Market Data

February 19, 2017

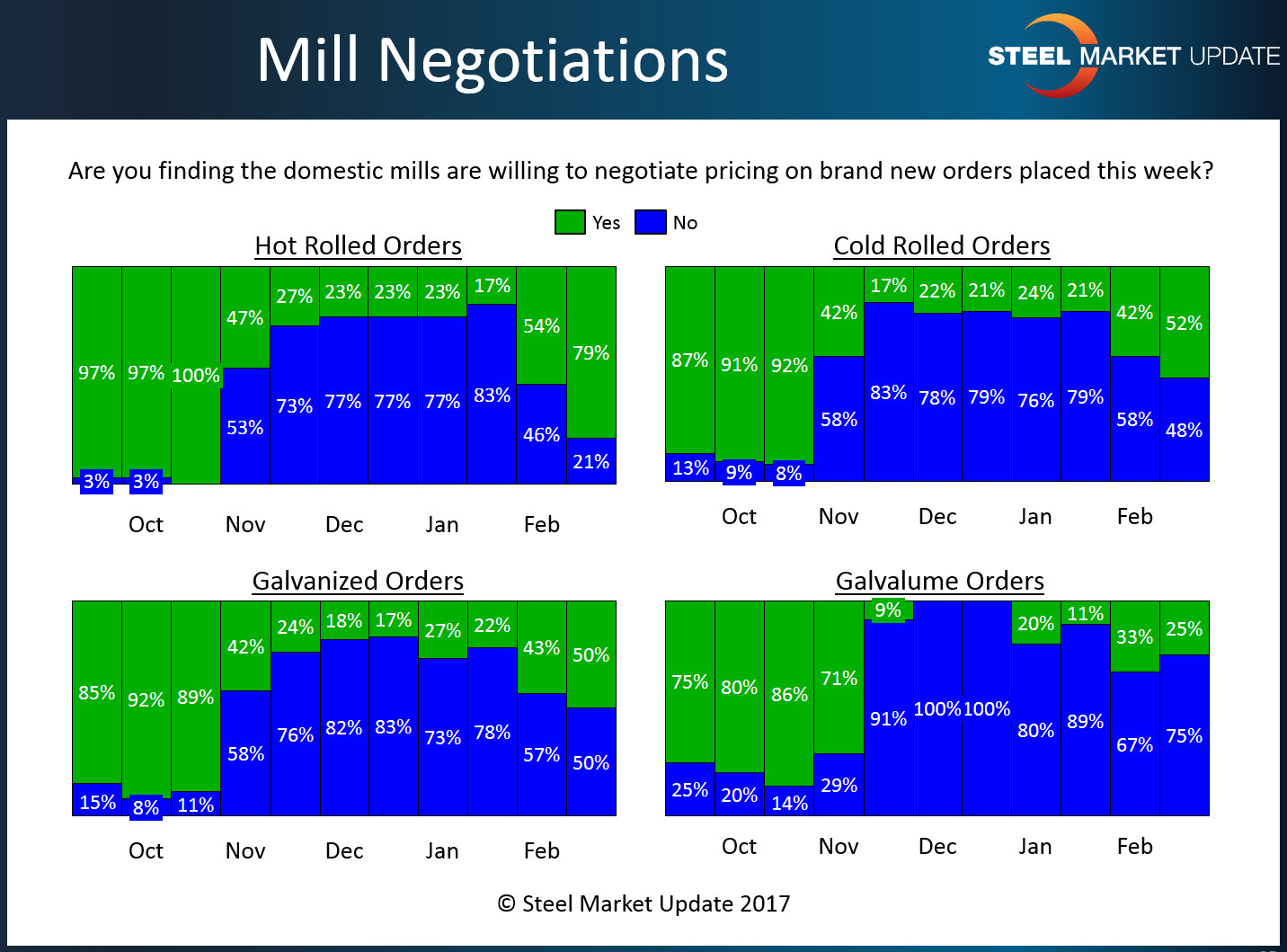

Steel Mill Price Negotiations on Flat Rolled Increasing

Written by John Packard

The respondents to our latest SMU Flat Rolled Steel Market Trends Analysis are reporting steel mills as actively negotiating prices on all flat rolled with the possible exception of Galvalume.

Seventy-nine percent of the respondents reported steel mills as willing to negotiate hot rolled spot pricing. We need to go back to our mid-October 2016 analysis in order to find a percentage exceeding 50 percent.

Fifty-two percent of our respondents reported steel mills willing to negotiate cold rolled prices. As with hot rolled above, you need to go back to mid-October 2016 to find the mills as willing to talk about cold rolled steel prices.

Fifty percent of those responding to our questionnaire reported galvanized spot prices as negotiable. In mid-October 2016 the percentage was 89 percent.

Galvalume has fared better than HR, CR an GI products as only twenty-five percent of our respondents reported AZ prices as being negotiable. In early November 2016, that percentage was 71 percent.

SMU Note: In late October, the domestic steel mills began announcing price increases which resulted in prices going up by a minimum of $160 per ton before slipping back recently.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.