Market Segment

February 21, 2017

Service Center Intake, Shipments and Inventory through January 2016

Written by Peter Wright

January service center shipments were exceptional. There are times when we wish we weren’t so hung up on three month moving averages and this is one of them. Daily shipments increased by 29.9 percent from December. Since 2009 on average, January has increased 8.1 percent hence our enthusiasm for the latest data. Carbon steel shipments increased by 733,700 tons from December and were 273,000 tons up on January last year. The number of shipping days was unchanged at 21 and tons per day (t/d) shipments increased by 34,900 tons. Inventories at 6,831.200 tons were up by 77,000 tons.

![]() Intake and Shipments

Intake and Shipments

In January total carbon steel intake at 155,200 t/d was 3,700 tons more than shipments. This was the second month of intake surplus after three months of deficit. The deficit averaged 13,100 tons in the three months through November following an average surplus of 4,000 tons in the three months through August. Total sheet products had an intake surplus of 1,400 t/d in January made up of 900 tons of HRC, zero tons of CRC and 500 tons of coated products.

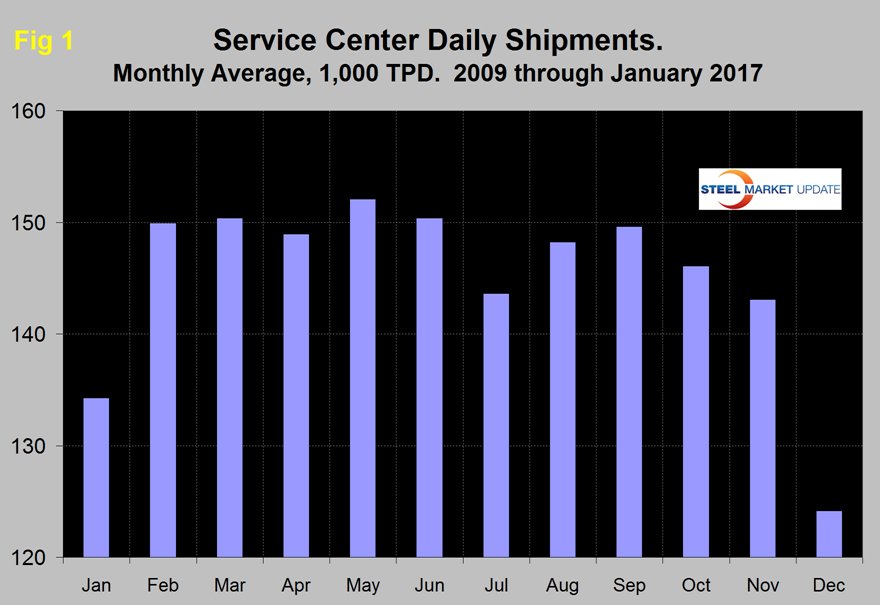

Total service center carbon steel shipments increased from 116,600 tons in December to 151,500 in January on a per day basis. MSCI data is quite seasonal and we need to get past that before commenting in detail on current results. Figure 1 demonstrates this seasonality and why comparing a month’s performance with the previous month is usually misleading.

Provided that the January shipment tonnage didn’t steal from February we can expect the next report to be up by over 11 percent. In the SMU analysis we always consider year over year changes to eliminate seasonality, our intention is to provide an undistorted view of market direction.

