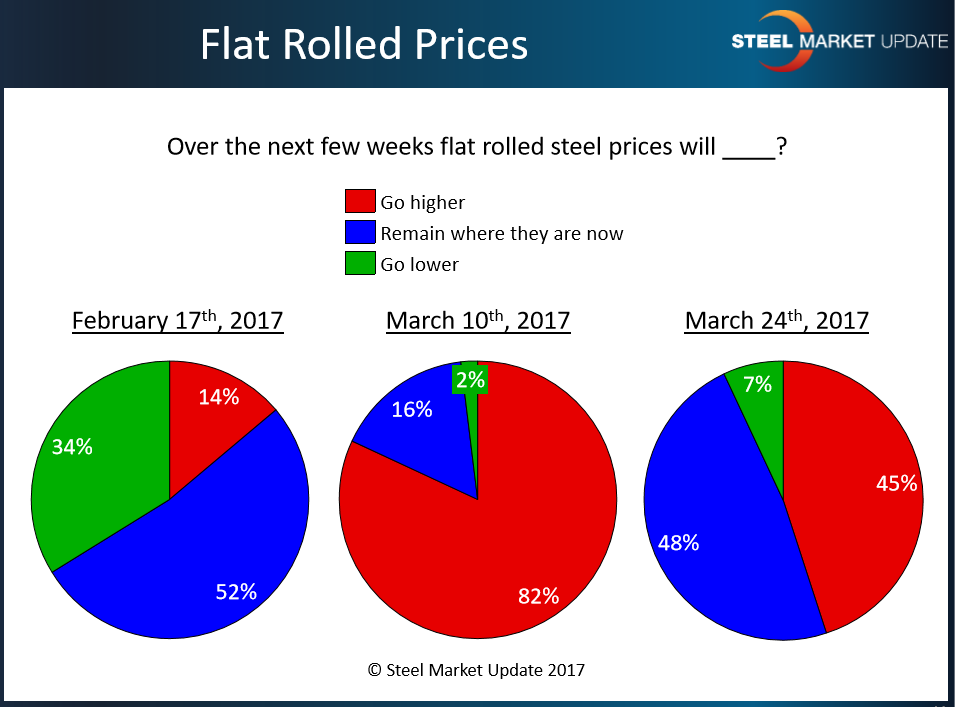

Buyers and sellers of flat rolled steel having been bouncing like the proverbial rubber ball over the past six weeks as they try to make sense of where steel prices are heading over the near term. Steel Market Update (SMU) asked those responding to our flat rolled steel market trends survey last week where they felt prices were headed over the next few weeks. As you can see by the graphic below their opinions have been anything but consistent.

In the middle of February on 14 percent of our respondents were of the opinion that prices would move higher. That changed completely by the 10th of March when 82 percent of our respondents thought prices were going to move higher. Now, just a couple of weeks later and that number has dropped to 45 percent.

What Our Respondents Had to Say

We encourage our respondents to make comments and we did receive a number of comments on this question.

“The trend is your friend until its peaked and that’s the 64,000 question.” Service center

“Not sure the mills can collect all of the announced increases that were announced.” Service center

“If scrap moves up next month (April) then I do see another price increase.” Service center

“Mistake on the mills part things are slowing down their order books will not be full.” Service center

“Depends on the scrap market in April. At this time it appear to be flat if not slightly down. Mill lead times are not changing.” Manufacturing company who also told us, “Depends on the steel mills intentions to force price increases to the market. There is no reason for the HR base to be above $600/ton and not a good reason for a 4200/ton spread between HR and CR/coated steel.”

“People trying to digest the latest round.” Service center

We appear to be heading into a period where uncertainty is raising its ugly head and questions about what will push prices from here are bubbling and becoming more prevalent in the discussions SMU is having with steel buyers. Right now, it seems there are two keys being watched by most in the industry: lead times at the domestic mills and negotiations of ferrous scrap prices once we get into April.