Market Segment

February 16, 2017

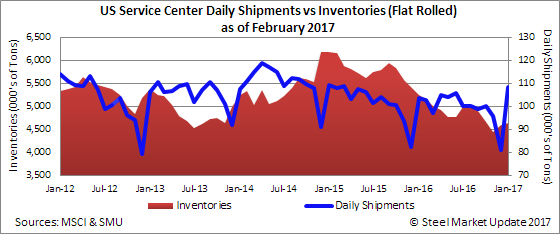

Steel Distributors Flat Rolled Inventories Fall as Shipments Improve

Written by John Packard

The Metal Service Center Institute (MSCI) released shipment and inventories data for the steel service centers located in the United States. They reported higher shipment rates coupled with lower flat rolled inventories (higher overall for all products) which is very supportive for prices to tighten over the next 30 days.

U.S. steel service centers (all products) shipped a total of 3,340,400 tons during the month of January. This total for shipments is 9.4 percent above year ago levels. The 9.4 percent increase year-over-year is the largest increase we have seen in a long time. During 2016 there were only two months of positive growth YOY, November at 3.3 percent and August at 2.1 percent. The daily average shipment rate was 159,100 tons per day.

Inventories stood at 7,296,500 tons at the end of January, an increase of 71,100 tons from the end of December levels. Inventories are now 8.3 percent lower than year ago levels and the number of month’s supply (all products) stands at 2.2 months compared to 2.8 months at the end of December.

Carbon Flat Rolled

Distributors shipped 2,273,300 tons of carbon flat rolled or “sheet” products during the month of January. Shipments were up 201,800 tons compared to year ago levels and 577,600 tons greater than December 2016. Sheet shipments were 9.7 percent higher than last year.

Flat rolled inventories totaled 4,625,100 tons which are slightly higher than December’s 4,595,300 tons and 11.8 percent below year ago levels.

The number of month’s supply stands at 2.0 months compared to the 2.7 month’s supply reported by the MSCI at the end of December 2016.

The MSCI reported hot rolled inventories as being 2.20 months, this is down from over 3.0 months just a few months back. Cold rolled months supply is now at 1.89 months and coated (galvanized/Galvalume) are at 1.75 months up only slightly from the 1.69 months just a few months back.

Assuming the MSCI data is correct then inventories are very tight and the orders on the books will not radically change that scenario if the AISI raw steel production data is anywhere near close to be accurate.

Carbon Plate

Plate shipments totaled 291,800 tons during the month of January. Shipments of plate were 9.3 percent higher than year ago levels. The daily shipment rate was 13,900 tons per day compared to 13,400 tons per day one year ago and 11,600 tons per day reported at the end of December.

Plate inventories increased slightly from 722,500 tons at the end of December to 737,400 tons at the end of January. Inventories are 0.3 percent lower than year ago levels and the number of month’s supply dropped dramatically from 3.0 months at the end of January to 2.5 month.

Carbon Pipe & Tube

Pipe and tube shipments out of the U.S. service centers stood at 194,800 tons at the end of January. This is 2.2 percent better than year ago levels.

Inventories of pipe & tube stood at 471,500 tons which is 18 percent lower than year ago levels. The number of month’s supply stood at 2.4 months at the end of January. This is down from the 2.8 months at the end of December.