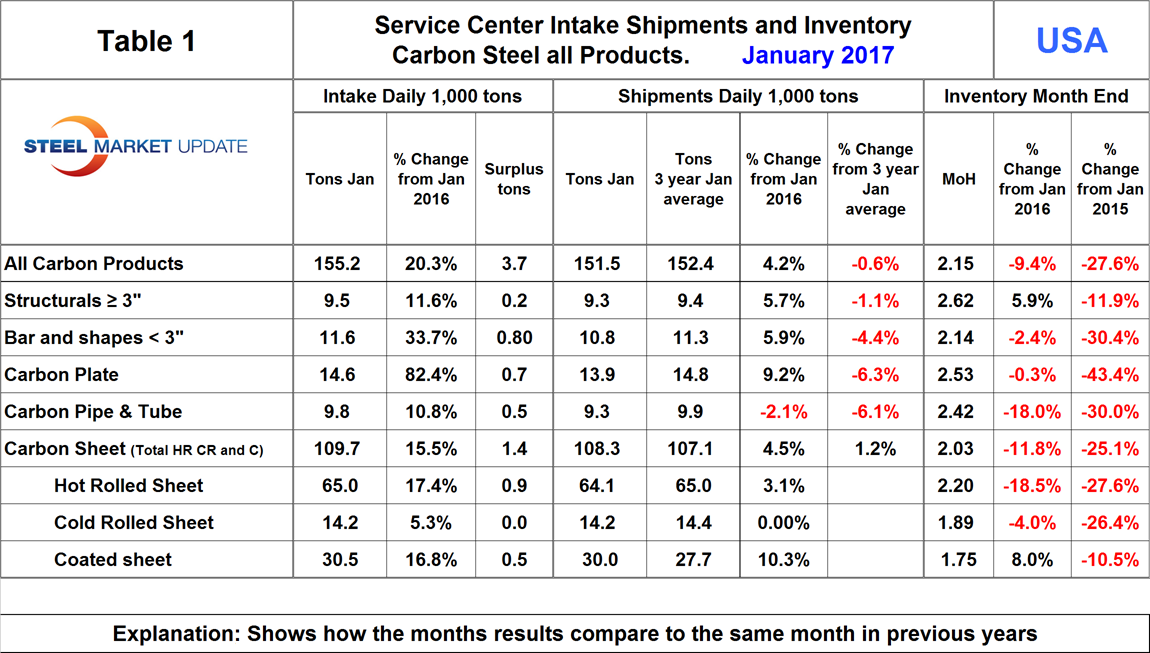

Table 1 shows the performance by product in January compared to the same month last year and also with the average t/d shipments for this and the two previous months of January.

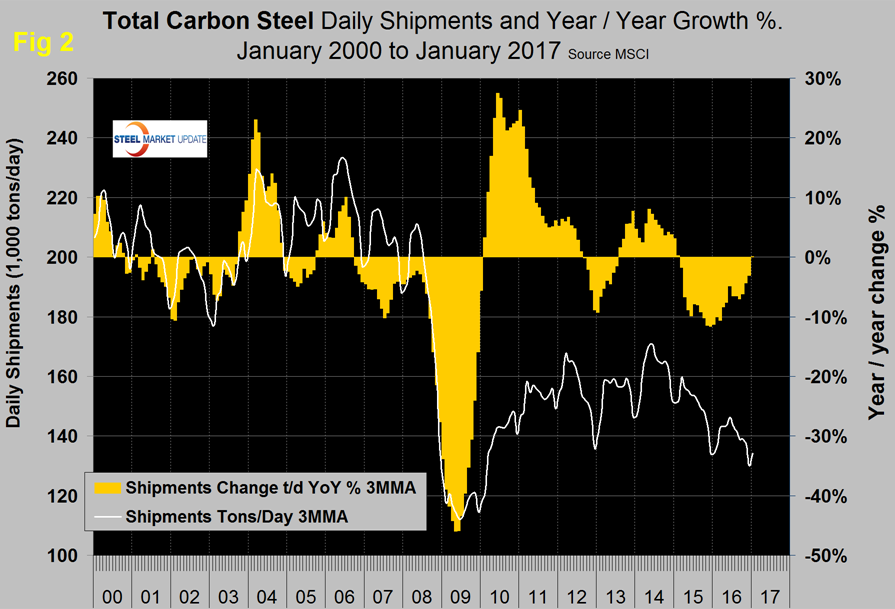

We then calculate the percent change between January 2017 and January 2016 and with the most recent 3 year January average. January this year was up by 4.2 percent in January 2016 but was still down by 0.6 percent from the three year January average. The fact that the single month y/y growth comparison is better than the three year comparison suggests that momentum is positive. In January 2015 the MSCI expanded their data to include sub sets of the major product groups and provided two years of data for 2014 and 2015. Table 1 shows the breakdown of sheet products into hot rolled, cold rolled and coated products on the same basis as for the other major product groups. Shipments of all products except carbon pipe and tube were up from January last year. Figure 2 shows the long term trends of daily carbon steel shipments since 2000 as three month moving averages (in our opinion the quickest way to size up the market is the brown bars in Figures 2, 4, 5 and 6 which show the percentage y/y change in shipments).

