Analysis

March 2, 2017

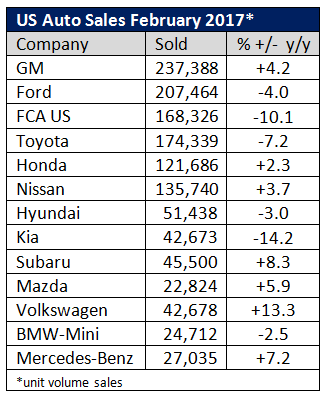

Automotive Sales Slower in February

Written by Sandy Williams

Automotive sales slowed overall in February. Ford and FCA saw declines of 4 and 10 percent, respectively. There were still some strong sales among auto manufacturers, notably, GM up 4.2 percent, Nissan 3.7 percent, Subaru 8.3 percent, Mercedes-Benz 7.2 percent, and Volkwagen Group up 13.3 percent year-over-year.

WardsAuto puts light vehicle sales for February at a seasonally adjusted annual rate of 17.5 million. Total February sales were 1.326 million units, a 1.1 percent decline from a year ago.

Strong sales were attributed to the 13.5 percent year-over-year increase in incentives. Higher inventory is creating fiercer competition and there are some worries that discounting could lead to declining profitability if the trend continues.

Dealership inventory levels, according to Kelly Blue Book, rose to a 70 day supply from 77-78 days in February 2016.