Market Data

March 12, 2017

SMU Flat Rolled Steel Market Trends Analysis: Demand

Written by John Packard

Twice per month, Steel Market Update conducts a detailed analysis of the trends impacting the flat rolled steel markets. We issue over 670 invitations to people associated with manufacturing, distribution, steel mills, trading companies and toll processors to assist us in our analysis.

We finished conducting our early March research on Thursday of this past week. We would like to share with our Executive members some of what our Premium level members get to see shortly after we finish crunching the numbers and putting them into a historical context in a Power Point presentation.

Last week 42 percent of our respondents were distributors/wholesalers while 40 percent were involved in direct manufacturing. Another 7 percent were steel trading companies and the survey was rounded out with 6 percent from steel mills and 5 percent from the toll processing portion of the industry. SMU intentionally targets manufacturing and distribution to be the two biggest segments of our survey. We feel they will provide the most information and combined they provide a balanced picture which can then be complimented by the trading companies, steel mills and toll processors.

Demand

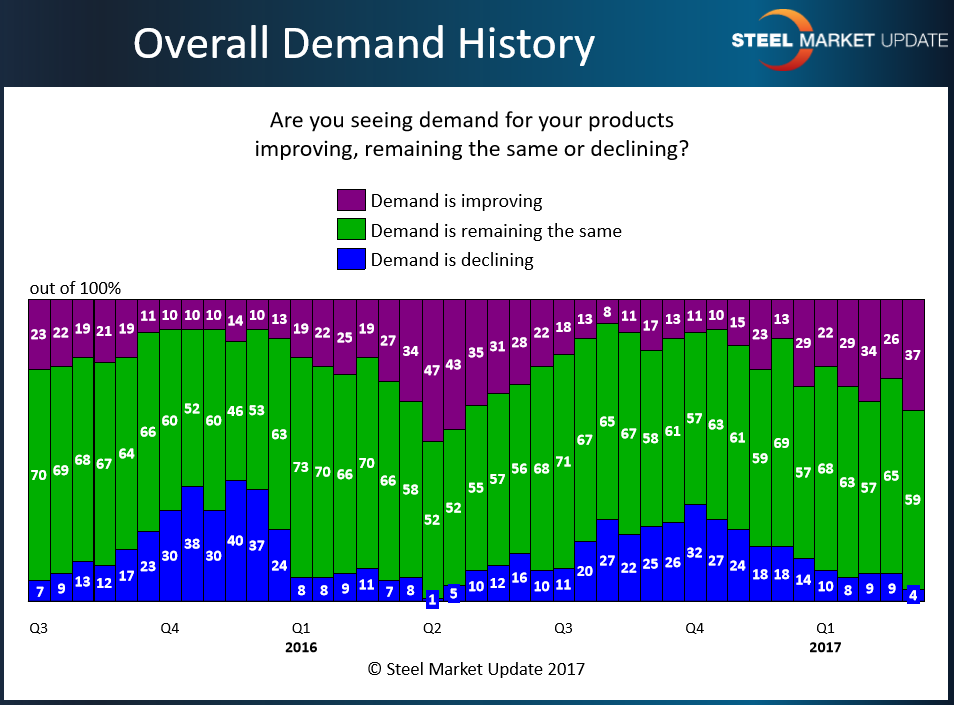

Demand is one of the key focal points for any of our market trends surveys as we strive to get a better handle on the market as a whole and then on individual market segments within the industry. Last week 37 percent of our respondents reported demand for their products as improving, 59 percent reported demand as remaining the same and only 4 percent pegged demand as in decline. That 4 percent is the lowest level measured since the 1 percent recorded during the first week of April 2016. The 37 percent reporting demand as improving is 10 percentage points better than what we saw one year ago.

We received a number of responses to this particular inquiry so we thought we would share some of them with you to provide a sense of what individuals thought as they worked on demand questions:

“Demand is improving, but margins are eroding with each steel price move up.” Manufacturing company

