Analysis

March 8, 2017

Dodge Momentum Index Shows Nonresidential Planning Increasing

Written by Sandy Williams

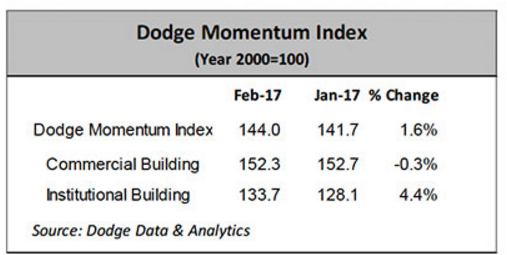

The Dodge Momentum Index jumped 1.6 percent to 144.0 in February. The index, a measure of the initial planning for nonresidential building projects, made the gain from January due to an increase in institutional building activity.

Planning for institutional buildings rose 4.4 percent last month while commercial planning dipped 0.3 percent. Dodge Data & Analytics says the overall trend indicates increased activity despite volatile month-to-month reports for the individual sectors. The Momentum Index has recorded increases for five consecutive months.

The Index was up 22 percent on year-over-year basis with commercial planning showing a gain of 28 percent and institutional planning up 15 percent.

Four projects valued over $100 million entered the planning stage in February.

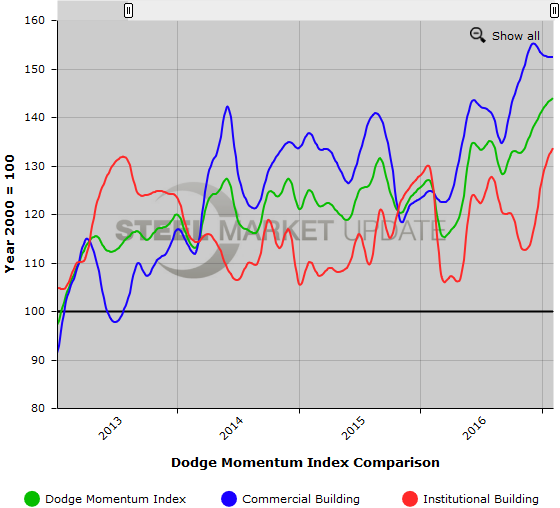

Below is a graph showing the history of the Dodge Momentum Index. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance logging into or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.