Prices

February 14, 2017

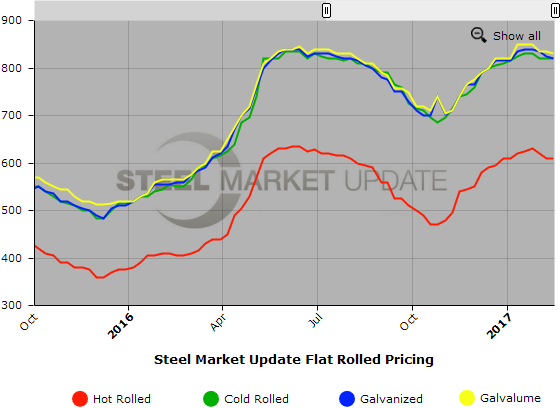

SMU Price Ranges & Indices: A Breather as Prices Remain Stable

Written by John Packard

Flat rolled prices held their own this week and remained at, or very near, last week’s levels. At the moment we are seeing the mills as willing to negotiate prices on some items but, at the same time we are see some strengthening as scrap prices have firmed up over the past week and may go higher in March. We continue to be in a transition phase and prices could be stable for a week or two before deciding (usually with a push) which direction they will go next.

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $590-$630 per ton ($29.50/cwt-$31.50/cwt) with an average of $610 per ton ($30.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range are unchanged compared to one week ago. Our overall average is the same compared to last week. Our price momentum on hot rolled steel is now pointing to Neutral which means that prices are expected to move sideways over the next 30-60 days.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU Range is $800-$840 per ton ($40.00/cwt-$42.00/cwt) with an average of $820 per ton ($41.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range are unchanged compared to last week. Our overall average is the same compared to one week ago. Our price momentum on cold rolled steel is now pointing to Neutral which means that prices are expected to move sideways over the next 30-60 days.

Cold Rolled Lead Times: 4-9 weeks

Galvanized Coil: SMU Base Price Range is $40.00/cwt-$42.00/cwt ($800-$840 per ton) with an average of $41.00/cwt ($820 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago while the upper end declined $10 per ton. Our overall average is down $5 per ton compared to last week. Our price momentum on galvanized steel is now pointing to Neutral which means that prices are expected to move sideways over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU Range is $869-$909 per net ton with an average of $889 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-10 weeks

Galvalume Coil: SMU Base Price Range is $40.50/cwt-$42.50/cwt ($810-$850 per ton) with an average of $41.50/cwt ($830 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to last week while the upper end remained the same. Our overall average is down $5 per ton compared to one week ago. Our price momentum on Galvalume steel is now pointing to Neutral which means that prices are expected to move sideways over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1101-$1141 per net ton with an average of $1121 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.