Market Data

February 2, 2017

SMU Steel Buyers Sentiment Index Sets New High

Written by John Packard

Buyers and sellers of flat rolled steel are feeling good about the industry based on the results of the just completed flat rolled steel market trends analysis released by Steel Market Update (SMU). The SMU Steel Buyers Sentiment Index set another record high beating the high mark achieved just two weeks ago (an explanation of our Index is at the end of this article).

SMU Current Sentiment Index is +76, up +3 points from mid-January and a new high for a single data point since Steel Market Update began indexing Sentiment in 2008.

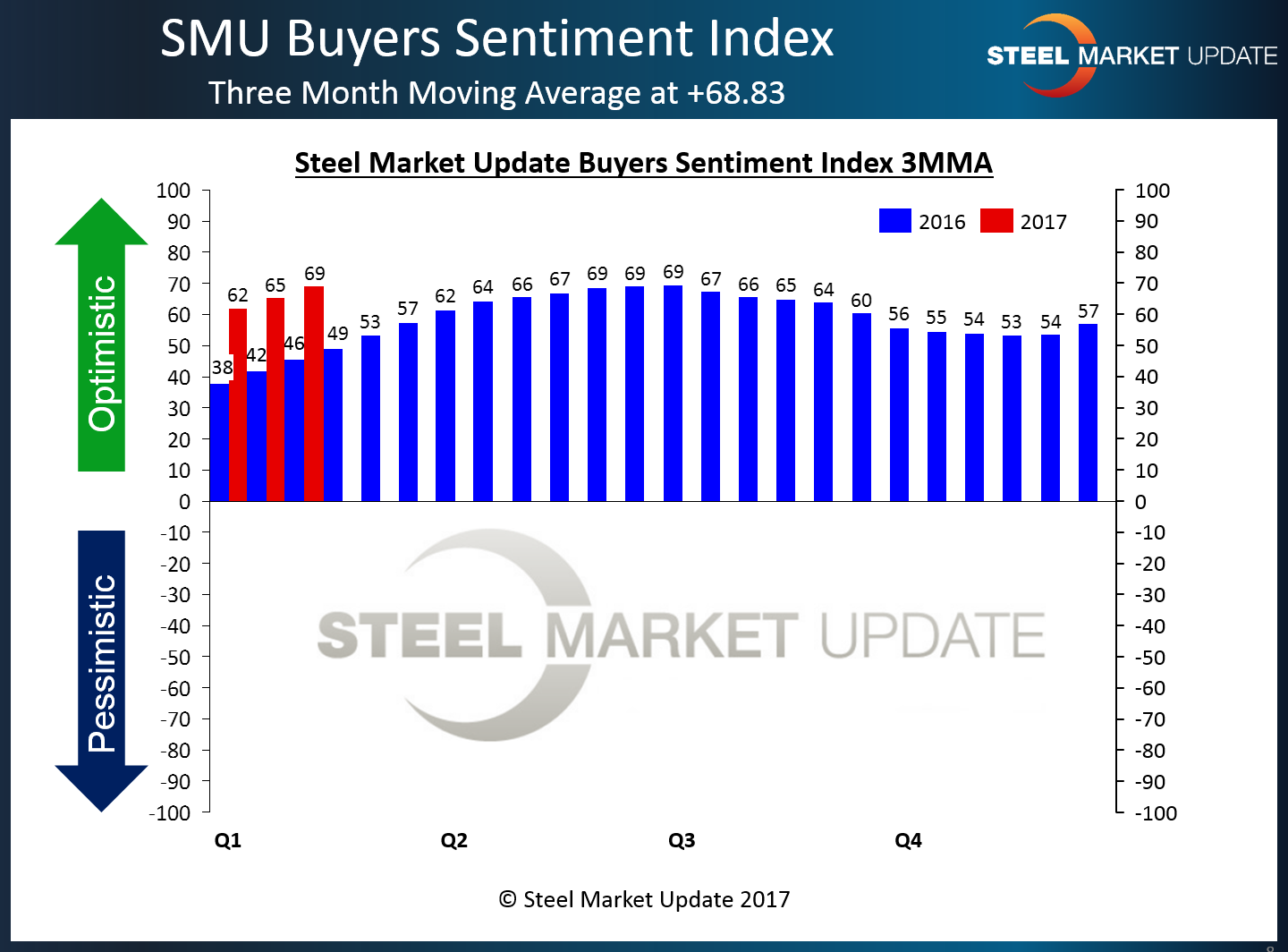

When looking at Current Sentiment on a three-month-moving-average (3MMA) basis our new reading is +68.83 which is not a record, but it is within 0.034 of the +69.17 recorded during the first week of July 2016.

In October 2008 Steel Market Update began measuring how buyers and sellers of steel feel about their company’s ability to be successful in both today’s market (Current Sentiment) as well as looking out three to six months (Future Sentiment). When we first began collecting data the market was reeling from the impact of the market crash associated with the Great Recession. Our very first report on Sentiment measured Current Sentiment as being -69 indicating a very pessimistic flat rolled steel market. The record low for our Index was set five months later in mid-March 2009 when we measured Sentiment as being -85.

