Market Data

January 19, 2017

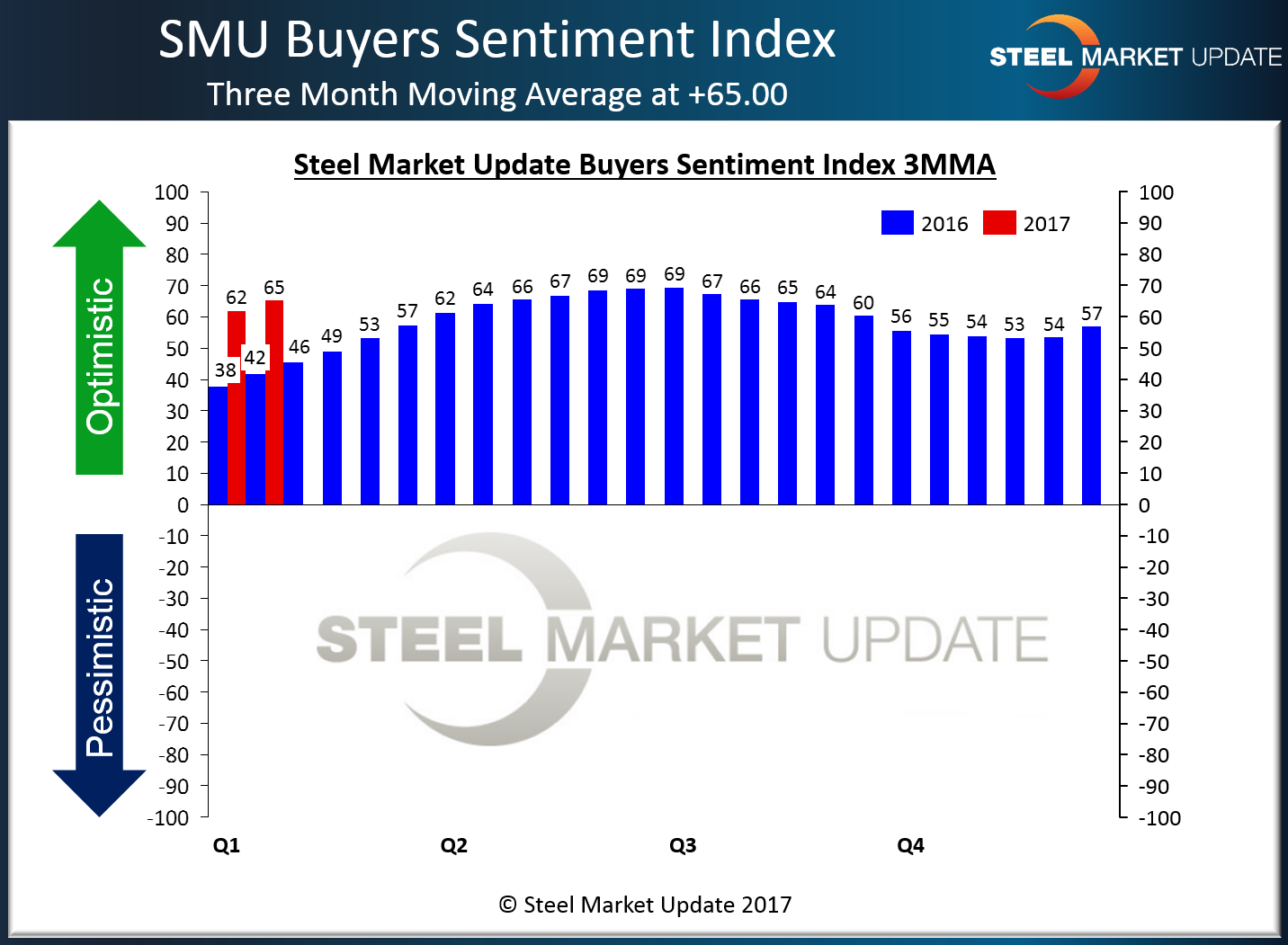

SMU Steel Buyers Sentiment Index Sets New Record High

Written by John Packard

The steel industry does not seem to be concerned about the transition of power as Donald Trump becomes the 45th President of the United States. There have been a number of cabinet appointees who have testified about the domestic steel industry and the need to “level the playing field” by taking governments, such as China, out of the subsidization of their industry. Whether these discussions are impacting buyers and sellers of the steel industry in the United States, we can only speculate.

Steel prices have been increasing both here in the United States as well as elsewhere around the world. At this time, it appears the higher steel prices are making those involved in the industry more optimistic and we are capturing that optimism in our analysis of the flat rolled steel markets.

One of the key proprietary indicators generated out of our twice monthly market analysis is our Steel Buyers Sentiment Indices. Buyers and sellers of flat rolled steel continue to be optimistic about their company’s ability to be successful both in the existing market environment (Current Sentiment) as well as looking out three to six months (Future Sentiment).

SMU Current Sentiment was measured at +73 this week. This exceeds the previous high of +71 set two weeks ago as well as the first week of July 2016 and again during the mid-April 2016.

When looking at Current Sentiment, our preference is to look at the data from a three-month moving average (3MMA) which removes some of the single data point bumps and provides a better view of the trend associated with the data. The Current Sentiment 3MMA rose by +3.33 points and now stands at +65.00 and is within 4.17 points of its all time high.

Future Sentiment Sets Record Highs for Single Data Point & 3MMA

Optimism is contagious for those looking out into the future. The SMU Steel Buyers Future Sentiment Index is unchanged from the beginning of January at +74. This is the record high for Future Sentiment.

When looking at Future Sentiment from a three-month moving average (3MMA) perspective our Index set an all time high at +69.17 which exceeds the previous 3MMA high set during the middle of April 2016.

What Our Respondents are Saying

“Not sure if people are just buying to beat price increases, building inventory or actually have the demand to support [we] will find out in early to mid February which it is!” Service center who went on to add, “Feel customers have bought heavy in December and January and are afraid later first quarter and early 2nd quarter will be lighter than normal!”

“Higher prices expected to affect downstream demand.” Manufacturing company

“Demand is the same but seeing an dramatic increase in optimism. Will this lead to more business only time will tell but definitely the overall feeling is very positive.” Trading company

“Due to us announcing an increase. It pulls business ahead.” Manufacturing company

After reporting demand as “remaining the same” a manufacturing company told SMU, “But long term trend is decline.”

A service center reported demand as improving with the following caveat: “Likely seasonal only.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s survey, 41 percent were manufacturing and 46 percent were service centers/distributors. The balance of the respondents are made up of steel mills, trading companies, and toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.