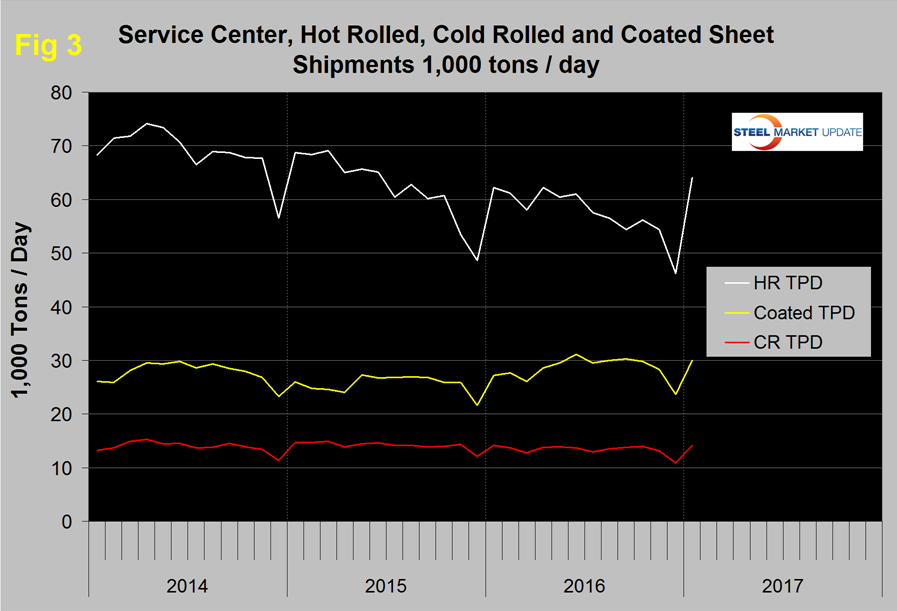

In January on a 3MMA basis there was positive y/y growth of 0.07 percent. As small as this was, it was the first positive y/y result since February 2015. Figure 3 shows the shipment history since January 2014 of the three major sheet products. All three improved in January led by HRC. These are single month results, not 3MMA.

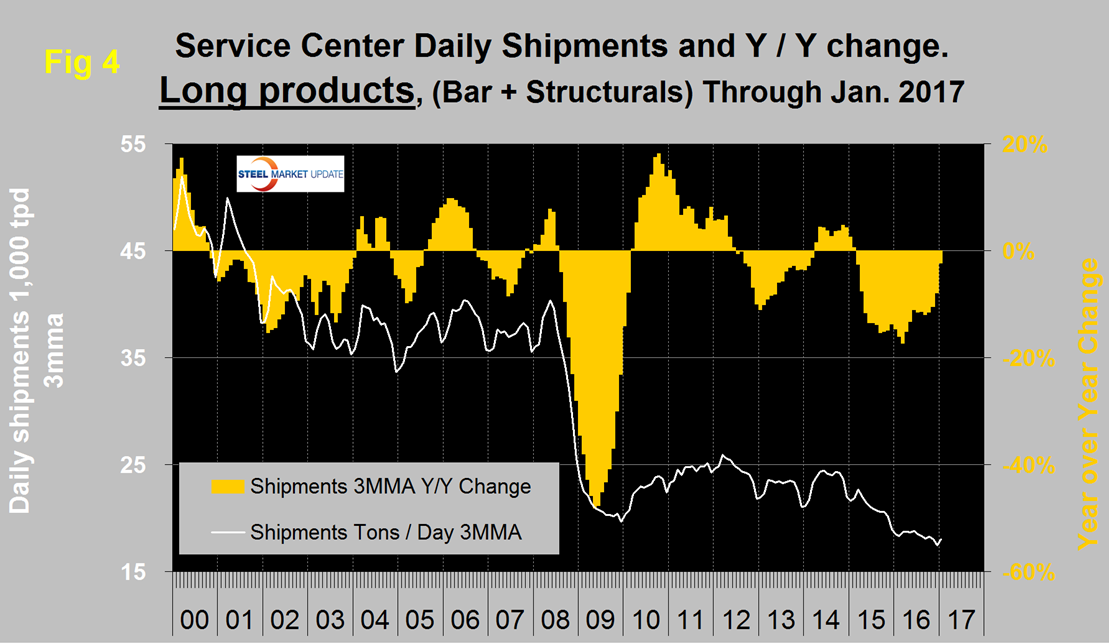

Long product shipments from service centers are now lower than they were at the depths of the recession which considering the growth in construction takes some explaining. There may have (probably has) been a migration of buyers away from service centers as mills have had inventory available for sale and room in their schedules. Other possibilities are that an unknown quantity of shapes has morphed from hot rolled to cold formed and there has been some move from beams to hollow structural shapes in building frames. Then possibly the numbers are inaccurate because of gaps in company participation (Figure 4).

