Analysis

January 22, 2017

NAFTA Vehicle Production through December 2016

Written by Peter Wright

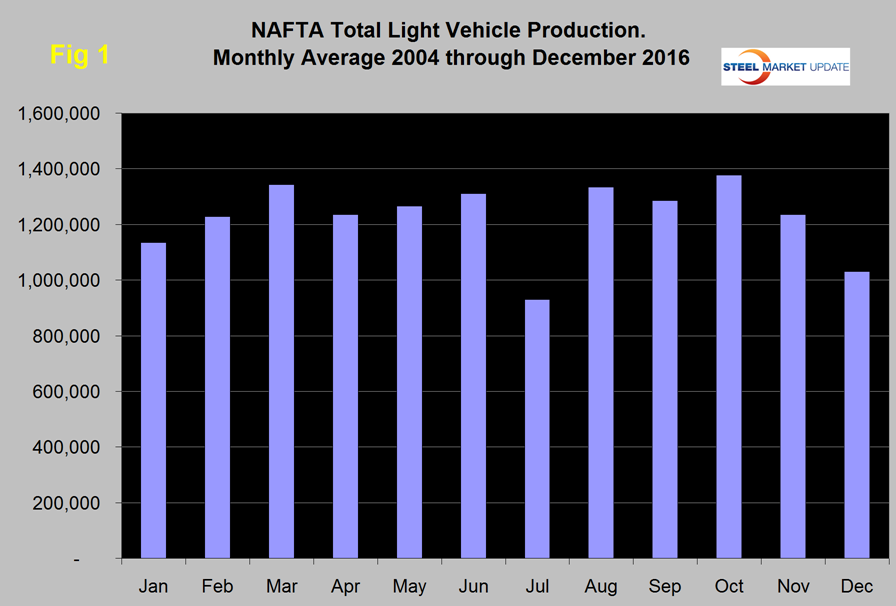

Total light vehicle (LV) auto production in NAFTA in December was at an annual rate, of 15.171 million units, down from 17.921 million in November. In cases where seasonality is more than a weather effect, we like to compare the monthly result with the monthly norm over a number of years. On average since 2004, December’s production has been 16.4 percent lower than November. This year production declined by 15.3 percent, therefore, we see December’s report as normal in the long term context (Figure 1). We can expect January and February’s production to bounce back by 10 percent and 13 percent, respectively.

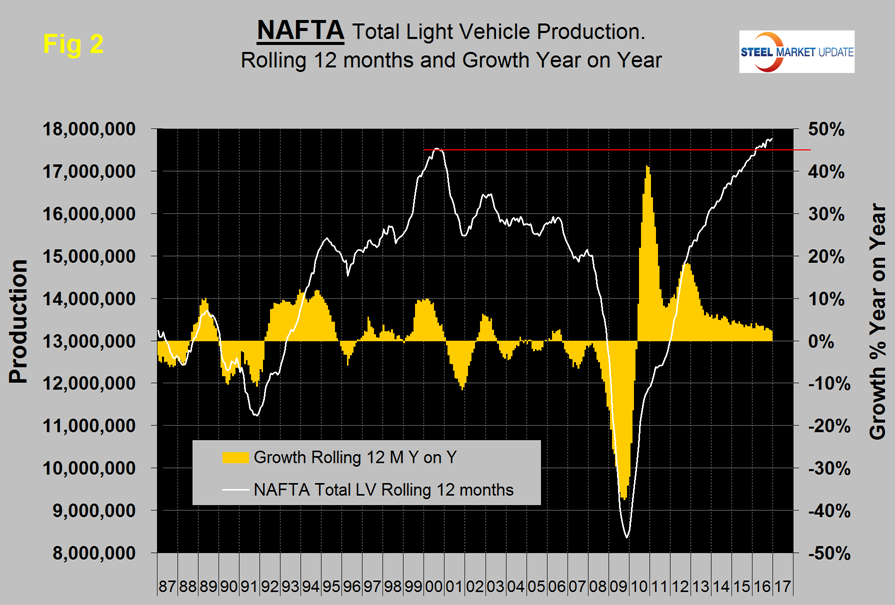

On a rolling 12 months basis y/y through December, LV production in NAFTA increased by 2.3 percent which was down from 2.5 percent in 12 months through November. There has been a very gradual slowdown in growth for the last three years as indicated by the brown bars in Figure 2, however production was at an all-time high every month in 2016.

