Market Segment

February 28, 2017

Chinese Steel Market Analysis for the Week Ending February 26th

Written by John Packard

The following analysis of the steel markets in China is from Beijing Metal Import & Export Co.,Ltd and is being reproduced by Steel Market Update with permission. We edited the original copy to assist our readers in understanding what the group is trying to relay to us. Here is what they had to say (edited version):

Please allow me to update China steel market (Feb 20 – Feb 26, 2017) as usual as follows:

In our last report, we indicated that the market is still on up trend and RMB3170/mt would not be the highest price in 2017! We listed 4 main reasons to explain why the market would be firm. Also we mentioned decreasing raw materials was giving big pressure to spot market, hence China steel market will fluctuate AT high levelS in the coming 2 weeks.

As we expected China steel market increased heavily in last week [price rose]. Spot price of Billets went up by RMB200/MT in 2 days and stood at RMB3330/MT on last Tuesday which is the highest in recent 3 years!

Main steel mills’ new EXW prices and firm Futures market are still the main factors for firm steel market. Heibei Group and Shagang all increased the prices for 3nd ten days of February sharply last week, details as following:

Shagang:

De-bar +RMB100/MT

Wire Rod +100/MT

Heibei Group:

De-bar +RMB380/MT

Wire Rod + RMB350/MT

For the futures market, there was a big increase last week, May Hot Rolled Coil contract stood at RMB3835 on Feb 21 which is the highest price in 2017(the lowest price is RMB3300 on Jan 04).

But China steel price already stood very high level, offered prices of most kind of steels is not competitive with India and Russia; Lots of capital swarmed into Futures market, 5 ministries under the State Council released a joint statement to remind market that there is a big risk in Futures market and market also needs a adjustment. So both Spot market and Futures market all dropped after reaching the highest level last Wednesday.

Please note that the National People’s Congress and the Chinese Political Consultative Conference (NPC & CPPCC) will be held in Beijing soon, many mills already got order that 50% of production will be limited from March 01 to March 15. Also I mentioned many times that coke price keeps dropping so now many coke suppliers are claiming for 276 policy again (Only allow coke/coal supplier to work for 276 days in one year in order to low down the production and want to increase the prices), hence spot market turned firm again in the weekend after the adjustment. Futures market also increased sharply today.

For the coming market, personal idea is that it will still fluctuate on high level, little possibility that market will drop heavily, especially Shagang/Heibei Group will release new price for 1st ten days of March end this week, if if increase slightly or make unchanged, means market still have space to go up. We will update market as usual next Monday.

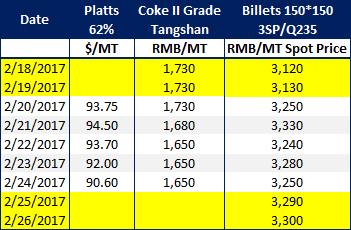

Below daily prices of Platts 62% index / Coke / Billets for your information

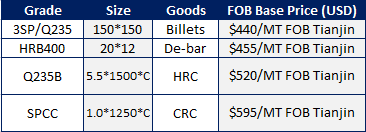

For export, below our offer TODAY just for your reference. Kindly please note that the market changes very fast, our offer will be adjusted according to market level.