Prices

March 14, 2017

SMU Price Ranges & Indices: Reacting to Increase Announcements

Written by John Packard

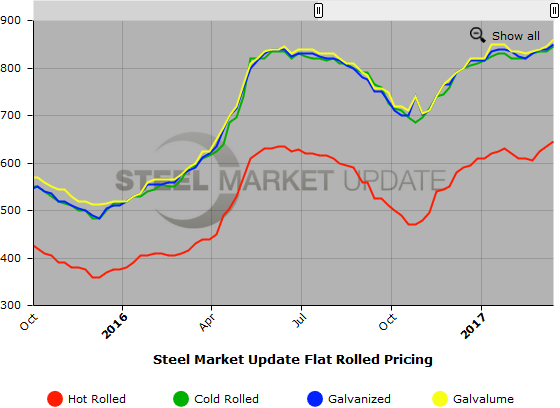

Flat rolled steel prices are reacting to the two $30 per ton price announcements made by the domestic steel mills over the past month. The culprit (or scapegoat depending on your perspective) has been the rapid rise in ferrous scrap prices which are the primary inputs for electric arc furnace (EAF) steel mills and is also used in the integrated steelmaking process.

Prices for hot rolled, cold rolled and coated products are higher than week ago levels. However, we want to point out that our index average is not a weighted average. If it were, the average would be higher than what we are showing in tonight’s report.

Steel buyers reported most mills as offering hot rolled at, or slightly above, $660 per ton ($33.00/cwt). That is at the high end of the range that we are publishing this evening and buyers should be aware that our number could adjust higher later this week depending on the data collected as the week continues.

Cold rolled and coated product base prices have been consistently pointing toward $860 per ton on cold rolled and trending even higher on coated products.

Even so, there were a number of comments made to Steel Market Update over the course of the day (Tuesday, March 14th) regarding stability in lead times (although SDI had put a number of their items on an “inquire” basis at both their Butler and Columbus mill – buyers were still not concerned).

When asked about lead-times one large service center told us earlier today, “Difficult to say on lead-times. CSI just closed April yesterday, which is only 6 weeks, which is “normal” for them. Last year at this time I think they were in June or later, as a comparison. My sense is that, so far, lead-times overall have not measurably extended as a result of the price increases. Perhaps this changes but I’m having doubts that they will, as we move into May and later lead-times. The question becomes, who would want to “load up” at these prices, which would be the normal reason lead-times would extend?”

Another large service center told us, “Mills are definitely bullish right now – but lead times aren’t moving out the way they had been. This might be one of those rare points where we see some relative stability in pricing for a month or so….”

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $630-$660 per ton ($31.50/cwt-$33.00/cwt) with an average of $645 per ton ($32.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago while the upper end remained the same. Our overall average is up $10 per ton compared to last week. Our price momentum on hot rolled steel is pointing to Higher which means we expect prices to increase over the next 30-60 days.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU price range is $830-$860 per ton ($41.50/cwt-$43.00/cwt) with an average of $845 per ton ($42.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week while the upper end remained the same. Our overall average is up $10 per ton compared to one week ago. Our price momentum on cold rolled steel is pointing to Higher which means we expect prices to increase over the next 30-60 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU base price range is $41.50/cwt-$43.50/cwt ($830-$870 per ton) with an average of $42.50/cwt ($850 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $10 per ton compared to one week ago. Our overall average is up $10 per ton compared to last week. Our price momentum on galvanized steel is pointing to Higher which means we expect prices to increase over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $899-$939 per net ton with an average of $919 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-10 weeks

Galvalume Coil: SMU base price range is $42.00/cwt-$44.00/cwt ($840-$880 per ton) with an average of $43.00/cwt ($860 per ton) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week while the upper end increased $20 per ton. Our overall average is up $15 per ton compared to one week ago. Our price momentum on Galvalume steel is pointing to Higher which means we expect prices to increase over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1131-$1171 per net ton with an average of $1151 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks

Plate: SMU price range is $720-$770 per ton ($36.00/cwt-$38.50/cwt) with an average of $745 per ton ($37.25/cwt) FOB mill, east of the Rockies. Our price momentum on plate steel is now pointing to Higher which means we expect prices to increase over the next 30-60 days.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.