Market Data

February 1, 2017

Global PMI Steady in January

Written by Sandy Williams

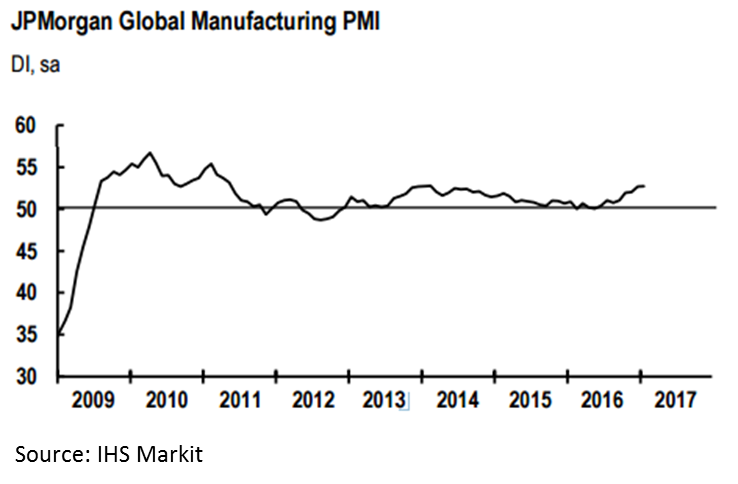

The JP Morgan Global PMI remained steady at 52.7 in January. Global manufacturing production increased for the fifty-first consecutive month according to data collected IHS Markit. Faster expansion was noted in the US, Eurozone and UK. Manufacturing expansion slowed in Japan in January and contraction was registered in South Korea, Brazil, Turkey and Greece.

At the time of publication of the global PMI, no information was available from China, Taiwan, Vietnam and Malaysia.

At the time of publication of the global PMI, no information was available from China, Taiwan, Vietnam and Malaysia.

David Hensley, Director of Global Economic Coordination at JP Morgan, said: “Business conditions in the global manufacturing sector improved at a solid pace in January, with output, new orders and employment all expanding at similar rates to December. With backlogs of work rising further and business confidence increasing, the sector looks firmly set to build on this solid start to the new year during the coming months Please note that later than usual release dates meant January 2017 PMI data were not available for. Previously published readings for the global manufacturing indices have also been restated following the annual review of the weights applied to the national PMI data.

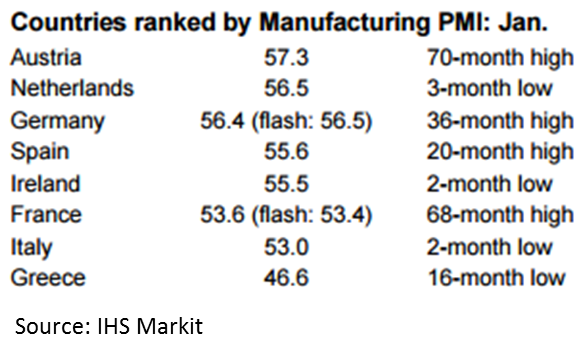

Eurozone

The PMI in the Eurozone rose to 55.2 in January form 54.9 in December for a 69-month high. New business and job creation was at one of the strongest rates since the first half of 2011, said IHS Markit.

Input and output prices continued to be pressured, with both recording increases in January. Markit linked increased pricing to higher import costs from a weaker euro and increased global commodity prices. Vendor lead times lengthened in January as purchasing activity increased.

Input and output prices continued to be pressured, with both recording increases in January. Markit linked increased pricing to higher import costs from a weaker euro and increased global commodity prices. Vendor lead times lengthened in January as purchasing activity increased.

Chris Williamson, Chief Business Economist at IHS Markit said there are “signs of demand running ahead of supply, which hints at a tentative build-up of core inflationary pressures.”

“If current growth of manufacturing activity and the associated rise in prices is sustained, rhetoric at the ECB is likely to become more hawkish, albeit tempered with caution over the potential for political developments to cloud the outlook.”

Russia

Manufacturing continues to accelerate in Russia with a sharp increase in domestic new orders and output. The PMI was at a 70 month high of 54.7 in January. As production and orders increased so did backlogs and lead times. Employment levels grew to meet demand. New export business continued to fall in January, continuing a downturn that has lasted almost three-and-a-half years.

Output and input charges increased at a slower pace last month, said IHS Markit. “According to anecdotal evidence, unfavourable exchange rate movements, alongside higher prices for steel, iron, copper and cotton, contributed to the overall increase in average cost burdens during January.”

China PMI information was not available from IHS Markit

Mexico

Production continued to be lackluster in Mexico in January. The PMI registered 50.8, up from 50.2 in December. The manufacturing sector saw modest increase in output in new orders. Export orders grew at a softer pace last month. Input prices increased due to the weakness of the peso against the U.S. dollar. Average costs increased to their highest in 10 months. IHS Markit noted that ongoing political and economic uncertainty was undermining optimism among manufacturers.

Canada

The Manufacturing PMI indicated a jump start to business activity for the new year. The PMI rose to 53.5 from 51.8 in December. IHS Markit said it was the strongest upturn in operating conditions in more than two years. Production output jumped as new orders jumped from domestic sources. Anecdotal reports indicated sales were rising, in particular, to energy sector clients. Exports only saw a modest expansion in January. Increase new work led to a boost in employment levels. Inventories declined in January and supplier delivery times lengthened, most likely due to weather delays. Higher prices were noted commodities and for imported raw materials.

United States

The Markit manufacturing PMI rose to 55.0 in January from 54.3 in December as output and new orders accelerated.

Commenting on the final PMI data, Chris Williamson said: “The US manufacturing sector has started 2017 with strong momentum. Despite exports being subdued by the strong dollar, order books are growing at the fastest pace for over two years on the back of improved domestic demand.

“With optimism about the year ahead at the highest since last March, the outlook has also brightened.

“Production is consequently growing at the strongest rate for almost two years and inventories are rising at a rate not seen for nearly a decade as firms respond to higher demand, suggesting the goods-producing sector will make a decent contribution to first quarter GDP.

“With input costs also rising at the steepest rate for over two years, and hiring sustained at an encouragingly solid pace as firms expand capacity, all of the survey indicators point to the Fed hiking interest rates again soon.”