Analysis

February 24, 2017

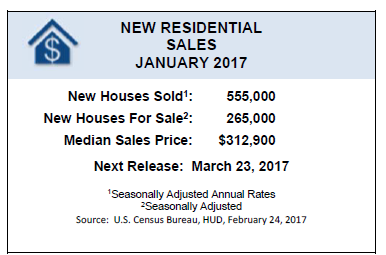

January New Home Sales Up 3.7 Percent from December

Written by Sandy Williams

Sales of new homes climbed 3.7 percent in January to a seasonally adjusted annual rate of 555,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. January sales were 5.5 percent higher than the January 2016 estimate of 526,000.

An estimated 265,000 new homes were for sale at the end of January representing a supply of 5.7 months at the current sales rate.

“This increase in new home sales is in line with our forecast for a steady, gradual recovery of the housing market,” said Granger MacDonald, chairman of the National Association of Home Builders (NAHB) and a home builder and developer from Kerrville, Texas. “However, the pace of growth may be hampered by supply-side headwinds, such as shortages of lots and labor.”

“We can expect further growth in new home sales throughout the year, spurred on by employment gains and a rise in household formations,” said NAHB Chief Economist Robert Dietz. “As the supply of existing homes remains tight, more consumers will turn to new construction.”

On a regional basis,, new home sales increased 15.8 percent in the Northeast, 14.8 percent in the Midwest and 4.3 percent in the South. Sales fell 4.4 percent in the West.