Market Segment

January 19, 2017

December Distributor Shipments Lower While Inventories Grow

Written by John Packard

The Metal Service Center Institute (MSCI) released shipment and inventories data for the month of December as well as the full calendar year 2016. Total steel products, carbon flat rolled, steel plate and pipe and tube saw shipments drop and inventories rise during the month of December compared to the prior year.

The U.S. steel distributors shipped 2,585,100 tons of steel (all products) during the month of December 2016. This is 6.9 percent lower than year ago levels and the 123,100 tons per day shipping rate was the lowest seen during calendar year 2016 (and 2015 for that matter).

Total tons shipped during calendar year 2016 were 37,358,800 tons which is 6.3 percent lower than 2015 shipment levels.

Total steel inventories rose 190,600 tons from the end of December. The number of months on hand also rose from 2.4 to 2.8 months.

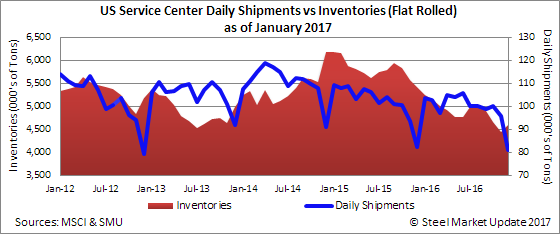

Carbon Flat Rolled

U.S. steel distributors shipped 1,695,700 tons of carbon flat rolled steel during the month of December 2016. The 80,700 tons per day shipment rate was the lowest of the year and 6.3 percent lower than December 2015 levels.

For the year, the MSCI reported flat rolled shipments as being 25,336,200 tons which is 2.6 percent lower than the 26,020,700 tons shipped during calendar year 2015.

Inventories rose by 150,500 tons and ended the month at 4,595,300 tons. Carbon flat rolled inventories are more than 1 million tons lower in 2016 than what we saw at the end of December 2015.

The number of months on hand surge due to the low shipment rate combined with the 150M build and now stands at 2.7 months supply.

Carbon Plate

Domestic service centers shipped a total of 243,500 tons of plate during the month of December. This is 6.5 percent lower than year ago levels. The daily shipment rate was 11,600 tons per day, the lowest level seen this year as well as over the past two years.

Annual plate shipments totaled 3,259,400 tons, down 20.2 percent year-over-year.

Inventories of plate increased at the end of December to 722,500 tons from the 697,000 reported by the MSCI at the end of November 2016. Inventories are 14.7 percent lower than year ago levels.

The number of months on hand are 3.0 based on the December shipment rate.

Pipe & Tube

Pipe and tube service centers shipped a total of 162,700 tons during the month of December. This is 15.7 percent below year ago levels. The daily shipment rate was 7,700 tons per day during the month.

Total pipe and tube shipments for the calendar year 2016 were 2,300,000 tons which was 12.0 percent lower than year ago levels.

Pipe and tube inventories closed December at 460,700 tons which is 21.7 percent lower than year ago levels. The number of months on hand stood at 2.8 months supply as of the end of December.