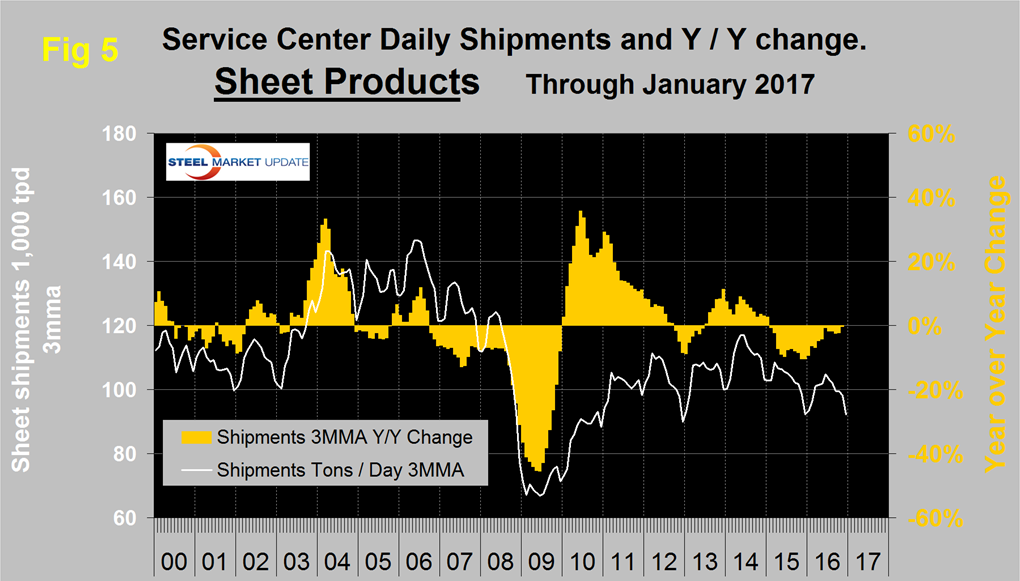

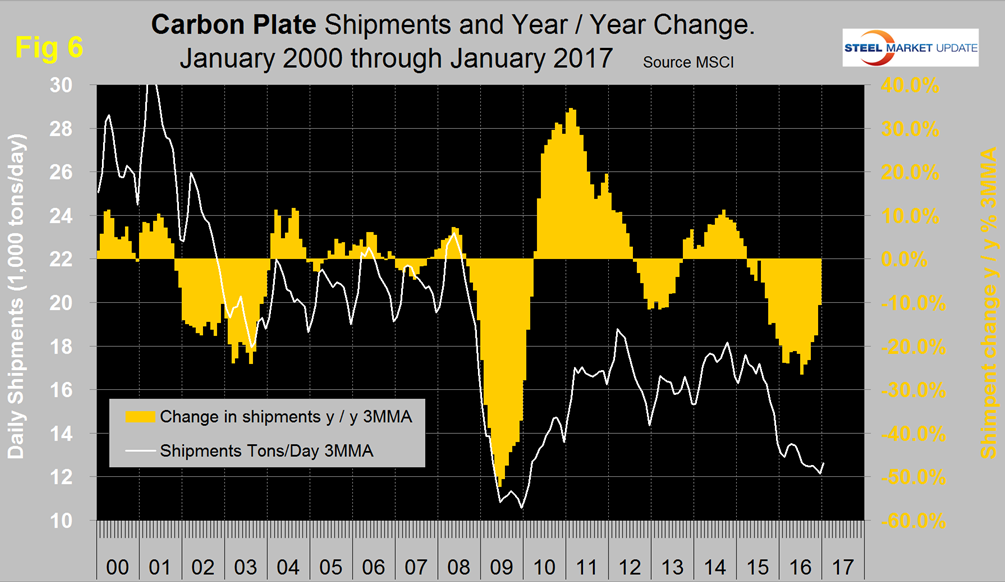

The only good thing we can find to say about long products is that the y/y contraction was the smallest in the last two years. Sheet and plate have performed very differently recently therefore the decision by MSCI to separate their data was very worthwhile. Sheet and plate products both had a good post-recession recovery. Both had some contraction in 2013 and growth in 2014 but since early 2015 they have diverged dramatically with plate performing much worse than sheet. Figures 5 and 6 show the 3MMA of t/d shipments and the y/y growth for sheet and plate respectively.

