Analysis

February 9, 2017

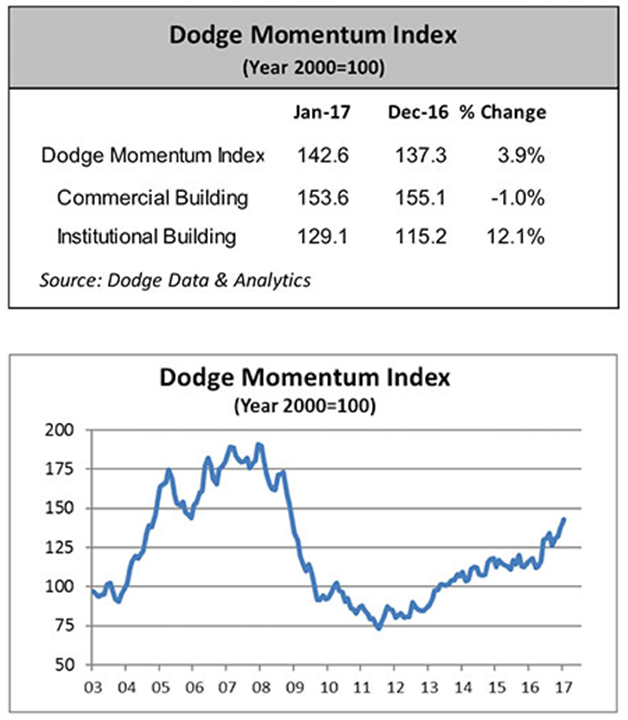

Dodge Momentum Index Up 3.9 Percent in January

Written by Sandy Williams

The January Dodge Momentum Index gained 3.9 percent to register at 142.6 from a revised reading of 137.3 in December.

The index is a monthly measure of the initial report for nonresidential buildings in planning and leads nonresidential construction spending for buildings by a full year. The index is considered an indicator of future construction growth.

Institutional construction planning gained 12.1 percent while commercial planning fell by 1.0 percent. Dodge Data & Analytics said the decrease in commercial is minor and planning for the sector remains near an eight year high, suggesting stronger growth in 2017.

Institutional planning has been the more volatile component of the index in 2016 but trended higher at the end of the year, suggesting 2017 may have potential for increased activity.

Eleven projects with a value exceeding $100 million entered the planning stage in January.