“Can’t tell yet – may be slight upturn.” Manufacturing company

“Existing customers are ordering less.” Service center

“Lots of holes out there.” Service center

“Slow improvement – nothing out of scale.” Steel mill

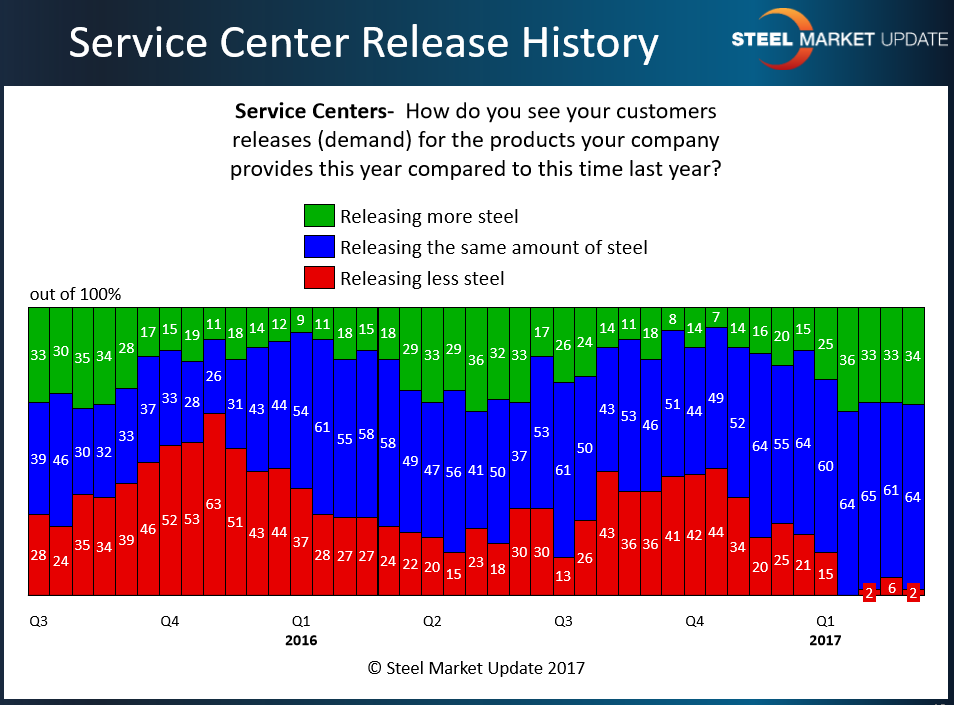

Service Centers Reporting Customers Releasing More Steel

As our survey process continues we break out the various market segments so we can inquire specifically about how they see the market as manufacturers, steel service centers/wholesalers, steel mills, traders and toll processors.

We like to concentrate on service centers, asking them how they are seeing the releases (demand) from their customers. Here is what they told us:

As you can see by the graphic above, 34 percent of service centers are reporting their customers as releasing more steel than last year. One year ago, only 18 percent of the distributors were reporting releases as being better than the previous year. At the same time the negative part of the question saw 2 percent of the distributors/wholesalers as responding that their customers were releasing less steel. This is 22 percent lower than what we measured last year.

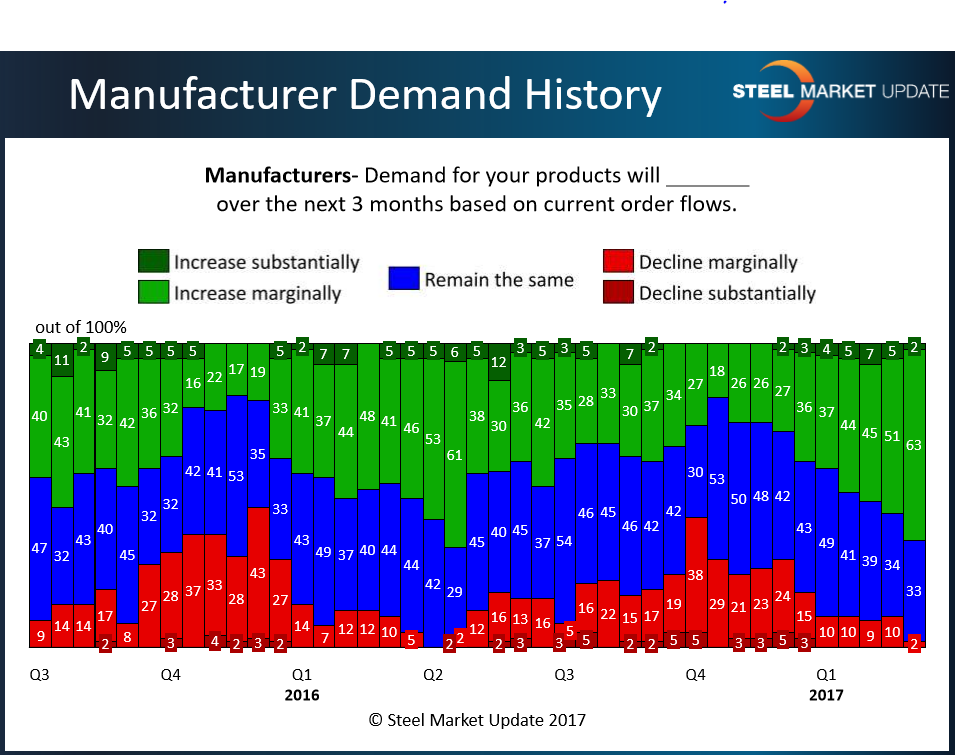

Manufacturers Confirm Demand is Getting Better

We don’t just take the service centers and wholesalers words to be gospel, we go out and ask the end users (manufacturers) to provide feedback about how they are seeing demand for their products. We specifically ask how demand for their products will be over the next three months based on current order flows. In last week’s analysis, we found 65 percent were reporting demand as increasing substantially (2 percent) or marginally (63 percent) with only 33 percent reporting things as staying the same and a modest 2 percent saying business will decline marginally. Compare that against year ago levels when 46 percent reported demand as growing, 44 percent remaining the same and 10 percent as declining marginally.

A large manufacturing company left behind a comment that we think our readers would enjoy as added “color” to the market:

“The shale fracking industry is starting to bring wells back on-line so things are looking up for us in the Oil & Gas segment. Demand for HVAC equipment above normal demand patterns has also been beneficial.”

If you are intrigued with the slides and analysis provided above you may be interested in upgrading to a Premium Level membership. Details are on our website or you can contact us at info@SteelMarketUpdate.com and we will do our best to answer any questions that you might have.