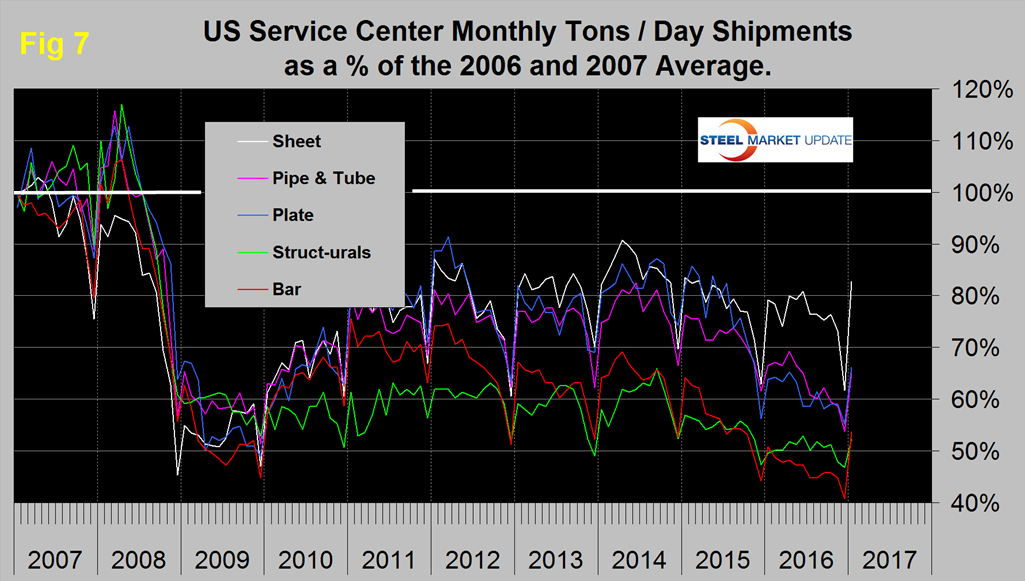

In 2006 and 2007, the mills and service centers were operating at maximum capacity, Figure 7 takes the shipments by product since that time frame and indexes them to the average for 2006 and 2007 in order to measure the extent to which service center shipments of each product have recovered.

Each year all products experience the December collapse and January pick up. The total of carbon steel products is now at 71.4 percent of the shipping rate that existed in 2006 and 2007, with structurals and bar at 52.4 percent and 53.7 percent respectively. Sheet is at 82.7 percent, plate at 66.2 percent and tubulars at 65.0 percent.

