Prices

February 7, 2017

SMU Price Ranges & Indices: Looking for Orders

Written by John Packard

Steel buyers are telling Steel Market Update that there are a few steel mills “looking for orders” and that flat rolled steel prices are “somewhat negotiable with tons” but, otherwise, the steel mills are doing a good job of holding the line on prices. We have seen a couple of drops in pricing due to the lower end of our range getting nicked and a tightening of the spread between the low and the high numbers being asked in the marketplace.

One steel executive told us today, “Its getting a little weaker. We are being approached by mills we normally don’t do business with looking for tons. It is very unusual for prices to back off in early February.” He then went on to point out an observation that we have an article on in tonight’s newsletter, “Scrap appears to be firming back up.”

Steel Market Update continues to have our Price Momentum Indicator pointing toward a Neutral pricing environment over the next 30 days. There has been some minor erosion of prices but we do not expect a sharp decline during the next 30 days. Having said that one mill told us today when asked about Big River Steel becoming a competitor for their business, “It is what it is, and well, gotta battle and out do your competitors anyway. This is not patty-cakes!”

Another executive at a different mill told SMU, “[Market Price] is, “Flat…stable. I believe big tons can get folks a slightly better deal. Nobody super excited to load up right now. We believe this is the lull before the Spring market hits… Late March/April lead times should bring better apparent demand.”

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $590-$630 per ton ($29.50/cwt-$31.50/cwt) with an average of $610 per ton ($30.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to our revised price last week, and the upper end declined by $10 as well. Our overall average is down $10 per ton compared to last week. Our price momentum on hot rolled steel is now pointing to Neutral which means that prices are expected to move sideways over the next 30-60 days.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU Range is $800-$840 per ton ($40.00/cwt-$42.00/cwt) with an average of $820 per ton ($41.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range are unchanged compared to last week. Our overall average is the same compared to one week ago. Our price momentum on cold rolled steel is now pointing to Neutral which means that prices are expected to move sideways over the next 30-60 days.

Cold Rolled Lead Times: 4-9 weeks

Galvanized Coil: SMU Base Price Range is $40.00/cwt-$42.50/cwt ($800-$850 per ton) with an average of $41.25/cwt ($825 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to one week ago while the upper end remained the same. Our overall average is down $10 per ton compared to last week. Our price momentum on galvanized steel is now pointing to Neutral which means that prices are expected to move sideways over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU Range is $869-$919 per net ton with an average of $894 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-10 weeks

Galvalume Coil: SMU Base Price Range is $41.00/cwt-$42.50/cwt ($820-$850 per ton) with an average of $41.75/cwt ($835 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to last week while the upper end increased $10 per ton. Our overall average is unchanged compared to one week ago. Our price momentum on Galvalume steel is now pointing to Neutral which means that prices are expected to move sideways over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1111-$1141 per net ton with an average of $1126 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-9 weeks

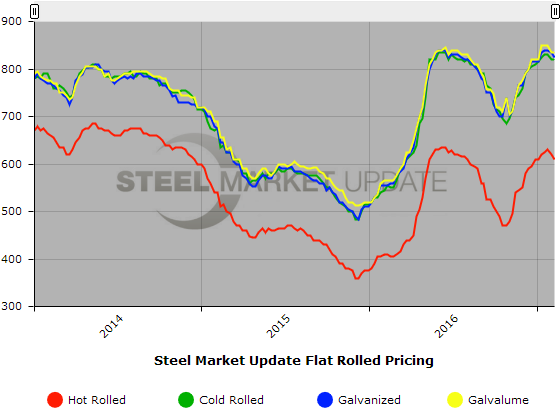

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.