Since then Sentiment has been steadily improving first breaking above zero in mid-April 2010 (+4). By mid-June 2010 Sentiment dipped back below zero before finally popping out of the pessimistic area of our Index on December 1, 2010 (+1) and it has remained firmly ensconced in the optimistic camp ever since. The graphic shown below is from the SMU website and is available to all of our member companies.

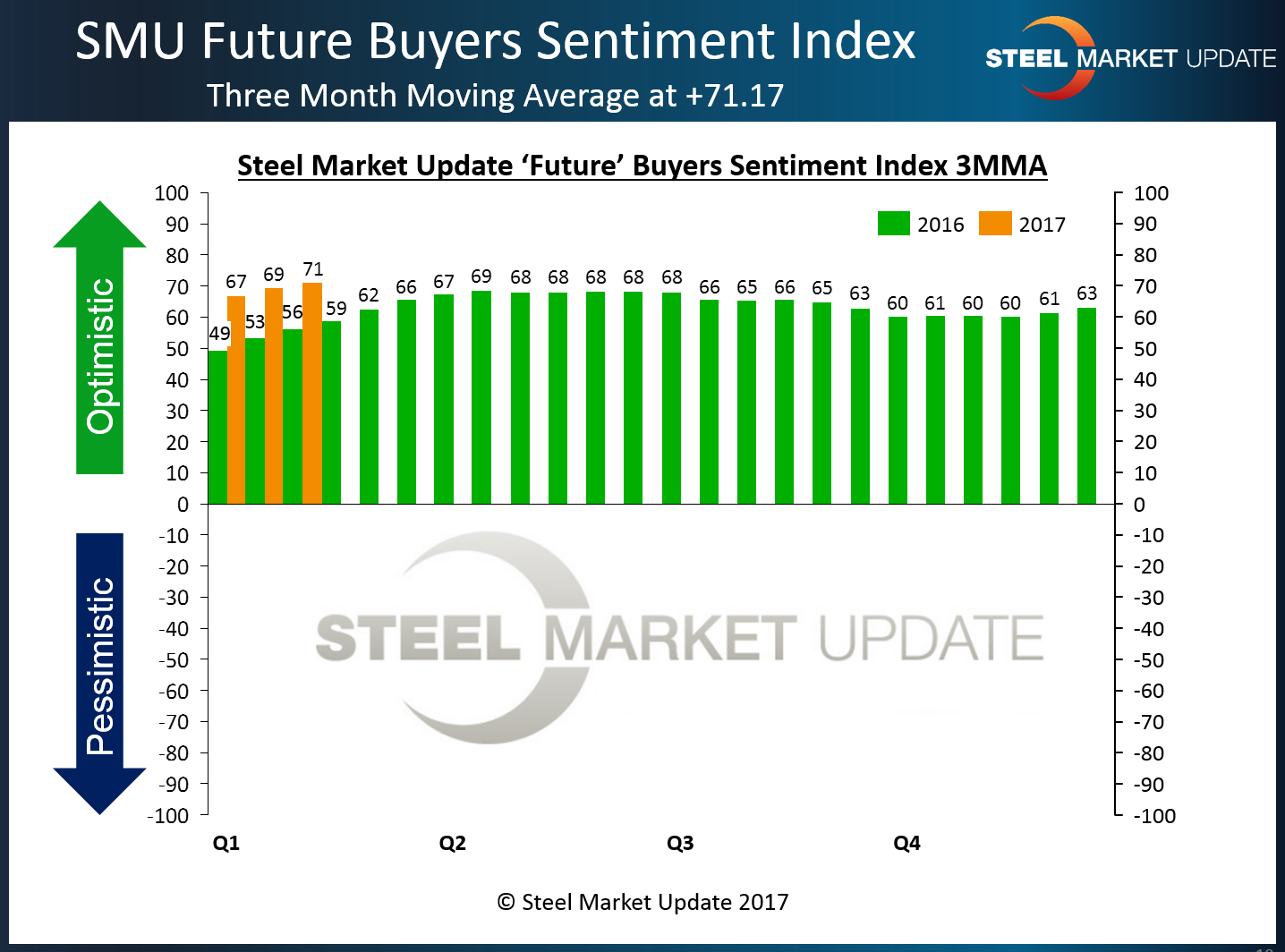

Future Sentiment Breaks Records for both Single Data Point and 3MMA

Flat rolled buyers and sellers of steel remained enthusiastic about their company’s ability to be successful three to six months into the future. We recorded a +75 as a single data point. This is up +1 point from mid-January and is the all-time high for Future Sentiment.

Looking at Future Sentiment from a 3MMA basis the +71.17 is an all-time high breaking the mid-January record by +2 points.

What Our Respondents are Saying

“Demand has been okay, but not as strong as last January.” Manufacturing company

“We manufacture products that sell primarily into the single-family new housing market. That outlook is strong for the next few years. My concern lies in the rising steel prices and the impact on our ability to pass those along to our customers.” Manufacturing company

“Managing lean inventory becomes a challenge when lead times grow.” Service center

“Especially on coated products.” Trading company – SMU Note: question was how does the respondent feel about their company’s ability to be successful in today’s market.

“The high price of steel makes me a little nervous.” Wholesaler

“Lots of uncertainty.” Service center

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s survey, 41 percent were manufacturing and 46 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies, and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.