Market Data

February 28, 2017

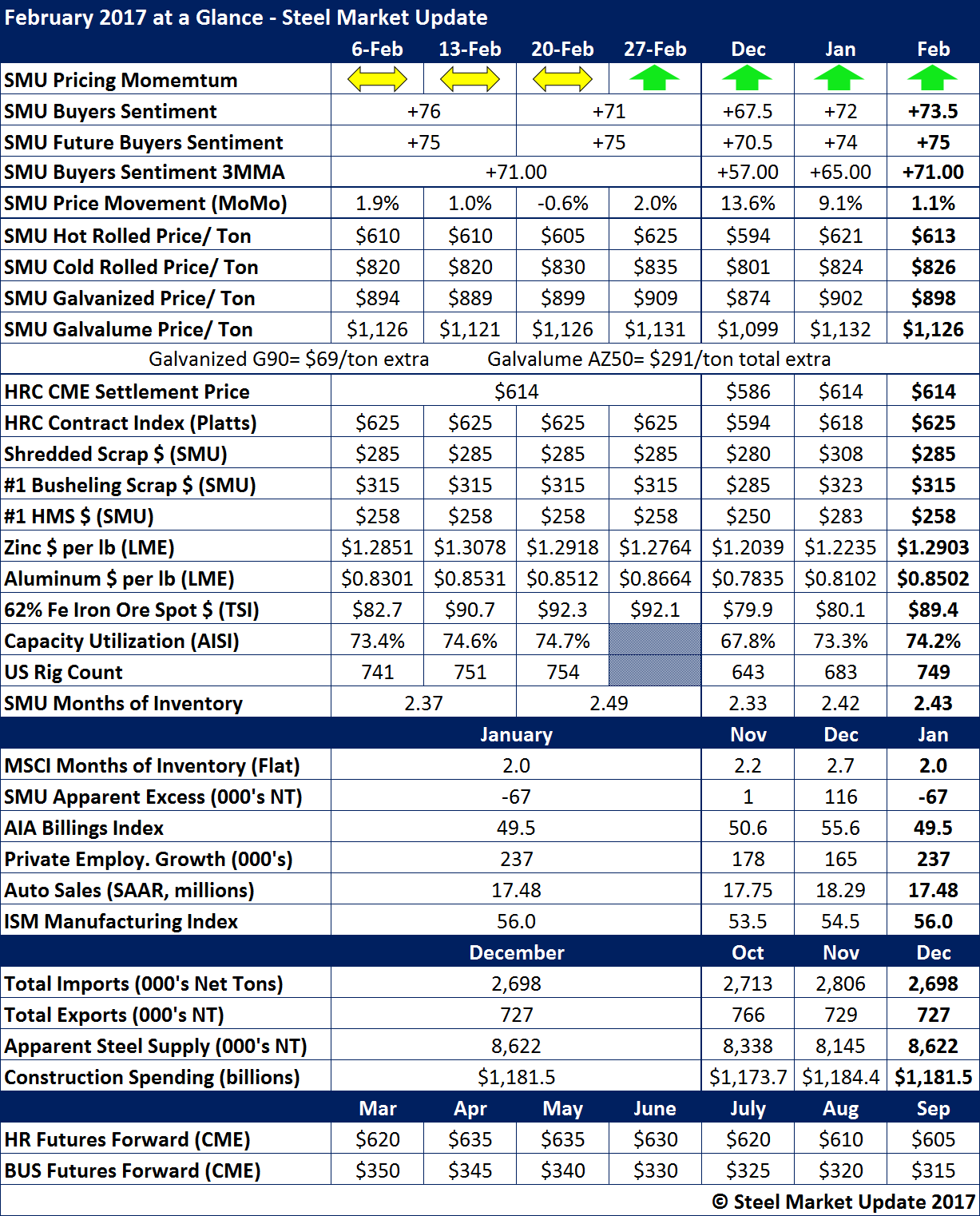

February at a Glance

Written by John Packard

As the month of February comes to a close our SMU Price Momentum Indicator reverted to “Higher” from “Neutral.” However, we should be aware that the vast majority of the month saw our Price Momentum Indicator at “Neutral.”

The SMU Steel Buyers Sentiment Index continued to show strength both as single data points as well as our three-month-moving average (3MMA). The Sentiment Index has been at record high levels for the Index which dates back to 4th Quarter 2008.

Average hot rolled prices were lower in February than January and we were slightly lower than the CME settlement number as well as what Platts averaged for the month.

Inventories are quite low as expressed by the MSCI number of 2.0 month’s supply and our own proprietary data measured service center inventories as being 67,000 tons in deficit at the end of January.

Here is what the month looked like in numbers: