Market Data

February 16, 2017

SMU Steel Buyers Sentiment Index 3MMA at Record High

Written by John Packard

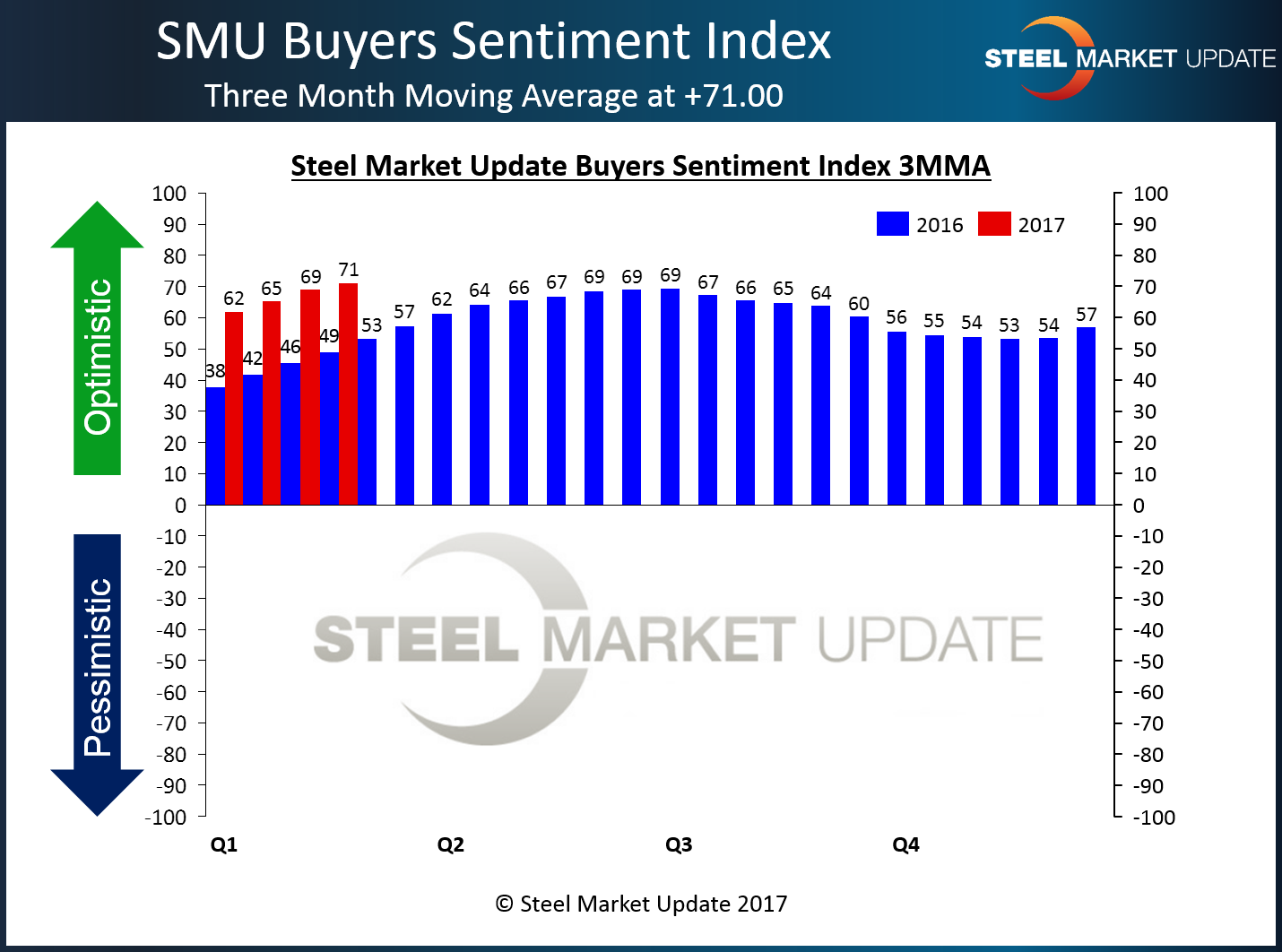

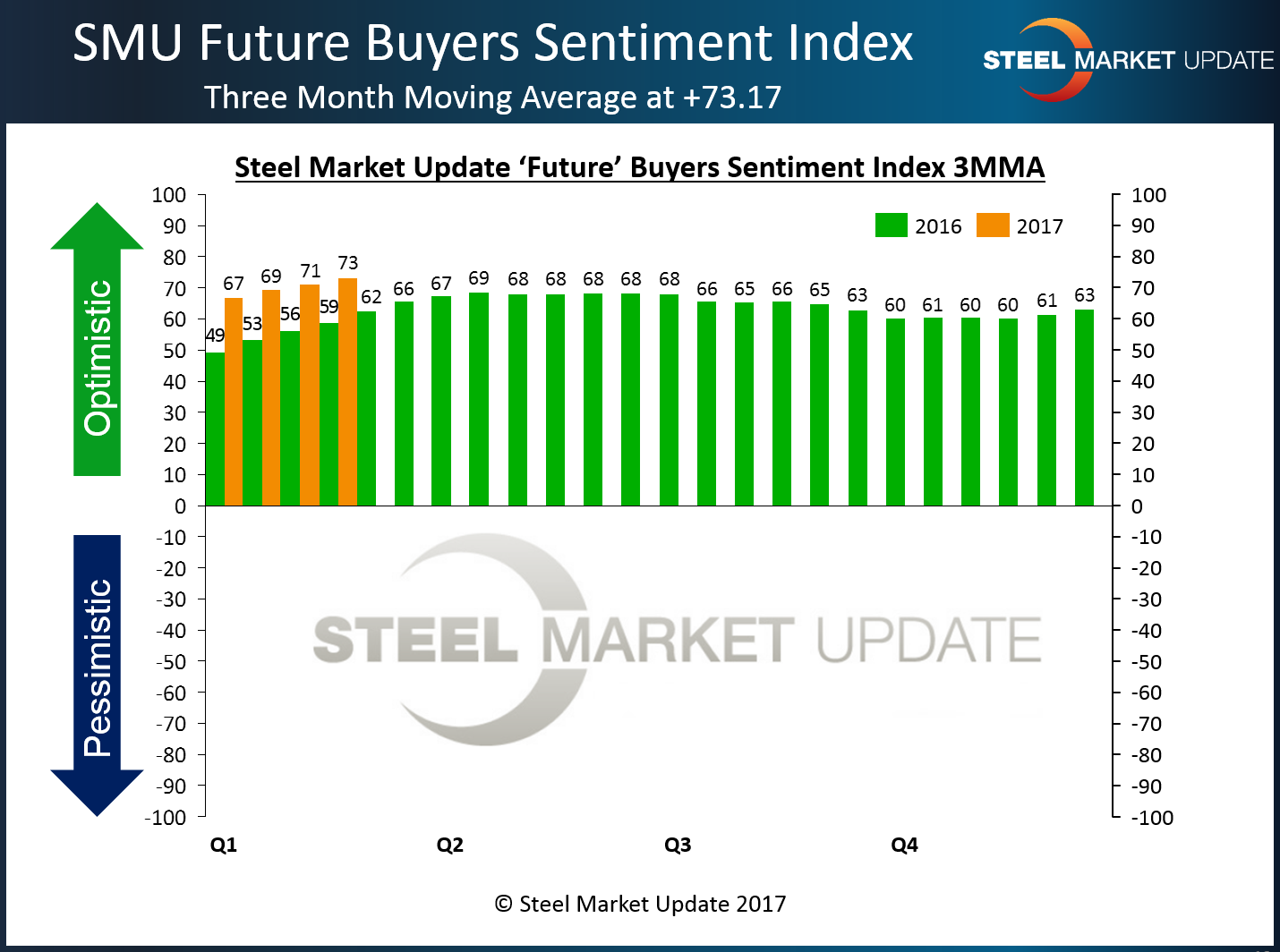

Buyers and sellers of flat rolled steel continue to fly high and are optimistic about their company’s ability to be successful both in the existing market environment (Current Sentiment) as well as looking out three to six months into the future (Future Sentiment). Both Current Sentiment and Future Sentiment set record highs based on the three-month moving average.

As a single data point our SMU Steel Buyers Sentiment Index came in at +71 which is down -5 points from the beginning of this month. One year ago Sentiment was reported as being +58. Steel Market Update is of the opinion that our Sentiment Index is a harbinger for a better steel demand environment in the coming months.

When looking at Current Sentiment based on a three-month moving average (3MMA) the +71.00 being reported this week is the highest recorded by SMU since we started the Index in 4th Quarter 2008. We will have to watch to see if the next few data points push our 3MMA lower. We believe this could occur should flat rolled steel prices come under pressure and companies feel the need to liquidate inventories. We do not think that will happen but, we need to keep our eyes and ears open.

Future Sentiment Breaks Records for both Single Data Point and 3MMA

Future Sentiment as a single data point is +75 which is unchanged from the beginning of the month and continues to be the highest single data point recorded. We prefer to look at the data through three-month moving averages which smooths out any “bumps” in the data. Our 3MMA for Future Sentiment set a record high this week at +73.17.

What Our Respondents are Saying

“Quiet, no move in demand, things are consistent.” Manufacturing company which reported business conditions as being “Good.”

“We are hopeful that demand will surprise to the upside.” Service center

“Clouds ahead.” Service center who also told us, “March scrap pricing will be key to where prices go. Would love to see us last 30 days without movement up or down.”

“Plate is doing very well.” Service center

“I believe it is just the season. All of the contractors in this area are slow but are bidding many projects.” Service center who reported business conditions as “Excellent.”

“In line with seasonal expectations.” Manufacturing company.

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s survey, 40 percent were manufacturing and 42 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies, and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.