Analysis

January 22, 2017

Auto Sales Plateauing is Not a Bad Thing for Steel Industry

Written by Sandy Williams

The Associated Steel Distributors regional meeting in Detroit on January 19 very appropriately focused on the automotive industry. The meeting was held during the last weekend of the North American International Auto Show in Detroit where a vast array of technological innovation was showcased through virtual reality, simulators and presentation of current models and concept vehicles.

Bernard Swiecki, senior automotive analyst at the Center for Automotive Research (CAR) gave an enlightening presentation during the Thursday ASD meeting regarding where the automotive industry is and where it is headed. And, of course, as one of the largest consumers of steel, where the industry goes will also affect the steel industry.

The Center for Automotive Research (CAR), an independent, non-profit, research organization, produces industry-driven research and analyses; develops forecasts; fosters dialogue and convenes forums; and publicly disseminates its research through conferences, events, and the media.

The automotive market finished 2016 with sales at a seasonally adjusted annual rate of 18.4 million vehicles, for a second consecutive all-time sales record. There were 17.5 million units sold last year setting a variety of records including all-time highest transaction values. Swiecki noted that revenue doesn’t stop at the automaker; nearly two thirds of a completed vehicle comes from the supply base.

The 2016 light vehicle record exceeded the previous year by 56,000 units. The auto industry posted a record of seven consecutive year-over-year sales in 2016 making the past year an unprecedented period of growth for the industry. Incentives pushed sales during the period and no manufacturer last year was below 2.0 percent of the industry average.

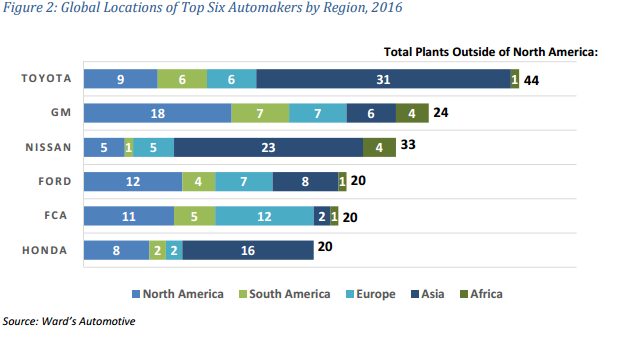

The top five manufacturers by market share were GM Ford, Toyota, FCA, and Honda. The new normal, starting in 2010, said Swiecki, is flat market share. Auto manufacturers are not really swapping market places anymore, he said. Consolidation has created stability and increased competitiveness. GM’s market share is only 10 percent higher than the seventh largest company in the country. “That is competitive,” said Swiecki. “It is much harder to get by in this business, even if you are the top dog.”

Sales of midsize and smaller cars are declining but are still the second and third largest segments and a large part of the market. Those sales are not lost, said Swiecki, instead it means someone bought a more expensive crossover. The average sales price for a vehicle in 2016 was $35,000 per unit, the highest ever.

CAR forecasts that the automotive market is going to plateau. Unfortunately, said Swiecki, plateau “is unfairly being cast in a negative light.”

“We have had market plateaus before, and keep in mind we have had a record period of growth, hit several other records, and record revenue. We could do worse than hit a record in every regard and then sustain it for awhile.”

This is different than 2009, said Swiecki, if you are going to have a downturn, staying flat is better than what happened then.

In the early 2000s the automotive industry plateaued, and, even though record numbers of autos were being sold, said Swiecki, the OEM supply base had massive overcapacity. As a result the necessary closures and job losses during the downturn were extremely painful. That is not the case now, he said. The industry is at a peak plateau but struggling with undercapacity–a very different situation. Back then, the Detroit 3 market share was being replaced by international producers. While GM, Ford and Chrysler were closing plants in the North, said Swiecki, internationals were opening them in the South. This time around the industry is stable.

Even though the industry will be at a plateau it will still be a time of tremendous upheaval and transformation as manufacturers work toward achieving EPA requirements. Auto industry strategy is planned years in advance and very little change will occur with the new administration.

One of the growing concerns of the industry is workforce availability and capability. Michigan prides itself as being ground zero where there is always worker availability, said Swiecki. Now that is beginning to change and the industry is having difficulty finding workers. Manufacturers are forced to think about where than can find necessary labor, thus holding up investment while considering where they may need to go.

Another problem that occurred during the last industry crash was brought on by manufacturers themselves. Sales were bulked up with incentives to encourage people to buy vehicles they really couldn’t afford. When the crash occurred, consumers hung on to their vehicles and weren’t buying new ones, making the situation worse.

The automotive industry is through with its building boom, especially in Mexico, said Swiecki. Mexico’s was finished 1.5 years ago, not because the new president is scaring them now.

