Prices

February 19, 2017

Price Increase Rumors Starting to Float

Written by John Packard

A large flat rolled steel service center shot me a note late on Friday advising a steel mill had told them earlier in the day to expect a $40 per ton price increase as soon as Monday of this week. At the same time the customer was told if scrap prices in March increase by more than $50 per ton there would be a second increase in the first week of March.

The distributor then went on to say about the timing of any increase announcement, “Earlier they announce the better chance of impacting March CRU.”

March is the third and last month in the first quarter so the domestic mills will try to do everything they can to influence prices in order to reset their second quarter contracts at the highest numbers possible.

A couple of mills have been whispering of announcing new increases either prior to the March scrap negotiations (this week or early next week) or as soon as the domestic mills know the new prices they will pay in March for ferrous scrap.

Logic tells us to watch the “mini mills” of Nucor, SDI and, potentially, NLMK USA as leading the way as they will be the most affected by any upward movement in scrap pricing.

What is Leading the Push for Higher Prices?

One word, “scrap,” as prices for the feed stock have taken a surprise turn up over the past couple of weeks. The dealers are now telling SMU that we should expect prices to be at worse sideways and most likely will be higher moving into March negotiations.

Based on the comments being made by the one mill to the service center mentioned at the beginning of this article, they seem to be expecting scrap to move $40-$50 per ton higher in March.

A second word that could impact pricing is “inventories” as the MSCI published flat rolled steel service centers were holding just 2.20 months of hot rolled, 1.89 months of cold rolled and 1.75 months of coated steels. A mill told us during a conversation late last week that at these levels (if correct) distributors will need to move back into the market as buyers in order to maintain or increase their inventories.

SMU Note: We do a much less scientific study of service center inventories during our flat rolled surveys. The most recent survey which concluded late last week had service center inventories averaging 2.43 months.

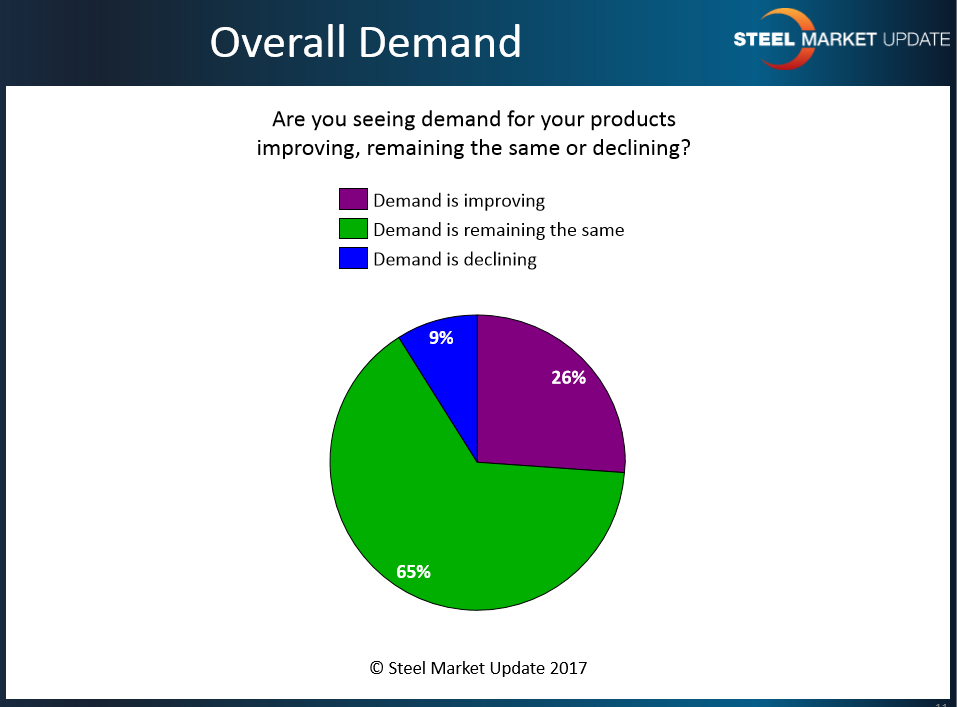

The third word which is much more difficult to quantify is “demand.” If true demand is improving, whether it be seasonal or otherwise, this could put pressure on the mill order books. Our most recent flat rolled market analysis found 26 percent of our respondents reporting improving demand while 65 percent felt demand was the same and only 9 percent found demand in decline. These numbers are similar to what we reported during the first two months 2016.

There are some headwinds coming on demand as multiple auto companies have bloated auto inventories on their floors and will need to move the excess most likely through incentives. If incentives aren’t successful, then the companies will need to scale back production (or they do both).

We will need to watch demand carefully in the coming weeks as we move into the 2nd Quarter. In the meantime, be prepared for the domestic steel mills to make a move on hot rolled, cold rolled and coated steel prices over the next two weeks.