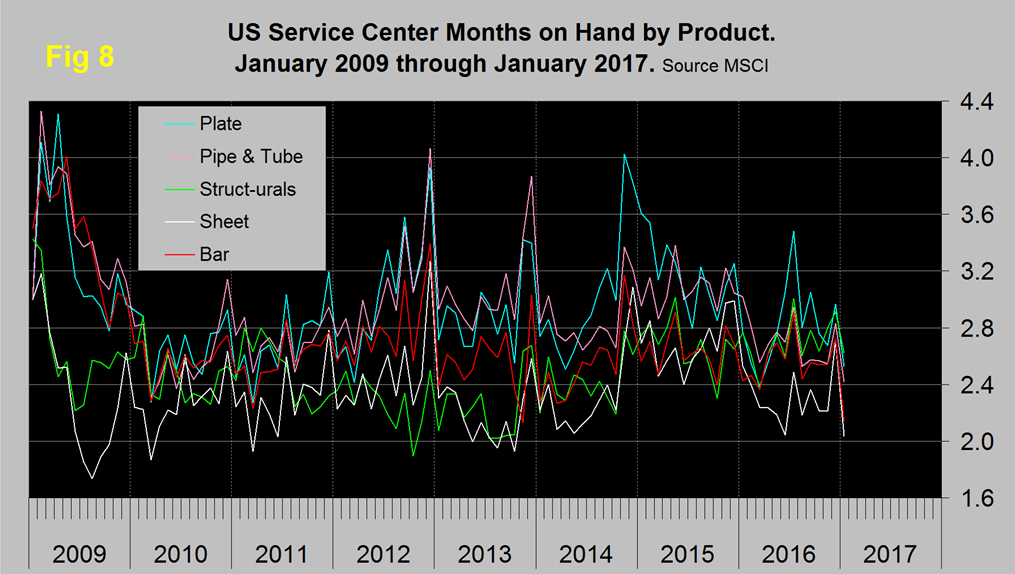

January closed with months on hand (MoH) of 2.15 for all carbon steel products, which was down from 2.76 at the end of December. The actual inventory tonnage increased by 1.1 percent but the MoH declined so much because of the shipment increase. All products except structurals and coated sheet had a decrease in MoH year over year with HRC down by 18.5 percent and tubulars down by 18.0 percent. Figure 8 shows the MoH by product monthly since January 2009.

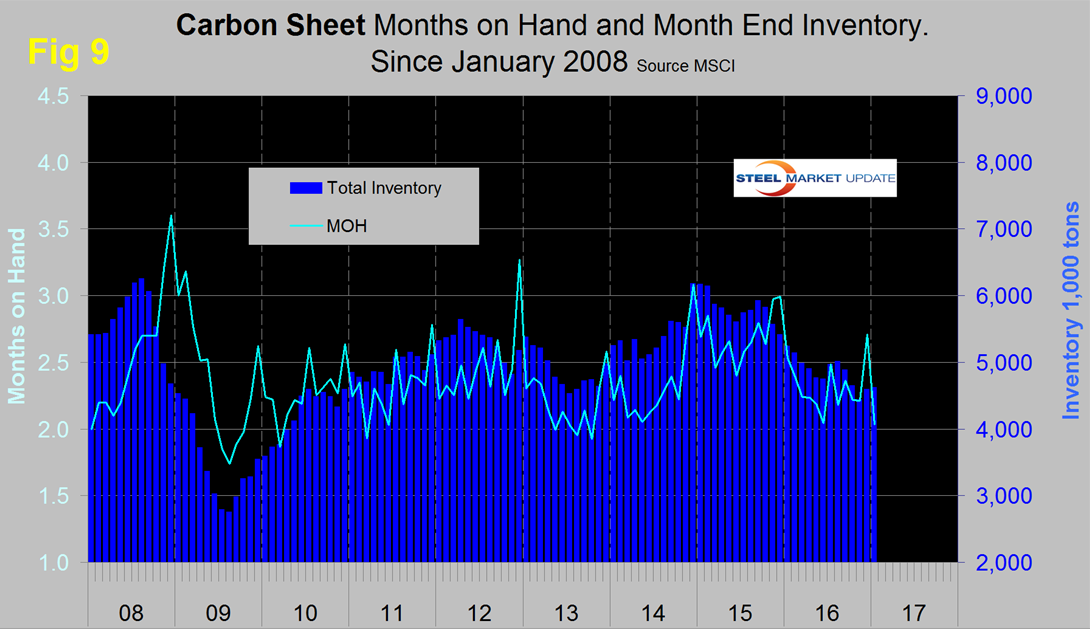

All products had a surge in months on hand in July 2016 driven not by an inventory volume increase but by a decrease in monthly shipments as a result of a small number of shipping days. This does not break the individual sheet products out separately. Figure 9 shows both the month end inventory and months on hand since January 2008 for total sheet products.

