Market Segment

February 6, 2017

Chinese Steel Market Analysis for the Week Ending February 5th

Written by John Packard

The following analysis of the steel markets in China is from Beijing Metal Import & Export Co.,Ltd and is being reproduced by Steel Market Update with permission:

Please be informed that we are back in our office on Feb 03. Very sorry we didn’t update on the China steel market for more than 2 weeks due to our Spring Festival. Here is our new steel market report (Jan 17 – Feb 05, 2017), should you have any questions on the China steel market, please feel free to contact us.

Before China reopened on Feb 03, steel market kept stable as no real transactions, there was no change EXW prices were higher than spot prices.

During the Spring Festival, most steel mills chose to cut some production, this means spot stock kept increasing. Normally China steel market has a good start after the Spring Festival as banks normally releases credit line and traders will decrease their stock in order to get more cash then can book new cargo from mills. But China’s central bank surprised the market on the first working day (last Friday) of the year of the Rooster by raising lending rates to banks, a 10 basis point rise in the interest rate of open-market operations. This policy was obviously out of market expect [unexpected], hence Futures Market dropped heavily, till today morning, Futures market still very weak. Spot market has been kept stable from Jan 19 to Feb 04 (Billets price’s RMB2810/MT), but started to drop yesterday. Billets dropped by RMB60/MT yesterday, stood at RMB2750/MT. I don’t think the decrease will last long time as it’s only an normal reaction to Futures market. Also Please note Shagang still make EXW prices unchanged for first ten days of Feb and spot prices seems turning stable today morning. IF market drops heavily mills will order their agencies to lock the sale price.

What am focusing is Coke price. Price of Ⅱ grade coke in Tangshan already dropped to RMB1880/mt, before Chinese Spring Festival, it’s RMB1930/MT. Also some second level private steel mills started to low down [lower] their EXW prices slightly for domestic market, Shagang and Heibei Group will issue their new prices for second ten days on Feb 11, we will update you in next weekly report if they will follow to decrease prices or not.

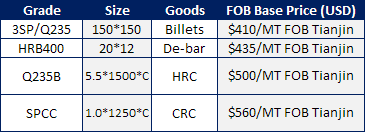

For export, below our offer TODAY just for your reference: