Prices

March 21, 2017

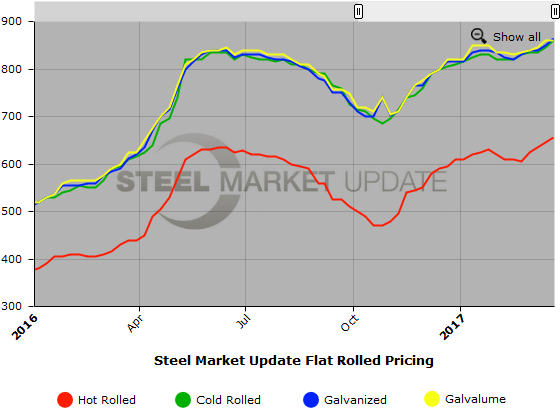

SMU Price Ranges & Indices: Price Move Higher but Questions Increasing

Written by John Packard

Flat rolled prices moved higher over the past week based on SMU sources. Even so, there is much discussion as to what direction prices will go from here and we will have more on that subject later this week. We did receive comments from a large service center that our readers might find of interest as you think about the markets and what may happen next:

You [SMU] mentioned the key issue in one of your last articles – lead times. With scrap looking sideways, it’s all about lead times, and your article hit on the right points associated with them. Right now, I’m not seeing the push-out in lead times one would see in a market that is on a sustained up move. There appears to be enough disparity among the mills, which is allowing for buyers to still have some flexibility.

Galvanized has the longest lead times, with CR nearby, but the price spreads to foreign are high on the radar. Buying interest in foreign Galv and CR is increasing, and I’m hearing of more folks placing at least some orders for early summer arrivals. Many are also placing trial/first orders with BRS [Big River Steel] for CR and Galv as well, in order to have them qualified for their future possible needs.

My sense is this is a market in balance, and scrap price direction will remain a key component since everything else is basically in “constant” mode. May is a 5 week book month for the mills, and I don’t see it filling up fast, just at normal pace. Then we’re into summer and lower activity, etc. All in all, this should be considered a great market for the mills, and I think HR can hold $600+ into fall, assuming we don’t see a collapse in scrap.

SMU also recommends our readers take a look at the HARDI conference call article in this evening’s issue for more color (and questions) about the current market conditions.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $630-$680 per ton ($31.50/cwt-$34.00/cwt) with an average of $655 per ton ($32.75/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago while the upper end increased $20 per ton. Our overall average is up $10 per ton compared to last week. Our price momentum on hot rolled steel is pointing to Higher which means we expect prices to increase over the next 30-60 days.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU price range is $840-$880 per ton ($42.00/cwt-$44.00/cwt) with an average of $860 per ton ($43.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week while the upper end increased $20 per ton. Our overall average is up $15 per ton compared to one week ago. Our price momentum on cold rolled steel is pointing to Higher which means we expect prices to increase over the next 30-60 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU base price range is $42.50/cwt-$44.00/cwt ($850-$880 per ton) with an average of $43.25/cwt ($865 per ton) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago while the upper end increased $10 per ton. Our overall average is up $15 per ton compared to last week. Our price momentum on galvanized steel is pointing to Higher which means we expect prices to increase over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $928-$958 per net ton with an average of $943 per ton FOB mill, east of the Rockies. Note that we are now using a $78 per ton ($3.90/cwt) extra for this product rather than $69 ($3.45/cwt) due to the revised US Steel galvanized price extras effective April 1, 2017.

Galvanized Lead Times: 5-10 weeks

Galvalume Coil: SMU base price range is $42.00/cwt-$44.00/cwt ($840-$880 per ton) with an average of $43.00/cwt ($860 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged compared to one week ago. Our price momentum on Galvalume steel is pointing to Higher which means we expect prices to increase over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1131-$1171 per net ton with an average of $1151 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks

Plate: SMU price range is $740-$790 per ton ($37.00/cwt-$39.50/cwt) with an average of $765 per ton ($38.25/cwt) FOB mill, east of the Rockies. Our price momentum on plate steel is now pointing to Higher which means we expect prices to increase over the next 30-60 days.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.