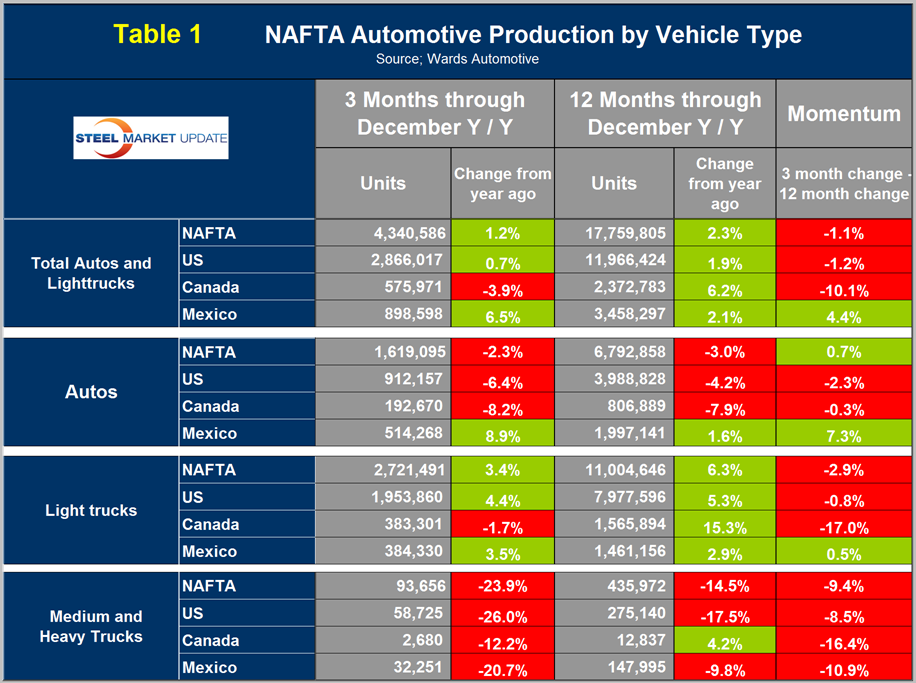

On a rolling 12 months basis y/y the US was up by 1.9 percent with negative momentum, Canada was up by 6.2 percent with very negative momentum and Mexico was up by 2.1 percent with positive momentum (Table 1).

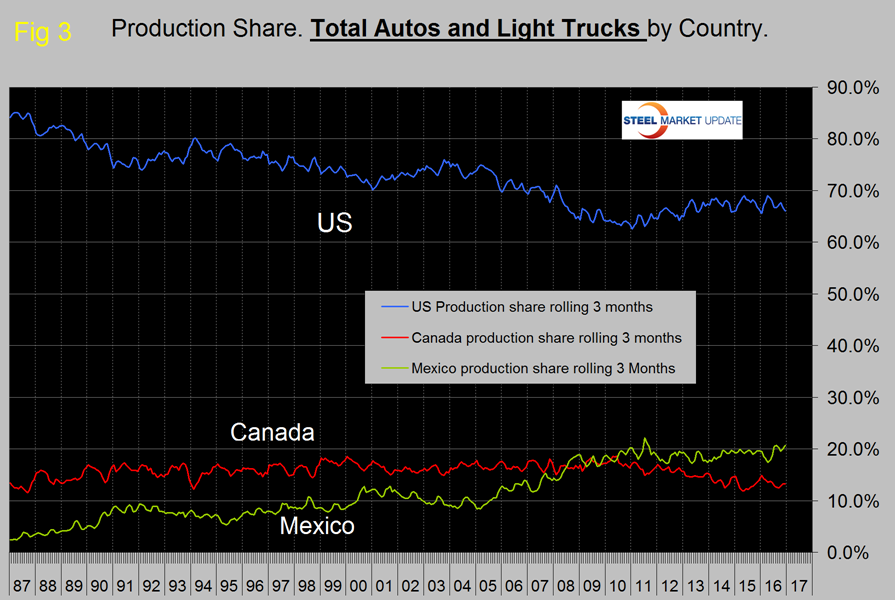

The six months July through December were the first months for Mexico to have positive momentum after fourteen straight months of slowdown. Canada experienced negative momentum in July through December following very strong momentum in the previous six months. On a rolling 3 months basis in 2016, Mexico has gained production share mainly at the expense of Canada (Figure 3) and the Mexican and US shares have been almost mirror images of each other as production has shifted backwards and forwards across the border with not much net change.

In December on a rolling three month basis, the US production share of total light vehicles was 66.0 percent, Canada’s was 13.3 percent which was the same as the 13.3 percent monthly average for the year. Mexico’s was 20.7 percent which was the highest share they have achieved since July 2011. Production in Mexico in 2014 was 3.2 million units, in 2015 was 3.4 million units and in 2016 3.458 million units. The Mexican production target for 2020 in 5.0 million units according to Eduardo Solis, president of the Mexican Automotive Industry Association.

Ward’s Automotive reported this week that total light vehicle inventories in the US were 62 days at the end of December, which was down 11 days from the end of November but up by 1 day from the end of the end of December last year. Month over month FCA (Fiat Chrysler Automotive) was down by 11 days to 82, GM was down by 15 to 71 and Ford was down by 9 to 73 days.

The SMU data file contains more detail than be shown here in this condensed report. Readers can obtain copies of additional time based performance results on request if they wish to dig deeper. Available are graphs of auto, light truck and medium and heavy truck production and growth rate and production share by country.