Market Data

March 22, 2017

Service Center Inventories: Apparent Deficit Grows to -377,000 Tons

Written by John Packard

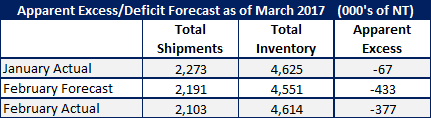

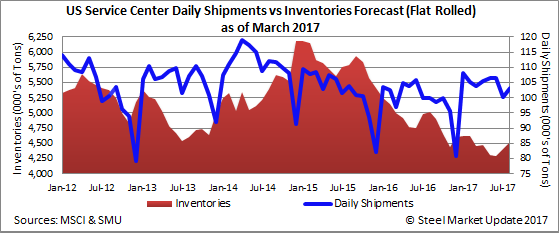

Based on the most recent MSCI data, carbon flat rolled service centers in the United States shipped 2,103,000 tons of sheet products. Our SMU Service Center Apparent Excess/Deficit forecast had called for shipments to be 2,191,000 tons. So, we missed our forecast by 88,000 tons.

Our original forecast called for 4,551,000 tons of flat rolled inventories to be held at the distributors at the end of February. Our forecast was off by 63,000 tons with carbon flat rolled inventories totaling 4,614,000 tons.

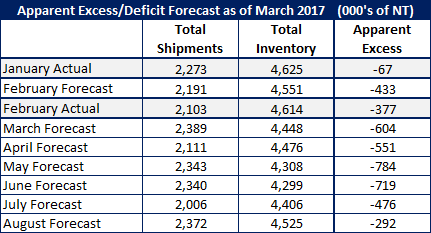

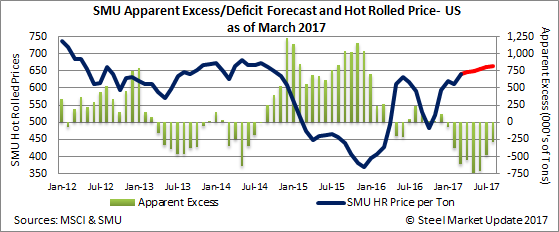

Overall, SMU forecast the balance of inventories needed versus where MSCI was putting them at the end of the month was relatively close. SMU forecast the deficit of inventories would grow from -67,000 tons at the end of January to -433,000 tons. In actuality, based on the SMU model inventories are in a deficit situation only not quite as bad as we had imagined one month ago. The new Apparent Excess Inventories at the end of February 2017 is -377,000 tons.

New Forecast

We are going to continue with the same model we used in forecasting last month. To remind everyone we are using the average rate of change month by month seen over the past 4 years.

Our March forecast is for shipments out of the U.S. flat rolled steel service centers to reach 2,389,000 tons. At the same time, we believe inventories will remain constrained at and not grow but rather will come in at 4,448,000 tons. If this comes to fruition the Apparent Deficit would grow to -604,000 tons.

Our forecast actual calls for shipments to be 7.2 percent higher than last March and receipts to also be up at 7.5 percent over March 2016.