In a chart that he showed during his presentation, Swiecki note a dip in sales around 2018 that will be due to the replacement cycle. The replacement cycle is a major driver of sales since most buyers are replacing cars not making first purchases. The average car on the road is now 11.5 years old. Most people keep cars for 4-5 years before replacing them. Currently the industry is in the eighth year of recovery and well into the mid-phase of the buying cycle. A resurgence of sales is expected in 2020.

NAFTA

The Trump Administration is considering the following plans that will affect the industry:

1) Renegotiate with Canada and Mexico and if that doesn’t work withdraw from NAFTA;

2) Kill the TPP (would have occurred under either candidate’s administration);

3) Label China as a currency manipulator;

4) Lots of other plans.

NAFTA has safeguards built in where trading partners can use a complaint procedure if they believe they are being unfairly treated. Swiecki says most of the complaints by the U.S. are against Canada, not Mexico.

One of the proposals Trump has bandied about is a 35 percent tariff against companies that produce items in Mexico and then sell them in the United States. A 35 percent tariff can be imposed, said Swiecki, but it can’t be sustained for more than 150 days; beyond that period the U.S. would be in violation of WTO rules and to continue would have to withdraw from the WTO.

Odds are, he said, that companies will not be deterred by a 35 percent tariff and would instead move production to a different foreign producer. Supply chains come from all over the world and so does the production of vehicles sold in the U.S. Car companies don’t think the changes to NAFTA will be as big as the talk about it, said Swiecki.

What does scare the U.S. automotive industry is the Border Adjustment Tax (BAT), said Swiecki. “BAT is the anti-tariff. No tariffs or fees on anything brought in from Mexico, China or whatever. It changes what you can reduce from your cost of goods—what you can write-off. Suddenly your corporation income goes higher because you couldn’t deduct as many things and you will pay a higher tax because your corporate income is higher.”

Vehicles produced in North America have approximately 40 percent content from the U.S. That content of manufactured parts would decrease dramatically if produced elsewhere, for instance, China. U.S. parts content could be down to just five percent.

Cheaper imported parts allow the assembly of vehicles at higher American wages in the U.S. Vehicles would be too expensive if they were wholly produced in the U.S., said Swiecki. “What makes it cost effective to produce a car in your country is dependent on getting cheap inputs from elsewhere, said Swiecki. “A long story short, everyone has their Mexico.” Countries are surrounded by regions where they can get cheaper inputs. “It is built into how we do business,” he added.

Exports and Investment

Michigan would suffer from a withdrawal from NAFTA, said Swiecki. The Detroit metropolitan area was the sixth largest metro area for all exports in 2015 ($4.38B) according to the U.S. International Trade Administration. Mexico and Canada are the top foreign markets for Detroit exports with 39 percent of export goods value headed to Mexico in 2016 and 34 percent to Canada. Detroit’s exported goods to Mexico are greater in both value and share than any other U.S. city according to the USITA.

In 2015, the U.S. auto industry consumed $44.38 billion of Mexican produced auto parts, reports CAR. Vehicles assembled in Mexico and exported contain on average of 40.3 percent U.S. produced parts. In an analysis of NAFTA, the proposed 35 percent tax is equal to 31,000 jobs lost, not gained.

“If you start closing off borders, it is never a one way story,” said Swiecki. “If you close off borders you will get retaliation, trade wars. You limit your own exports that are responsible for a lot of jobs.”

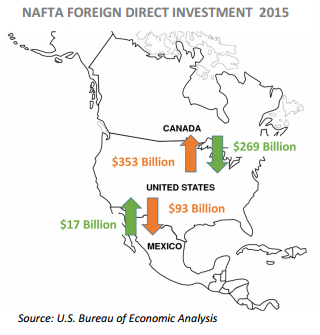

Another issue of contention is how much investment is going to Mexico and Canada from U.S. manufacturers.

The chart above shows total Foreign Direct Investment between the U.S., Canada and Mexico in 2015 according to the U.S. Bureau of Economic Analysis. CAR estimates $116.5 billion of investments were made by U.S. automakers, $6.7 billion to Canada, $85 billion in U.S., and $24.7 billion to Mexico.

The Mexico total may surprise some, said Swiecki. Most of the money spent in the industry is for reinvestment in existing plants. Assembly plants are considered the holy grail, said Swiecki, because they draw production with them. Since 2009, 10 assembly plants were announced for all of North America: zero for Canada, two for the U.S. and eight for Mexico. The caveat, however, is the building boom in Mexico stopped in Q3 2015 before the election. Recent announcements were the result of sound, fundamental decisions because of the industry plateau, not because of Trump threats. There is a tendency to coat the announcements in PR talk to curry favor from the new administration.

The Future

The future for the automobiles will be the use of mixed materials in vehicles to reach light weighting targets as well as advanced transportation technologies of intelligent transportation, automating vehicles, and connected vehicle systems. These technologies when combined will result in the fully automated, emissions friendly self-driving vehicles of the future.