Market Data

January 19, 2017

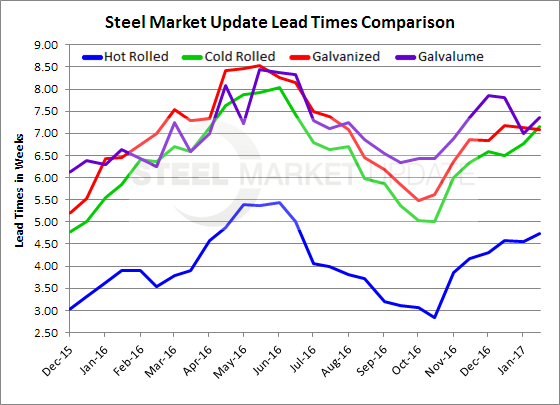

Steel Mill Lead Times Remain Extended

Written by John Packard

Steel mill lead times, the amount of time it takes for steel mills to produce new orders of hot rolled, cold rolled, galvanized or Galvalume products, continue to remain extended according to the results of Steel Market Update flat rolled steel market trends analysis conducted during the course of this week.

Hot rolled lead times are now averaging 4.73 weeks based on the cumulative average of the responses received during our survey process. The 4.73 weeks is slightly higher than the 4.55 weeks reported at the beginning of January. It is close to one week longer than what we saw one year ago when HRC lead times were reported as averaging 3.91 weeks.

Cold rolled lead times are now averaging 7.15 weeks, which is slightly more than one quarter of a week longer than what we reported at the beginning of January and is more than one week longer than the 5.85 weeks reported one year ago.

Galvanized lead times now average 7.09 weeks which is essentially unchanged from what we reported at the beginning of the year and is almost one week longer than the 6.45 weeks reported one year ago.

Galvalume lead times average 7.36 weeks which is about three quarters of a week longer than year ago levels.

One of the ways to measure the strength (or weakness) of the steel market is through the analysis of the domestic mill lead times. The numbers shown above are based on the average of the responses made during the survey process. These numbers have nothing to do with any specific mill and steel buyers should contact their mill sources for exact lead times for new orders.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.