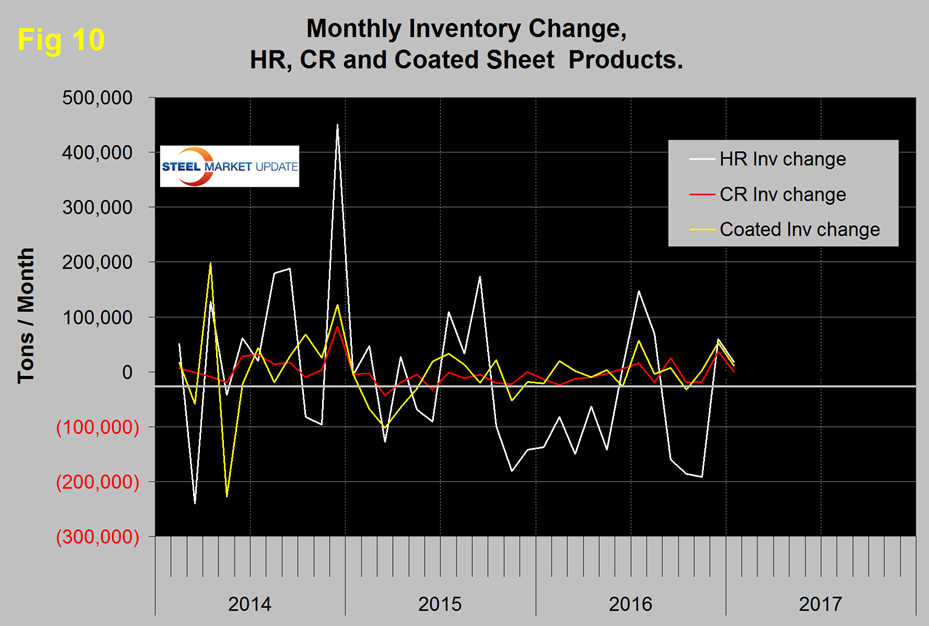

Total inventory tonnage of sheet products has been in decline for over a year. Figure 10 shows the change in inventory monthly for the big 3 sheet products. All three have come completely into line in the last two months.

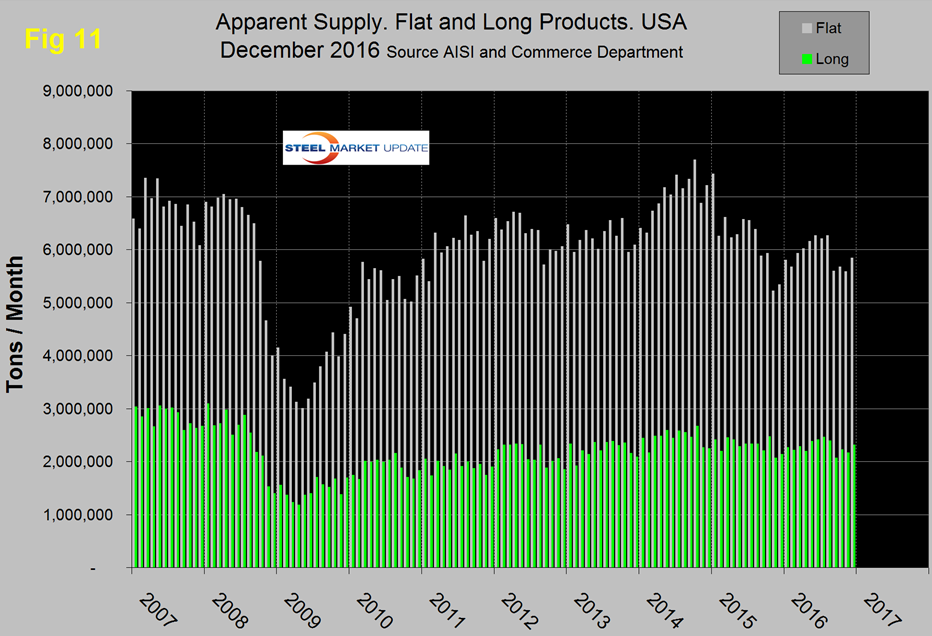

SMU Comment: In Figures 2, 4, 5 and 6, the white lines show t/d shipments. There was a decline in shipments for total carbon steel products since mid-2014 but the y/y decline halted in January this year. Figure 11 shows the total supply to the market of long and flat products based on AISI shipment and import data through December which is the latest data available.

Total supply of long products is much better than the MSCI report of service center shipments with a volume almost double the recessionary low point. Total supply of flat rolled products peaked in October 2014, declined through November 2015, recovered through August 2016 then was flat for the remainder of 2016. For flat rolled the MSCI and AISI data have been in reasonable agreement with one another.

The SMU data base contains many more product specific charts than can be shown in this brief review. For each product we have ten year charts for shipments, intake, inventory tonnage and months on hand. Some readers have requested these extra charts for a particular product and others are welcome to do so.